Shutterstock cover by Wit Olszewski

Monero Primed to Surge 20%, Outperforming Privacy Coin Competition

Monero looks ready to resume its uptrend, targeting $197.

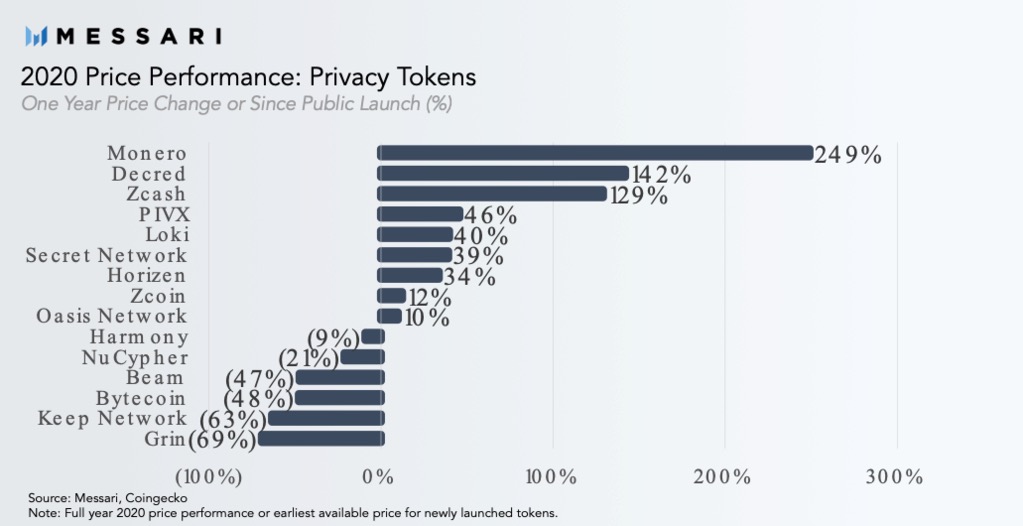

Monero outperformed all other privacy-centric altcoins in 2020 with a 249% price increase despite tightened regulation.

Following its excellent performance in 2020, XMR looks primed for further gains.

Leading the Privacy Coins Market Sector

As many cryptocurrency exchanges delisted XMR, demand continued to grow for censor-resistant solutions allowing the token’s market value to rise.

“There’s a larger societal war on privacy taking place, and when it comes to crypto, Monero and Zcash are on the front lines. Monero should, in theory, be the most difficult asset for exchanges to support from a compliance standpoint because all transactions are anonymized by default via the protocol’s ring signature scheme,”Messari reported.

Still, and despite the massive gains incurred in 2020, Monero looks poised to advance further.

Monero Shatters Consolidation Pattern

Monero took a significant 26% nosedive after surging to a high of $191 on Jan. 10.

Following the price crash, the privacy-centric cryptocurrency entered a consolidation period that led to creating a symmetrical triangle within its 1-hour chart.

A descending trendline has formed along with swing highs, while an ascending trendline has developed along with swing lows.

The triangle’s widest range suggests that Monero is poised to regain lost ground and rise by more than 22% now that it has broken out of this technical pattern. A spike in buying pressure could even send XMR’s market value to $197 or higher.

Though the odds favor the bulls, the Tom Demark (TD) Sequential indicator points to a correction before higher highs.

This technical index presented a sell signal in the form of a green nine candlestick within Monero’s hourly chart. The bearish formation forecasts a one to four 1-hour candlestick correction before the uptrend resumes.

If sell orders pile up, the TD setup’s outlook may be validated.

Under such circumstances, Monero could revisit the symmetrical triangle’s upper trendline at $158 before it marches towards $197.