Early Valentine: Aussie With Heart Sends $300k In EOS Back To Rightful Owner

Share this article

It’s going to be a very happy Valentine’s day for one EOS user, after the unexpected return of $300,000 dollars in cryptocurrency, which had been inadvertently sent to the wrong address. Although “no backsies” is a cardinal rule of the blockchain, the recipient was kind enough to return the unexpected fortune.

It’s a remarkable story, if only because it’s so unusual. Unlike credit cards, crypto transactions don’t have chargebacks, and there’s no telling how much money has been lost to giveaway scams, fat-fingered addresses and human error—not to mention exchange owners who died without sharing their keys.

Every so often, though, something happens to remind us that there are still generous people in the crypto space. One such story unfolded on EOS, when an account holder named “Australia123” became the unexpected beneficiary of over $300,000 in tokens.

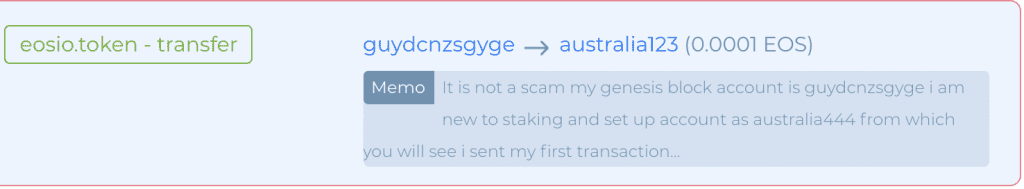

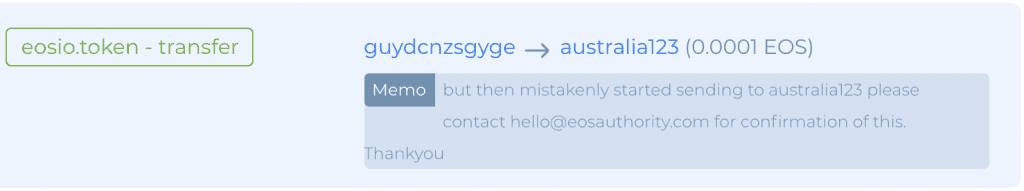

The tokens came from “guydcnzsgyge,” an inexperienced user who was trying to move tokens between his, or her, accounts. In addition to 102655.1076 EOS tokens, guydcnzsgyge (who we’ll call “Guy” after the first part of their address) also sent $1,600 in IQ tokens, and smaller amounts in six other denominations– all to a total stranger.

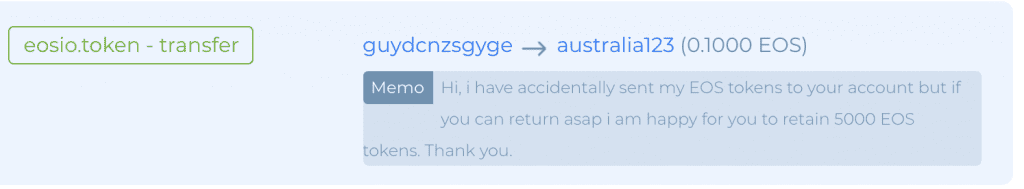

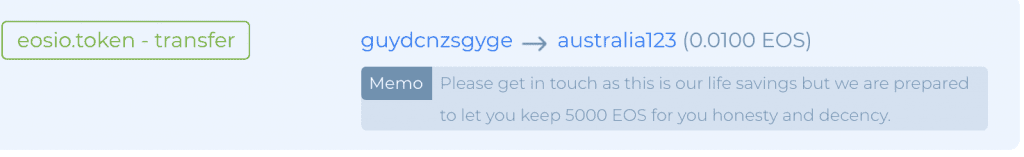

As the blockchain indelibly records, it took about two hours for Guy to notice the error.

Most crypto users would think twice before responding to this sort of message. Even though bounced check scams are impossible with cryptocurrency, you never know what other clever ideas a scammer might come up with.

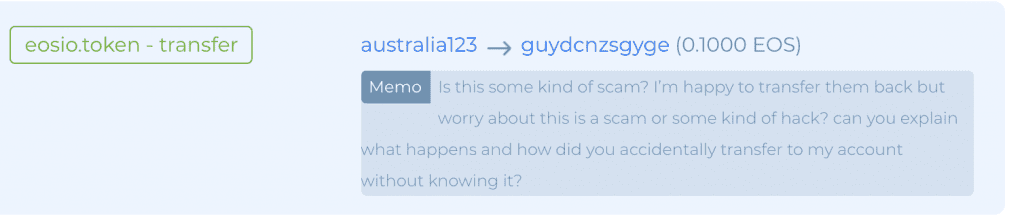

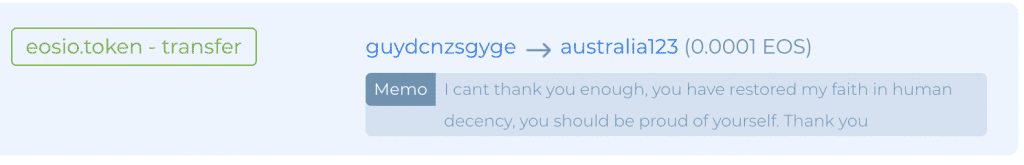

australia123 replied:

That seemed to be enough for Australia123, who promptly returned the excess tokens. Almost all of them, anyway: they kept the 5,000 EOS as consideration for their troubles.

But what if australia123 had not been so generous?

It wouldn’t have been the end of the line, although it would certainly have made Guy’s day worse.

Since EOS is limited to only a handful of block-producing nodes, that means transactions can be frozen or reversed. This power has only been exercised a handful of times; once, last November, a dispute involving an allegedly-phished account led to confirmed transactions being reversed by an arbitrator. Earlier, in June, Block Producers received an emergency order to freeze accounts involved in alleged phishing.

It’s not certain that Guy’s funds would have been returned, although it does seem likely. Since australia123 did not acquire the funds by theft or trickery, an arbitrator could conceivably rule from the doctrine of Finders v. Keepers.

Luckily, though, Australia123 did not require that sort of persuasion.

This isn’t the first instance of altruism in the crypto economy, even if it does disappear among its opposites. Two years ago, the BTC.com mining pool went to some trouble to refund a user who had accidentally entered a transaction fee of 80BTC –an exceptionally handsome miner’s reward, even for 2017.

There have been several other instances of miners refunding excess fees, showing crypto isn’t quite as cutthroat as you might think. We’ve also documented many cases of crypto-altruism, from charitable contributions through BitGive to spontaneous donations to needy Venezuelans.

In the meantime, it seems that Guy has learned a valuable – but not too expensive – lesson.

The author is invested in Bitcoin, which is mentioned in this article.

Share this article