Market Commentary: The Effects Of Tethers And A Future ‘Fed Coin’

Will the government create its own stablecoin?

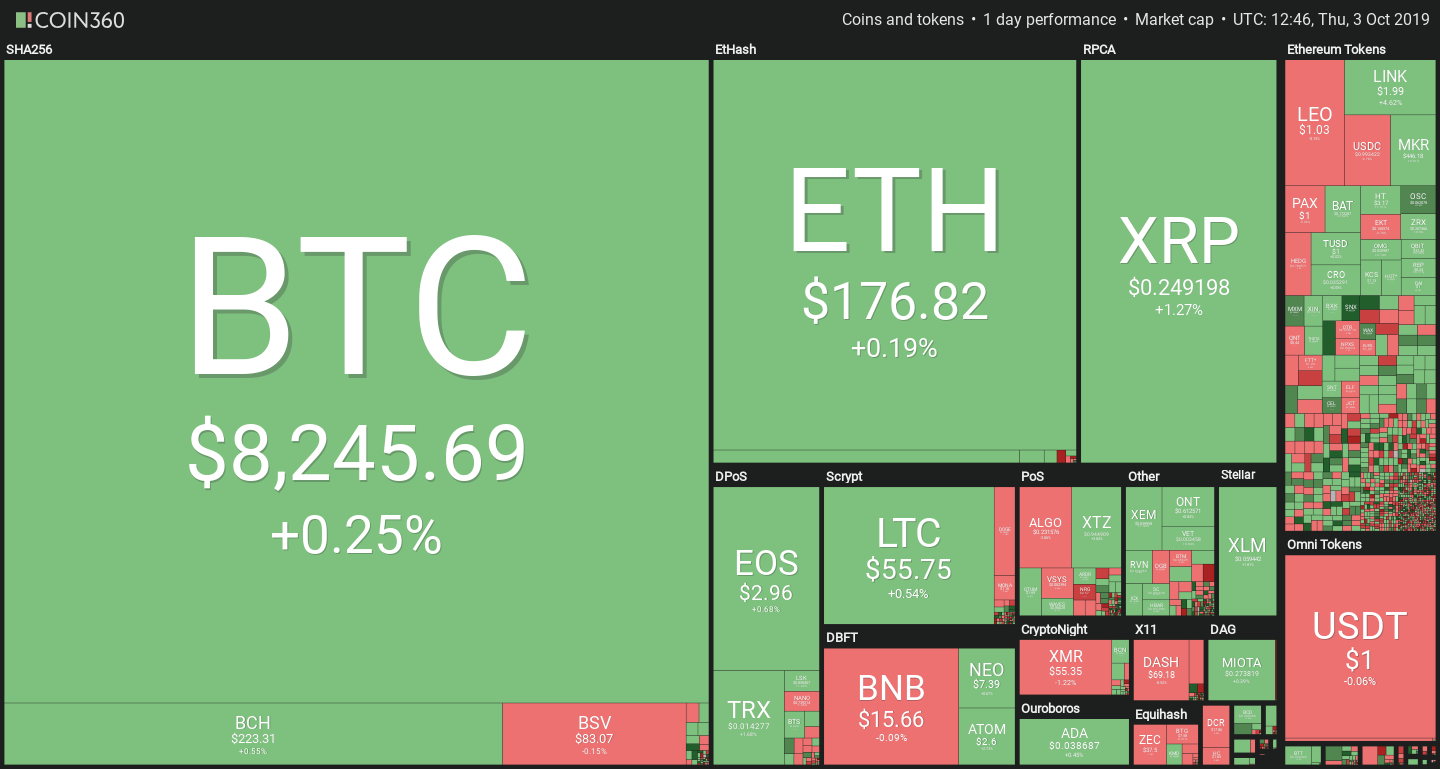

Cryptocurrency are flat today, with Bitcoin and most altcoins showing little sign of movement. The most notable exceptions are Chainlink, which is continuing its week of gains, and Tezos.

Can exchange supply flows explain price movements?

