Fridays Are For Firing Postal Employees, Drinking Beer, And Bad Crypto News

Retail investors are barely exposed to the two projects.

Friday afternoons on the East Coast of the USA have inexplicably become the time for big industry announcements. For whatever reason (answers on a postcard, please) the end of the week is deemed the most appropriate time for regulators to drop bombshells.

That’s doubly annoying for this writer, who is in London and sees his ale time unjustly condensed by inconsiderate Occidental regulators. See footnote.

Well, last Friday was no different. In the space of an hour, news broke that Mastercard, Visa, eBay, and Stripe had decided to pull out of Facebook’s Libra Association while the SEC announced it was suing Telegram, claiming its $1.7bn token sale broke numerous federal securities laws – just two weeks before the Telegram Open Network (TON) was due to go live on the mainnet.

At the time of writing, Booking Holdings had become the seventh member to drop out of the Libra Association.

Whether it’s mere coincidence or a masterstroke that the two blockchain projects headed by prominent social media platforms should announce their setbacks in the same afternoon is for conspiracy theorists and Crypto Twitter to decide.

CMC Shrugs

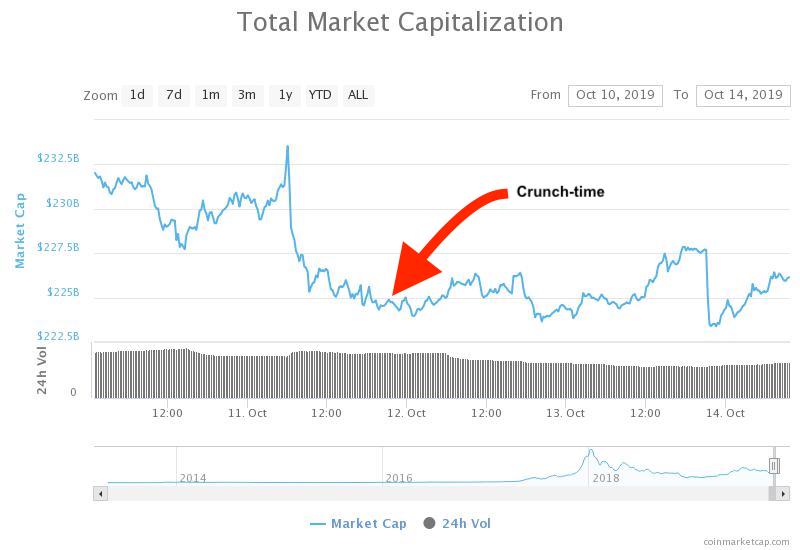

What is interesting is the market’s response to these developments: crypto’s total market cap has barely moved in the days following the announcements. Normally charts give a good indication on when the news registered with traders but looking at the one below you’d be hard-pressed to guess when the announcements became public.

Why isn’t the market moving?

The lack of response is peculiar. Considering Friday put the whole Libra project into question, and will likely cause Telegram to delay its mainnet launch, the digital currency markets would usually be on a major flush-out.

When the SEC delayed the VanEck SolidX Bitcoin ETF August 2018, the market fell by more than $50bn; when Goldman Sachs shelved their Bitcoin trading desk late that year, a mini-meltdown saw $40bn wiped from the market cap.

It’s been anything but plain sailing for Libra since its grand-unveiling in June. It was poorly received by existing crypto companies who accused it of being “bullshit“; with French authorities calling to ban it outright; and a Congressional hearing that expressed doubt about its fundamental viability.

“The centralisation of Libra as a cryptocurrency is what concerns regulatory bodies,” said Will Harborne, Founder and CEO of DeversiFI. They are concerned about private companies having jurisdiction over financial data, something that “would ultimately detract from the socially advancing technologies that blockchain offers.”

“Given the obstacles that Libra faced for some time, the market knew it was never going to be smooth sailing and that the launch date was on the optimistic side,” explained David Thomas, Director and co-founder of Global Block.

Rumors had long circulated that some Libra members were getting cold-feet; PayPal had already pulled out earlier that week. The slow drip of negative news means the “potential Libra capitulation, and hence the slower crypto adoption, was already priced into the market,” believes Vaibhav Kadikar, founder and CEO of CloseCross. The centralized nature of the project prevented any strong price reaction.

Telegram Slam

But the key for Nicholas Pelecanos, Advisor to NEM Ventures, is exclusivity. The TON ICO was for accredited investors, with a minimum buy-in of a $1M. Telegram succeeded in blocking out the majority of market participants, meaning TON news has little relevance to the majority of participants in the industry, and therefore little impact on price movements.

Combined with the fact that volumes have been historic lows since the beginning of September, “meaning the majority of traders are sitting on the sideline”, and any reaction Telegram expected from the market simply didn’t materialize, added Pelecanos.

The same exclusivity applies to Libra too, according to Charles Phan, Chief Technology Officer, Interdax: “Libra is driven by large corporations, most of them very keen to know exactly who you are, invitation-only, and headed by Facebook, a firm that’s known to have privacy issues.”

“It’s quite a leap for the crypto community to accept this, and so we wouldn’t expect Libra news to mean much to the market.”

Had Libra relied on Bitcoin, or if the TON sale had been public, the news might have created more of a stir among the industry. But the fact of the matter is it has little relevance to traders because so few of them are exposed to the projects.

Despite the large names attached, the weekend’s movements give an inclination of what really drives traders. As with a lot of things, it all comes down to how it affects the wallet.

P.S. – As a sidenote for the SEC, I will usually be in The Elephant’s Head public house from around 3pm GMT on Fridays, so enough with this nonsense, already.