Crypto Market Recovers While Monero Rockets, As Fed Considers Digital Dollar

The Fed is afraid of the Dollar losing reserve currency status.

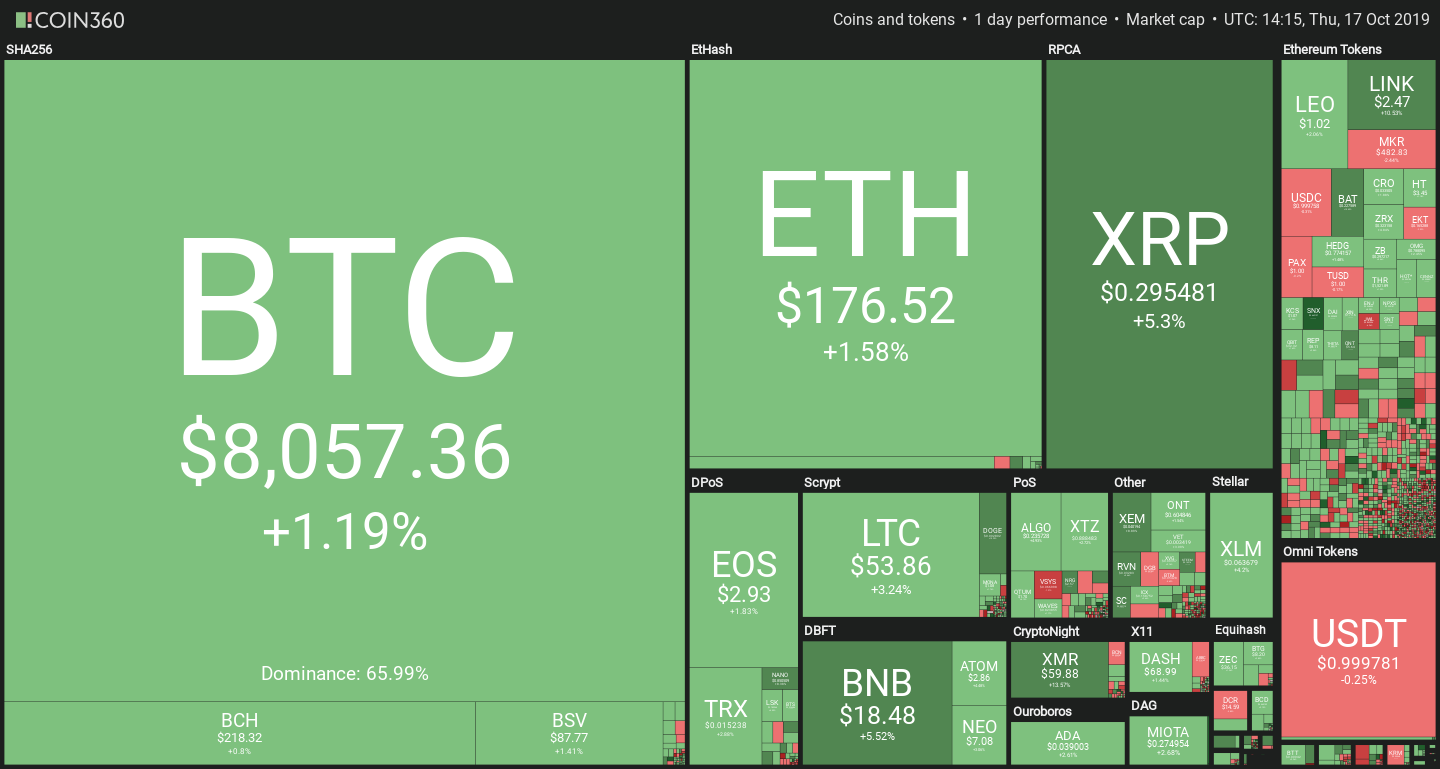

Cryptocurrencies are recovering somewhat today, as we alluded to yesterday. While Bitcoin is still weak at slightly above $8,000, the altcoin thawing continues with a few outliers leading the way.