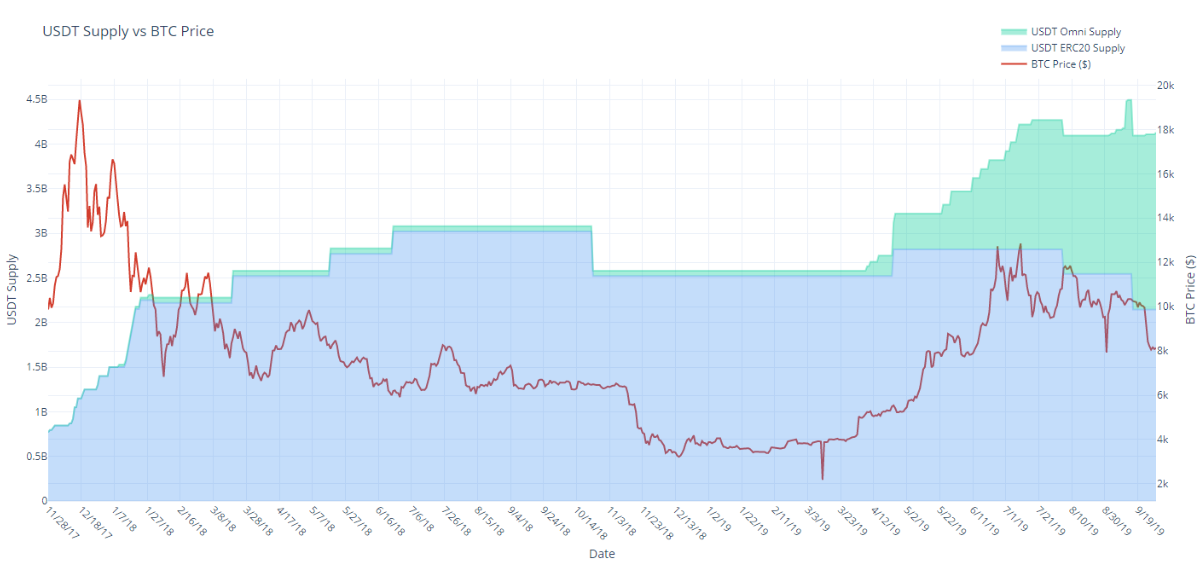

A report published by TokenAnalyst used blockchain analysis to study the effects of coin supplies on prices. It focused on two specific scenarios: newly minted stablecoins and the net inflow of BTC in exchanges.

As noted in its report, in the 24 hours after issuing Omni Protocol USDT, Bitcoin’s price rises about half of the time. With ERC-20 USDT, the percentage jumps to 70%.

It’s worth noting that correlation does not mean causation: a coin flip has a 50% chance of ‘causing’ a price hike. In other words, any price prediction will have a 50% success rate as a baseline, even if it’s a completely random indicator.

Thus, it appears that Omni USDT does not have any effect on the market, at least in the short-term. On the other hand, ERC-20 USDT has been around for a shorter time, meaning that its relatively strong 70% success rate could also be a coincidence due to timing or other factors.

BTC outflows could trigger price hikes

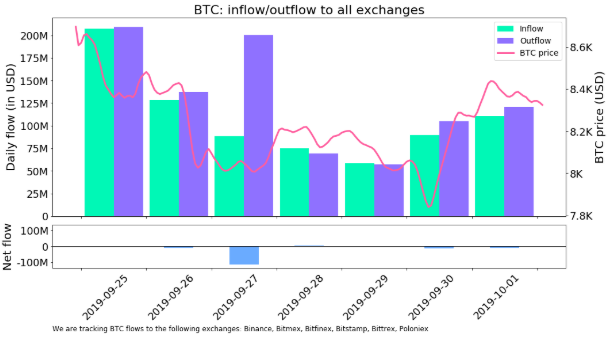

The second part of the puzzle are the flows of BTC to and from exchanges.

Each green bar represents an inflow, each blue one an outflow. The difference between them is the net flow, which remained mostly constant throughout the week of September 25. The exception is for September 27, when a modest price recovery followed a significant net outflow of BTC.

The apparent explanation is that less BTC in exchanges means less supply available for trading. In any event, the effect seems limited, as bigger price spikes did not have a corresponding flow imbalance.

Congressmen urge the Fed to develop digital USD

A letter from Congressmen French Hill (R-AR) and Bill Foster (D-IL) sent to Jerome Powell, Chairman of the Federal Reserve, urges the body to consider the creation of a state-backed digital US Dollar.

Citing that “the nature of money is changing,” the Congressmen focus on the rising trend of national digital currency projects. “We are concerned that the primacy of the U.S. Dollar could be in long-term jeopardy from wide adoption of digital fiat currencies,” they write, citing examples such as the e-peso and the digital Yuan as significant threats.

