Ethereum Takes Center Stage as ETH Edges to New Highs

Ethereum’s inability to catch up with Bitcoin’s price action has generated skepticism, creating the perfect conditions for a bullish impulse from a counter sentiment perspective.

Key Takeaways

- Ethereum looks ready for high volatility as it moves closer to an ascending triangle’s breakout point.

- A spike in buying pressure could push Ether’s price to a new all-time high of $1,650.

- ETH whales may try to fake out doubters by a final push to $1,160 before the uptrend resumes.

Share this article

Ethereum looks primed to rise to new all-time highs after enduring a week-long consolidation period that helped flush out weak hands.

Ethereum Prepares to Breakout

Following a 27% correction that saw its market value plunge to $900 on Jan. 11, Ethereum entered a stagnation period. Its price has made a series of higher lows since then, but the $1,270 resistance level continues to reject ETH from advancing further.

Such market behavior led to the formation of an ascending triangle on Ether’s 1-hour chart. A horizontal trendline was created along with the swing highs, while a rising trendline developed along with the swing lows.

A spike in the buying pressure behind Ethereum may be strong enough to break above the overhead resistance. If this were to happen, ETH’s price could shoot up nearly 29% to make a new all-time high of $1,650.

This target is determined by measuring the distance between the triangle’s two highest points and adding it to the x-axis.

Given the high volatility in the cryptocurrency market, it is likely that Ethereum will dive first to flush out overleveraged traders before it finally breaks out.

A spike in downward pressure by market makers could push Ether towards the $1,160 support level before it marches to new all-time highs.

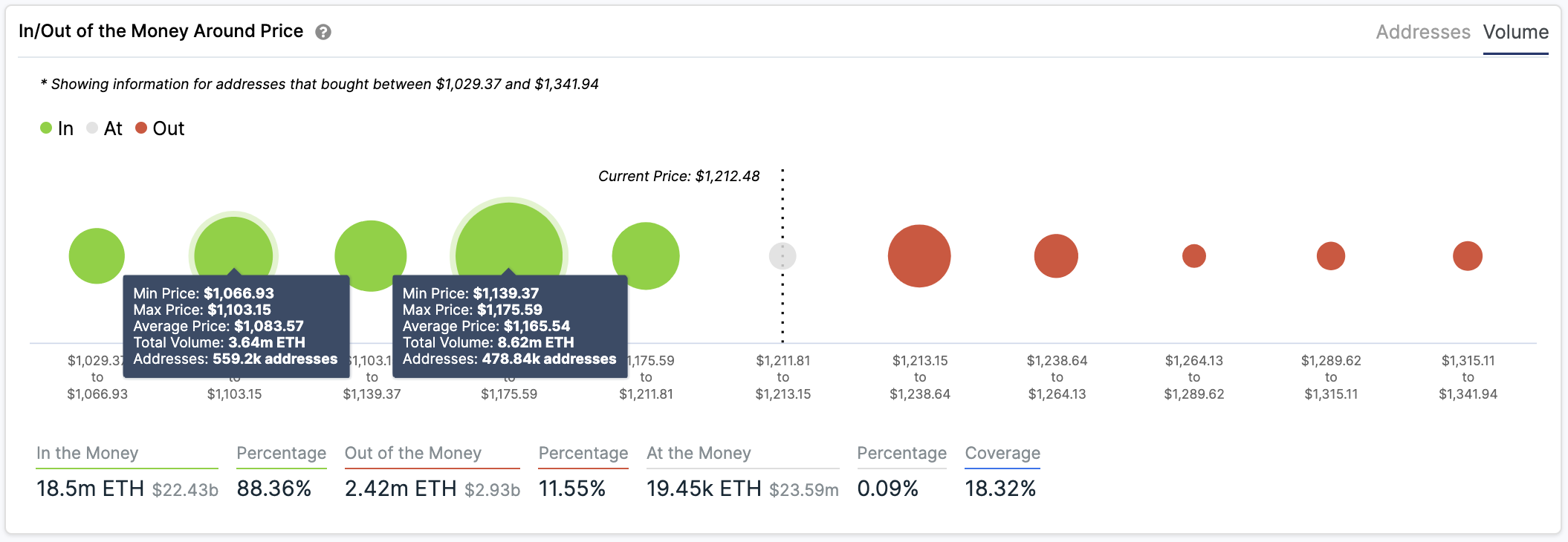

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model suggests that based on transaction history, this price hurdle will be able to contain falling prices. Nearly 500,000 addresses had previously purchased over 8.60 million ETH at an average price of $1,160, making it a significant area of interest.

It is worth noting that by slicing through the underlying demand barrier at $1,160, the odds will increase drastically for a steeper decline.

If this were to happen, the IOMAP cohorts show that $1,000 becomes the next crucial focal point for Ethereum. Here, roughly 660,000 addresses bought more than 3.60 million ETH.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article