What Is ETH? Defining Ethereum's Scarce Asset

Former BitMEX CEO Arthur Hayes recently penned an essay exploring how ETH could soon be valued as a perpetual bond. Is he right?

Key Takeaways

- While the Ethereum network is known for the crucial role it plays in the cryptocurrency ecosystem, ETH the asset is harder to define.

- ETH has previously been described as a "triple-point asset" and "ultra sound money" in Ethereum circles due to its utility and scarcity.

- Former BitMEX CEO Arthur Hayes argues that ETH will be valued like a bond when Ethereum completes the Merge to Proof-of-Stake.

Share this article

From a “triple-point asset” to “ultra sound money,” Crypto Briefing explores how Ethereum’s native asset has been conceptualized and whether viewing it as a perpetual bond might be the next to gain traction.

Ethereum’s Evolution

Since Ethereum launched in 2015, the cryptocurrency market has engaged in debates over how to define it. The Ethereum network itself is often described as the base layer of Web3, but its native asset, ETH, doesn’t have such a clear definition.

As with all new technologies, figuring out how to conceptualize them in reference to existing systems is a point of continuous debate. Ethereum is no different in this regard. The second-biggest blockchain has come a long way since its inception, but with a roadmap that stretches out well into the current decade, it still has a far to go before realizing its final vision.

In-between updates, Ethereum’s users have had plenty of time to think about the implications of each fork and speculate on the effects of future upgrades. Snappy soundbites like “Triple-Point Asset” or “Ultra Sound Money” have helped distill the often complex nature of Ethereum into viral memes that capture attention and provide a rallying call for those who believe in ETH the asset.

As Ethereum prepares to complete “the Merge” from Proof-of-Work to Proof-of-Stake, one prominent figure in the crypto space believes conceptualizing Ethereum as a bond could be pivotal to its next growth stage. Arthur Hayes, the co-founder and former CEO of the crypto trading platform BitMEX, is well respected in crypto circles for his insights into crypto and global financial markets. Hayes argued that institutions could feasibly regard ETH as a bond once Ethereum moves to Proof-of-Stake in a recent Medium post. Based on Hayes’ “Ethereum bond” classification, he believes the value proposition of buying and staking ETH should see the asset hit $10,000 by the end of 2022, sharing a popular view among Ethereum enthusiasts that ETH will become a five-digit asset.

Classifying ETH

Before exploring how ETH could hold up as a bond, it’s essential to understand the ideas that led to Hayes’ notion.

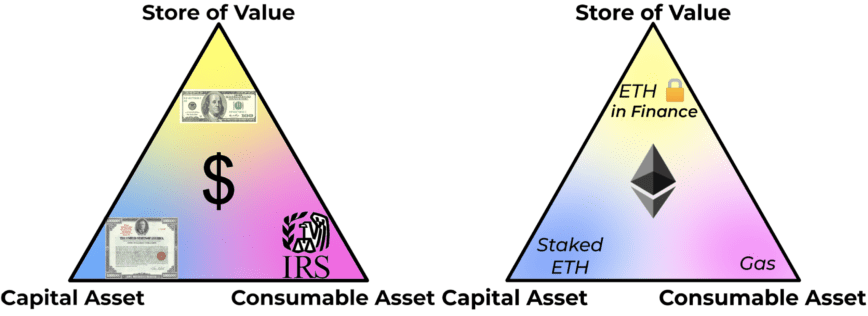

In 2019, Bankless co-host David Hoffman was one of the first to attempt to define ETH in reference to the traditional monetary system. In a blog post titled “Ether: The Triple-Point Asset,” Hoffman argued that ETH is the first asset that falls under all three major asset superclasses: store of values, capital assets, and consumable assets.

He explained that ETH becomes a capital asset when it is staked. This is because it generates yield and can therefore be valued based on its expected returns, similar to bonds. When ETH is used as gas to pay for transactions, it takes on the role of a consumable asset, analogous to how U.S. dollars are used to pay taxes. Finally, ETH acts as a store of value when holders deposit it to DeFi protocols such as Aave or Compound as collateral.

This triple-point asset definition forms the bedrock of the Ethereum ecosystem. It represents the different forces influencing ETH’s price while also providing a path to further adoption and growth. It also shows how ETH is analogous to key assets in traditional economies. For example, the trifecta of U.S. dollars, U.S. treasury bonds, and IRS taxes that form the U.S. economy can also be identified in the Ethereum ecosystem.

However, while Hoffman’s definition explains how ETH can be compared to capital assets like bonds, it’s still a long way from Hayes’ argument that it can be valued like a bond. This is where another popular meme used to define ETH, “ultra sound money,” comes into play. The phrase was coined by the Ethereum Foundation’s cryptographer researcher Justin Drake in early 2021 and has since become a rallying call for Ethereum enthusiasts. Vitalik Buterin has previously said that he thinks ETH is on a path to becoming ultra sound money.