The Congressmen also argue that this is not something that can be left to its own devices. “Relying on the private sector to develop digital currencies carries its own risks, including loss of control of monetary policy, as well as the ability to implement and enforce effective anti-money laundering and counter-terrorism financing (AML/CTF) measures,” they note, with a focus on one specific coin. “The Facebook/Libra proposal, if implemented, could remove important aspects of financial governance outside of U.S. jurisdiction.”

The letter then poses several important questions to the Chairman, specifically if the Fed already has plans for this. The letter shows that the primary concern of U.S. legislators of maintaining control over monetary policy. Decentralized currencies are still flying below their radar, but centralized, state-controlled digital currencies may be a more urgent issue to U.S. lawmakers.

Bitcoin Commentary By Nathan Batchelor

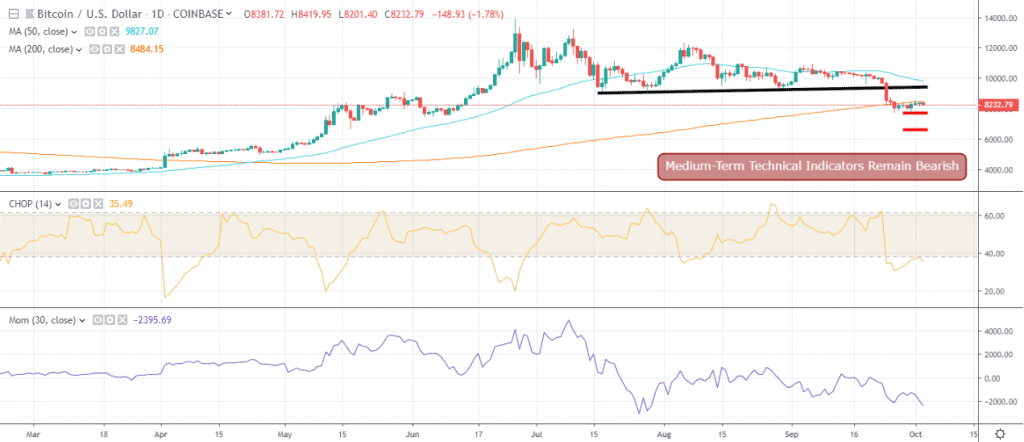

Bitcoin continues to trade on the ropes as we head into Thursday’s U.S trading session, as the cryptocurrency fails to attract meaningful short-term buying interest.

Today, I would like to look at two important technical indicators that suggest that the BTC / USD pair remains a sell over the medium-term horizon.

The Choppiness Index, also known as the CHOP indicator, is a key technical indicator which shows whether an asset class is likely to remain in choppy trading conditions or move in a trending direction.

For a more basic understanding of the CHOP indicator I will simply say that a higher value for the indicator points to more directionless trading ahead, while a lower reading indicates directional trading or a sustainable trend.

At present, the Choppiness Index is giving a very low reading on the daily time frame, which highly suggests that Bitcoin will continue on its bearish path. We should also remember that Bitcoin’s medium-term outlook recently changed to bearish for the first time since April this year.

The next indicator I would like to look at is the Momentum indicator, which provided a strong sell signal during Bitcoin’s recent decline and has remained consistently bearish ever since.

Generally, a sell signal is generated by a downside break of the 100 level, while a buy signal is given on an upside break of the 100 level. The daily time frame shows that a BTC / USD sell signal was generated on September 13th, which proved highly accurate.

It is worth adding that both the Choppiness Index and Momentum indicators are showing positive readings on a weekly time frame, which bodes well for Bitcoin over the longer-term horizon.

* Short-term technical analysis suggests that unless the $8,500 level is broken then the BTC / USD pair is still a sell. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has improved, to 47.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is moving lower, at 62.75%, but still remains positive.

UPSIDE POTENTIAL

The technicals remain unchanged from yesterday, with $8,500 still the key intraday technical resistance area which bulls need to break. Once above the $8,500 level, the $9,000 to $9,100 levels are absolutely key.

The $9,300 level is likely to be a pivotal area to watch if the $9,100 resistance level is broken. After a clear break above the $9,300 level I would expect that $10,000 could be reached fairly quickly.

DOWNSIDE POTENTIAL

Short-term technical analysis suggests that the BTC / USD pair will come under pressure if the cryptocurrency starts to trade below the $8,200 support level today.

Once below the $8,000 level it is extremely likely that sellers are going to force a technical test of the $7,700 level. Once below the $7,700 level the BTC / USD pair is under major technical pressure, with both medium and long-term technical analysis highlighting the $7,100 and $6,600 level as the strongest forms of support below.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.