Bitcoin On-Chain Metrics Spell Trouble as BTC Breaks $15K

Bitcoin has decouple from the rest of the cryptocurrency market, but the bulls party may soon come to an end.

Key Takeaways

- Bitcoin is up more than 10% in the past three days as investors grew concerned over the US election.

- Now that BTC is nearing $15,000, multiple on-chain metrics advise to take the precautionary approach.

- Although there is little to no resistance ahead, a spike in selling pressure could see prices retrace to $13,800.

Share this article

Bitcoin has been on a tear in the last few days, breaking new yearly highs. But as investors rush in to buy orders and a state of FOMO, BTC approaches a “danger zone.”

Bitcoin Faces No Resistance Ahead

Bitcoin was able to shrug off all the fear, uncertainty, and doubt surrounding the U.S. election and went parabolic.

The flagship cryptocurrency rose more than 10% in the last few days, while Americans cast their votes. As prices near the $15,000 threshold, there few significant supply walls ahead, preventing BTC from advancing further.

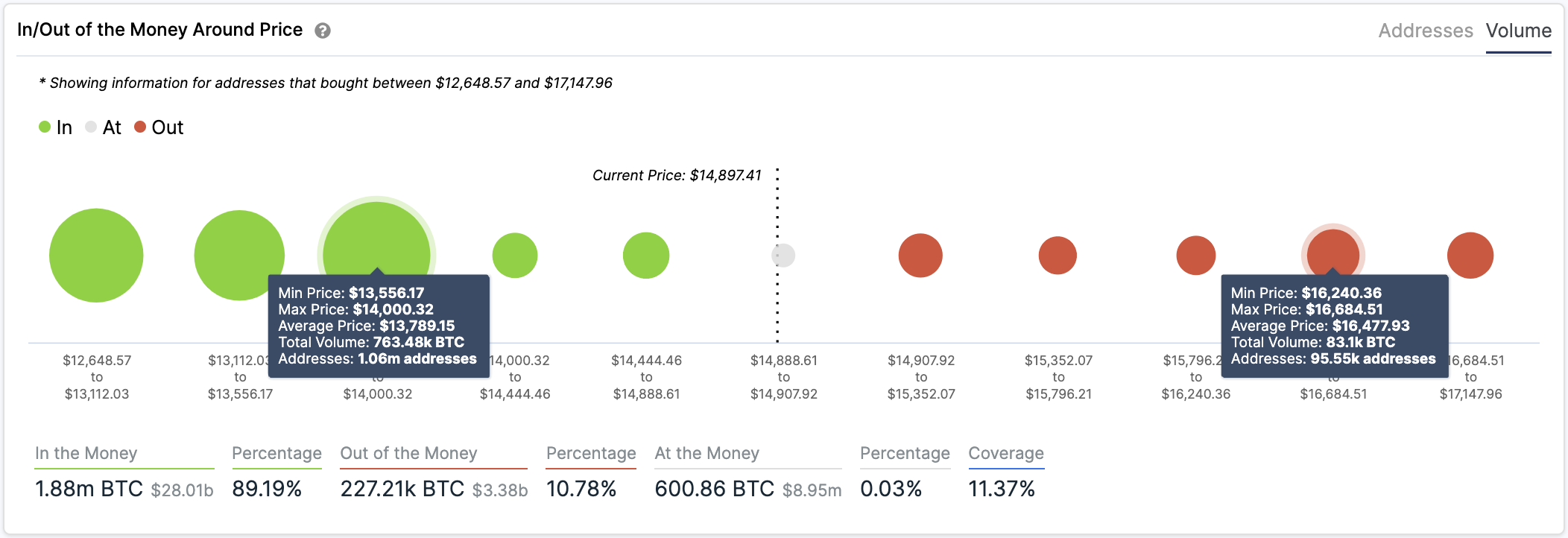

Indeed, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that the only considerable resistance ahead lies between $16,240 and $16,700.

Here, nearly 100,000 addresses had previously purchased over 80,000 BTC.

Although the pioneer cryptocurrency seems poised for higher highs, large investors are taking advantage of the upward price action to book profits.