The most impressive gain today is posted by Monero, currently at +14% and counting. Other notables include XRP’s +4%, as well as a +10-11% registered by Chainlink, BAT, Dogecoin, 0x and NEM.

Fed is actively considering a digital Dollar

As reported by CoinDesk, the director of Federal Reserve Dallas Rob Kaplan clarified the position of the bank regarding a potential digital dollar. “We have not at the Fed decided to pursue or drive to develop a digital currency, but it’s something we’re actively looking at and debating,” he remarked.

The Fed’s primary concern remains the status of USD as a worldwide reserve currency. Kaplan warned that its loss would result in at least $200bn losses, due to a presumed 1% increase in interest rate. The digital Dollar would come as a measure to remain relevant in the international scene, as recently outlined by former CFTC Commissioner J. Christopher Giancarlo.

Today’s rally seems too tame to be directly caused by this, especially since the market appears to be building a resistance to weakly-related news. But a digital Dollar could have strong repercussions on privacy coins, due to its probable traceability.

Could Monero’s rise have something to do with the Fed?

Bitcoin’s fundamentally traceable nature was highlighted in recent news. The IRS has taken down the largest child pornography site by tracking bitcoin transactions, arresting 337 of its users and causing at least two of them to commit suicide. Ah well.

While no sane person would ever consider this to be bad news, privacy is not just for outright criminals – which may have accentuated the use-cases of seriously private coins, although Zcash has not been a significant beneficiary of today’s upswing.

In addition, a DLT-based digital Dollar is unlikely to be based on a privacy protocol. Bitcoin-level traceability would give the government unprecedented control over how the money is used, boosting the relevance of uncompromising privacy coins.

