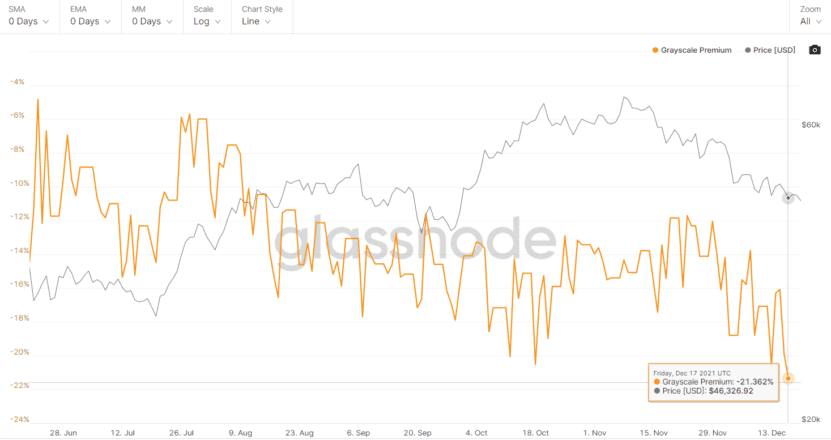

Grayscale Bitcoin Trust Hits Record Discount of 21.3%

GBTC closed last week with a 21.3% discount.

Key Takeaways

- Grayscale’s flagship product GBTC has registered a record discount.

- At last week's end, the price of one GBTC share was $34.42, which is 21.3% lower than its underlying value.

- The increasing discount on GBTC may hint at weakening institutional interest in the asset class.

Share this article

As of last week’s closing price, Grayscale’s GBTC traded at a 21.3% discount to its underlying value.

GBTC Hits Record Discount

Grayscale’s flagship product has registered a record discount.

GBTC’s last recorded price is 21.3% lower than the underlying price of Bitcoin held against it. According to Grayscale data, as of Dec. 17, 2021, the price of one GBTC share was $34.42, whereas its net asset value was 0.00093 BTC, the equivalent of roughly $43.77. GBTC previously traded at a discount of over 20% in May, but the 21.3% markdown is a record low.

Grayscale’s GBTC product lets investors gain exposure to Bitcoin through a private trust fund. Launched in September 2013, it holds $30.3 billion in assets under management and issues regulated shares tracking Bitcoin’s price.

Due to the way GBTC is structured, its shares often trade at a premium or discount. However, the current discount of 21.3% is the largest in GBTC’s eight-year history. The discrepancy in the underlying value and market price of GBTC is a useful indicator of institutional sentiment surrounding the top crypto asset.

The increasing discount on GBTC could potentially hint at weakening institutional interest in the asset class. The record low comes as Bitcoin has struggled to maintain strength in the market. It’s currently trading at roughly $46,000, down roughly 33% from its Nov. 10 all-time high price of $69,044.

While GBTC has long been a critical investment vehicle in the crypto space, the product has several drawbacks, including a six-month lockup period and an annual management fee of 2%. Some recently-launched Bitcoin futures ETF products offer institutional investors opportunities to invest without facing a lockup period at a smaller fee. For instance, ProShares, which recently launched the first Bitcoin futures ETF in the U.S., charges a fee of only 0.95% annually.

In the face of increasing competition from ETFs, Grayscale has applied to convert GBTC to a spot ETF with the Securities and Exchange Commission. Grayscale is hoping that by moving to an ETF product, it would be able to offer better pricing by eliminating the discrepancies seen between GBTC and Bitcoin’s spot value.

If approved, Grayscale’s proposed fund could become the first spot Bitcoin ETF to hit the U.S. stock market. However, there’s a reasonable chance that the SEC will block Grayscale from making the switch anytime soon. SEC Chair Gary Gensler has stated on multiple occasions that the agency is not in favor of a spot Bitcoin ETF product.

Disclosure: At the time of writing, the author of this piece owned ETH and other cryptocurrencies.

Share this article