Whales Realize Profits

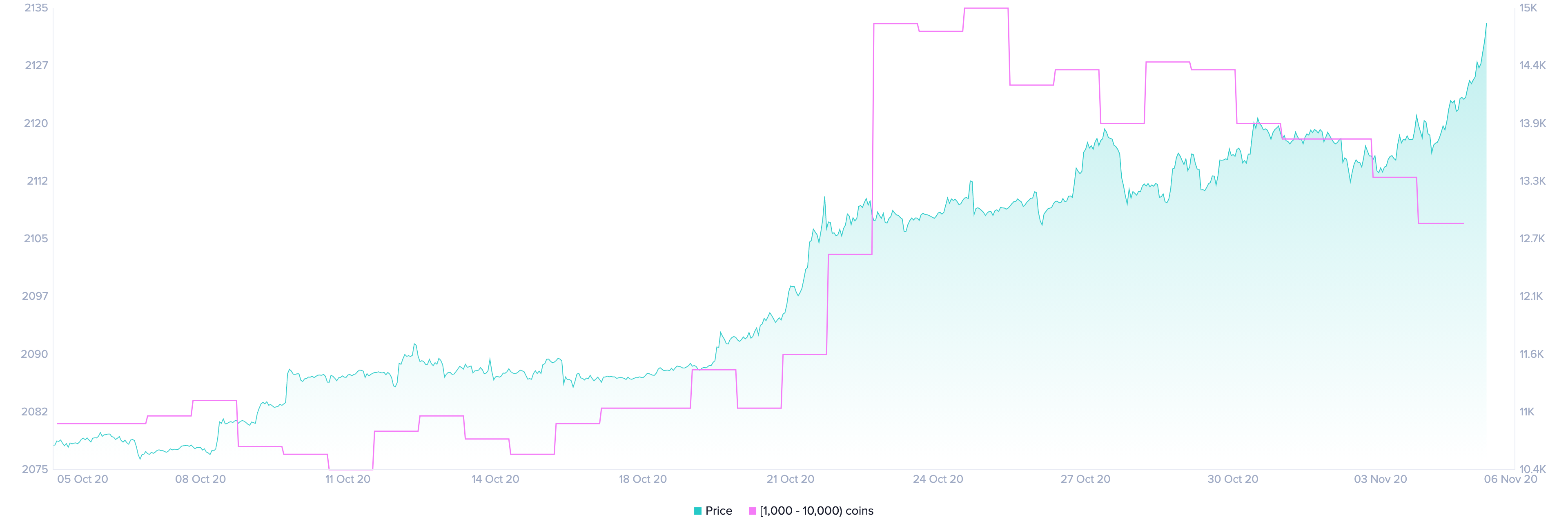

Santiment’s holder distribution chart recorded a significant spike in selling pressure behind Bitcoin while prices were rising. The number of addresses holding 1,000 to 10,000 BTC dropped by nearly 1.3% over the past two weeks.

Roughly 28 whales have left the network or redistributed their tokens over this short period.

The sudden downswing is significant when considering these investors hold between $15 million and $150 million worth of Bitcoin.

If sell orders continue to pile up at the current rate, prices will likely plummet towards the $13,800 support. The IOMAP cohorts reveal that over 1 million addresses bought more than 760,000 BTC around this price level.

This massive supply barrier may have the strength to keep falling prices at bay in the event of a sell-off.

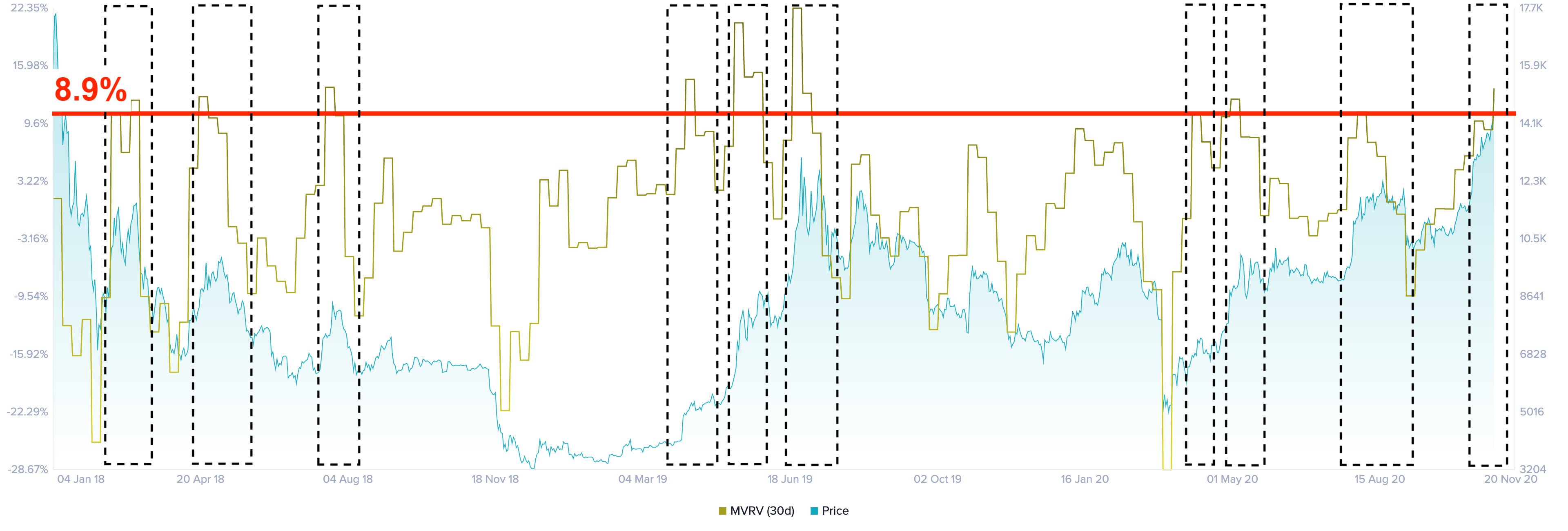

The Market Value to Realized Value (MVRV) index adds credence to the pessimistic outlook. Each time the MVRV has surged above 8.9% over the past year, a selling opportunity emerged.

This indicator recently entered the “danger zone” and is currently hovering around 13.5%.

Such high levels suggest that Bitcoin’s uptrend is reaching exhaustion. Therefore, it is imperative to pay close attention to the $14,600 support level.

Slicing through this price hurdle will confirm the pessimistic outlook and probably lead to a correction towards $13,800.

Share this article