In recent years, criticism of traditional financial systems has been on the rise, particularly in the case of the U.S. economy. A prominent narrative fueling Bitcoin’s rise is that it’s “sound money” because it has a limited supply. Unlike the U.S. dollar, which has undergone rapid inflation due to the Federal Reserve’s money printing, there will only ever be 21 million Bitcoin in existence. However, the ultra sound money thesis takes this idea a step further. What could be a better investment than an asset with a finite amount? An asset that actually increases in scarcity and eventually becomes deflationary as it sees more use. This is the concept that the ultra sound money meme represents.

In August 2021, Ethereum shipped an update that paved the way for ETH to become ultra sound money. The London hardfork introduced EIP-1559, a crucial update designed to change how Ethereum’s fee market worked. Before EIP-1559, users would have to bid to get their transactions included in new blocks in the chain. Now, they pay a base fee and can pay an additional tip to miners. The base fee gets burned, significantly reducing the ETH supply over time. This offsets the approximate 4.5% inflation that comes from mining and staking rewards. EIP-1559 hit 2 million ETH burned last month.

It’s important to note that burning transaction base fees alone is currently not enough to make ETH a deflationary asset outside of moments of extreme network congestion. However, once Ethereum merges with its Proof-of-Stake chain, it will stop paying block rewards to miners. At that point, which is slated for sometime this year, the amount of ETH burned from transactions could surpass the amount paid to validators with enough activity on the network. That would make ETH net deflationary.

The move to Proof-of-Stake will also unlock a vital functionality needed for ETH to be viewed as a bond. Currently, sending ETH to the Ethereum staking contract is a one-way process—funds that are staked cannot yet be withdrawn. However, soon after the Merge takes place, withdrawals from the ETH staking contract will be activated.

The First Perpetual Bond

Bonds are fixed-income instruments that provide around 1 to 2% low-risk yield in traditional markets. Currency bonds are usually issued by their corresponding governments and represent the trust that the government will be able to repay its debts in the future. Traditional bonds also have a time to maturity, ranging from one to 30 years, with yields increasing on higher time frame bonds.

Viewing ETH as a bond does not imply it becomes a debt instrument like government-issued commercial paper. It just compares the risk profile and future yields of staking ETH to traditional bonds.

For ETH, the staking yield is considerably higher than the interest earned on bonds. The current rate sits between 4 and 5% and is expected to increase to around 8% following the Merge. Another key difference is that while traditional bond yield rates are time-dependent, ETH staking rewards are not. This makes it better to think of ETH staking as a “perpetual bond” and must be accounted for when valuing it.

Hayes uses yield measurement metrics applied in bond markets in his blog post, combined with ETH’s projected post-Merge yield. The result implies that if institutional investors think about ETH in the same way they think about foreign currency bonds, it’s currently undervalued.

Hayes also points out that the current rates for hedging an ETH “bond” pay out a positive premium, making the trade even more lucrative. He states that the only things currently holding asset managers back from entering the Ethereum market are the inability to withdraw staked ETH and Ethereum’s high energy consumption—both of which will be fixed by the Merge.

While the argument for viewing ETH as a bond is compelling, it also begs the question: If ETH can be valued as a bond, why can’t other Proof-of-Stake tokens that are already more environmentally friendly and let stakers withdraw their funds?

Two reasons emerge in the context of classifying ETH as a triple-point asset and ultra sound money. Firstly, no other Ethereum competitor fulfills all three requirements to become a triple-point asset. To use Solana as an example, SOL holders can stake their tokens to generate a yield of around 6 to 7%, fulfilling its role as a capital asset. SOL is also actively used as a store of value asset to borrow against. However, Solana’s low fees impact its ability to act as a consumable asset, removing a fundamental value proposition.

As other Proof-of-Stake tokens have constant inflation without the balancing factor of fees reducing the supply, they can not be defined as deflationary ultra sound money like ETH. An asset with a supply that increases at the same rate as its staking rewards can not be valued as a bond as it has 0% real yield. Comparatively, ETH becomes deflationary as it sees more use, increasing its value proposition.

The idea that institutional investors could soon pick up ETH as a perpetual bond is undoubtedly an attractive proposition for ETH holders. Hayes’ math doesn’t lie, but several factors could impact his thesis. The biggest hurdle will be convincing wealth managers to view ETH as a bond in the first place. Nobody can predict what market participants will do, and the historical precedent of institutions turning up to crypto late is not a good sign. Another challenge to the ETH bond thesis will likely be liquidity for derivatives. As Hayes pointed out in his think piece, there is “scant liquidity” for ETH/USD futures further than three months ahead. While buying and hedging ETH may be a positive carry trade, a lack of liquidity could set back adoption.

Furthermore, it’s worth considering the impact of further delays to the Ethereum Merge. Although development appears to be on schedule now, the risk of another setback needs to be accounted for. Despite these factors, the idea of conceptualizing ETH as a bond looks likely to continue gaining traction. However, whether ETH will become an essential part of institutional portfolios and soar to a five-figure valuation remains to be seen.

Disclosure: At the time of writing this feature, the author owned ETH, SOL, and several other cryptocurrencies.

Share this article