XRP Performed the Worst among Altcoins in 2020

The substantial number of XRP tokens that Ripple has put in circulation could be affecting the upside potential of the altcoin.

Despite Ripple’s best efforts to speed the adoption of XRP, the number three altcoin is stuck in a downtrend that may see it reach new lower lows.

High Levels of XRP in Circulation

In a recent report, Messari affirmed that XRP was one of the worst-performing cryptocurrencies during the first quarter of 2020.

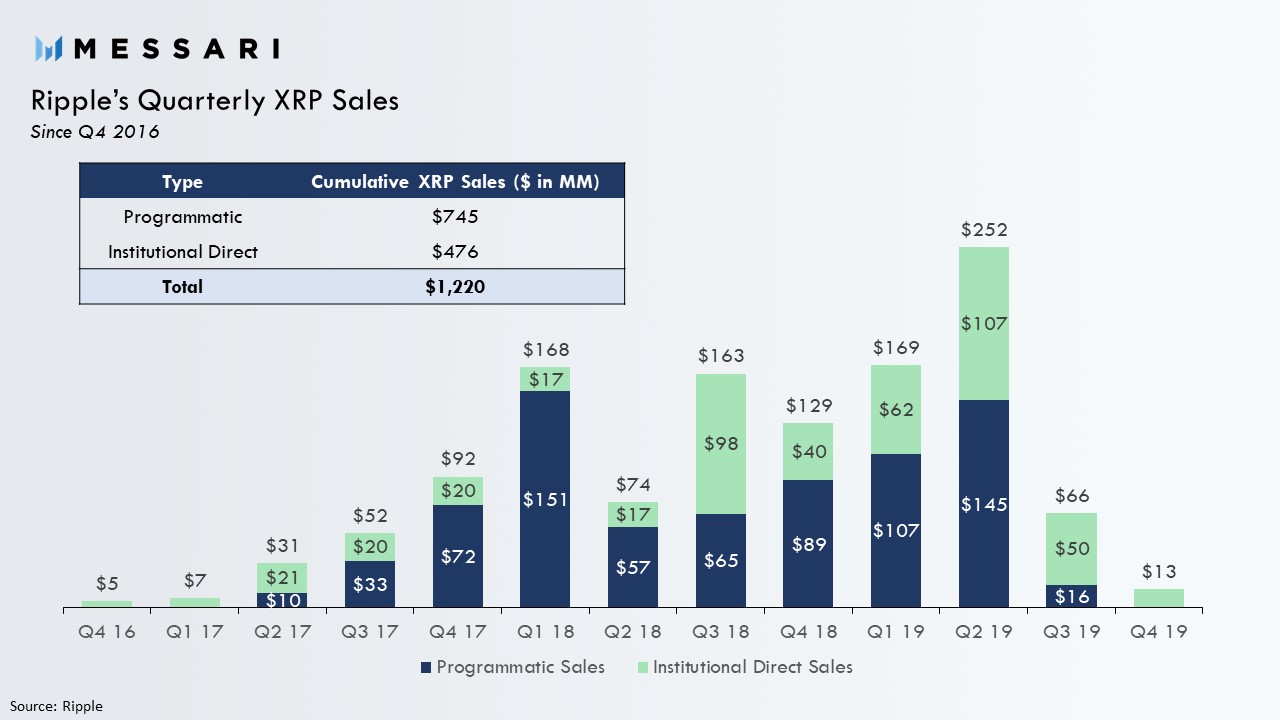

Although Ripple recently committed to acting as “disciplined, responsible stakeholders,” the $1.2 billion worth of XRP sold since 2016 appears to have jeopardized the token’s upside potential.

The cross-border remittances token opened the year at roughly $0.19 surging to a high of $0.35 in mid-February.

However, its price got slashed by 70% during Black Thursday, reaching levels not seen since May 2017. Following the crash, XRP was able to rebound and end Q1 with a negative return of 10%.

Despite the important partnerships that Ripple attracted to expand the adoption of its on-demand liquidity solution, the altcoin still performed poorly.

As interest in XRP seems to be declining, many investors are wondering whether Q2 will see its price continue to hit lower lows.

The Downtrend May Continue

From a long-term perspective, XRP is trading downwards since reaching an all-time high of $3.5 in January 2018. Since then, it has been making a series of lower lows and lower highs.

A bullish impulse that allows the cross-border remittances token to close above the Feb. 15 high of $0.35 could be considered as the beginning of a new uptrend. Until that happens, the downtrend would likely continue.

XRP could drop to the next level of support that sits around $0.062.

In the meantime, XRP appears to be breaking out of a rising wedge pattern.

This technical formation developed as a direct consequence of the price action seen over the last few weeks. One trend line connects the respective highs while another one joins the lows.

Now that this altcoin has broken below the lower trendline, it could drop another 24% to reach a target of $0.15.

This target is determined by measuring the height of the wedge at its thickest point and adding that distance to the breakout point.

Moving Forward

After flooding the market with tokens, Ripple significantly reduced the amount of XRP sold quarter-to-quarter.

The company sold $13 million in XRP during Q4 2019. This sum represented an 80 percent reduction from the previous quarter when it sold $66 million.

It appears these efforts have been in vain since Ripple have not been able to change the course of this cryptocurrency. XRP continues to make a series of lower lows without breaking out of the downtrend that began at the beginning of 2018.

With an on-going lawsuit over whether XRP is a security and Brad Garlinghouse, Ripple’s CEO, stating that the firm would not be profitable or cash flow positive without selling this token, investors must be aware of the downside potential for this token.

Earn with Nexo

Earn with Nexo