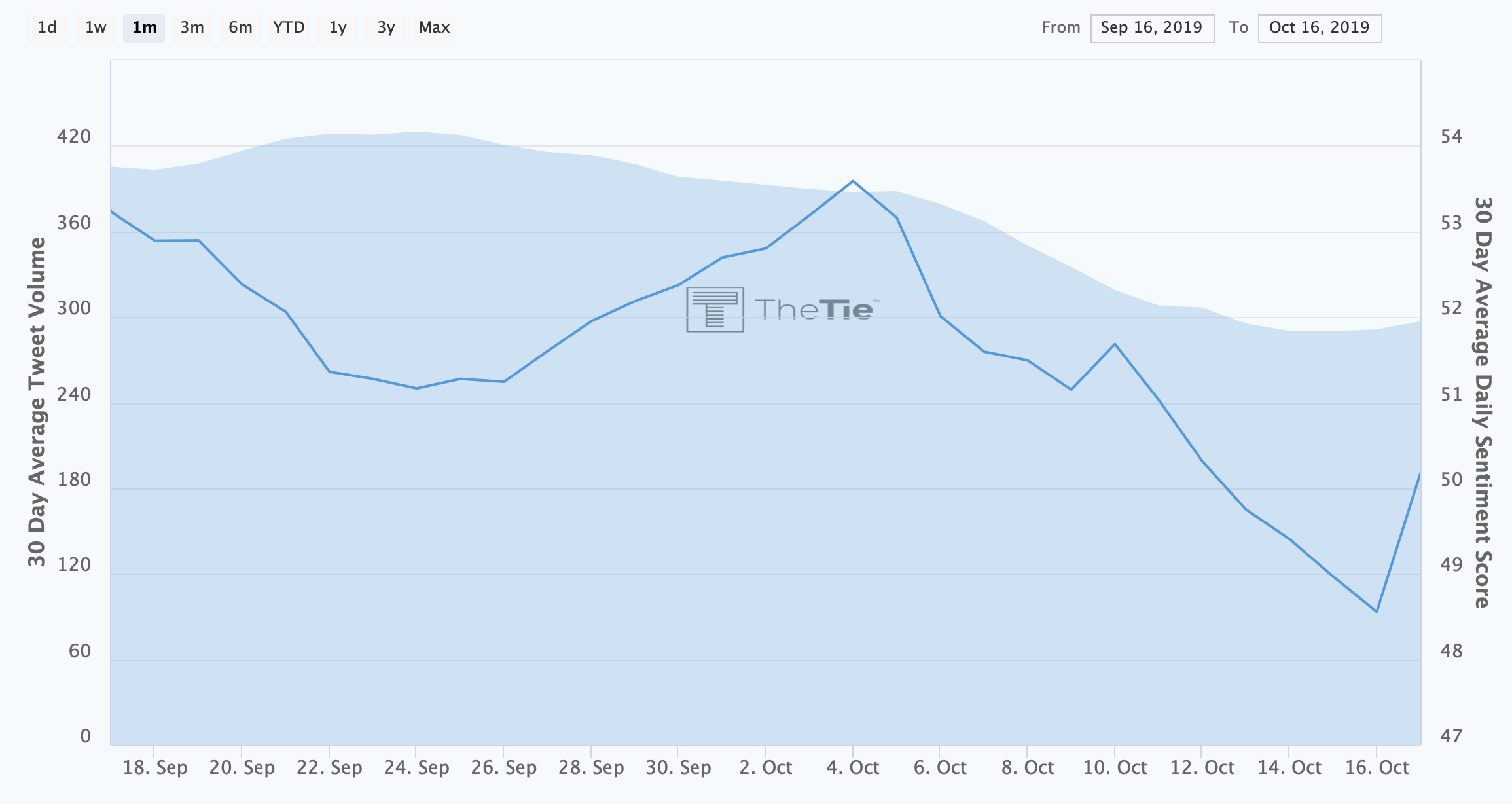

The combination of these news items may have provided the catalyst for today’s breakout, compounded by the strong fall during previous trading sessions. Sentiment has also registered a strong uptick these two days.

Bitcoin Commentary With Nathan Batchelor

Bitcoin is attempting to gather strength above the $8,000 level as we head into the U.S trading session, after the cryptocurrency found strong support from just above the $7,900 level.

In yesterday’s article I mentioned that the $7,900 level is technically important this week. A break below this area would likely be the trigger for a much deeper decline towards the $7,400 level.

Since Bitcoin buyers managed to defend the $7,900 level, it is likely that we will see the $8,100 level challenged before the next major directional move occurs today.

Looking at a chart of the total market capitalization of the entire cryptocurrency market, the weekly time frame is highlighting a possible drop towards the $190,000,000,000 level if the current weekly trading low is broken.

The $190,000,000,000 level appears to be a huge technical region that sellers may attack towards. A number of key technical metrics are located around this area, such as the lower weekly Bollinger band, 50-week moving average and long-term trendline support.

It is worth noting that a sustained loss of the $190,000,000,000 technical region would indicate that cryptocurrency market could see a much deeper and protracted decline.

Worryingly, the total market capitalization of the entire cryptocurrency market only has limited technical support below the $190,000,000,000 level, and if it is breached, there is not much in the way until the $145,000,000,000 level.

* ‘The $8,100 level should act as an important pivot point for the BTC/USD pair today’.*

SENTIMENT

Intraday sentiment for Bitcoin is extremely bearish, at 22.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is slightly lower, at 60.00%.

UPSIDE POTENTIAL

The one-hour time frame is showing that the $8,100 level offers the strongest form of near-term technical resistance. The mentioned time frame shows that a breakout above the $8,100 level could inspire a technical test of the $8,310 level.

The daily time frame shows that major intraday technical resistance for the BTC/USD pair is located at the $8,550 and $8,780 levels.

DOWNSIDE POTENTIAL

The four-hour time frame continues to highlight the $7,715 level as the strongest form of technical support below the $7,900 level.

Medium-term analysis shows that the $7,400 level offers the strongest form of technical support if the $7,715 level is broken.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Earn with Nexo

Earn with Nexo