CoinMarketCap’s New Rating Algorithm Sinks Top Exchanges

CoinMarketCap pushes top derivative exchanges to the bottom of its rankings.

CoinMarketCap pushed BitMEX into the 175th spot on the platform’s exchange rankings. Deribit and Bybit have also been pushed down the ladder, drawing concern over CoinMarketCap’s rating process.

CoinMarketCap Losing Objectivity

The impact of Binance’s acquisition of CoinMarketCap is becoming more visible by the day.

After re-evaluating its rating mechanism, CoinMarketCap’s rankings saw crypto’s most liquid derivatives exchange, BitMEX, sink to a ranking of 175.

Compare the stats between BitFlyer, which is ranked 7th in CoinMarketCap’s latest ranking, versus BitMEX.

BitMEX has been given a liquidity score of zero, while BitFlyer received a score of 131. For perspective, BitMEX’s 24-hour volume is 40x that of BitFlyer.

But it isn’t just BitMEX that’s been given a liquidity score of zero. Deribit and Bybit, two premier derivative exchanges, are in the same boat and have seen their ranks drop into the 170s as well.

BitMEX, Deribit, and Bybit facilitated over $3 billion of volume in the last 24 hours.

Binance sits at the top of the rankings. The exchange’s dominance is nothing new, and its futures exchange is also quickly catching up to the likes of BitMEX.

Yet, relegating BitMEX so far down the pecking order is unmerited. To say an exchange that facilitated over $2 billion in transactions in the last 24 hours has zero liquidity is absurd.

Coinbase, a competitor to Binance, is firmly in the top five, however, so this ordeal could be attributed to a fault with the machine learning algorithm CoinMarketCap employs rather than malice.

Community Speaks Up, Competitors Growing

CoinMarketCap was forced to adjust its rating mechanism after criticism from the community. This criticism has only increased now that the top derivative exchanges have been pushed to the bottom.

The crypto community is beginning to support the narrative that the data provider has lost its integrity in the wake of its recent acquisition by Binance.

BitMex is now completely gone from coinMarketCap, sitting comfy at spot, wait for it, 175.

This is despite the fact that Bitmex has the 2nd highest web traffic factor of all exchanges. Which according to coinMarketCap was supposed to be how exchanges would be ranked pic.twitter.com/bVJ6gwan9P

— Cosmo (@CosmonautC) June 8, 2020

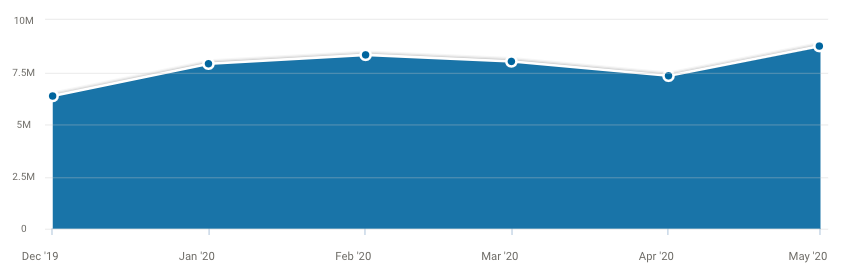

Despite these misgivings, CoinMarketCap still enjoys a majority of web traffic, with over 30 million total visits in May 2020.

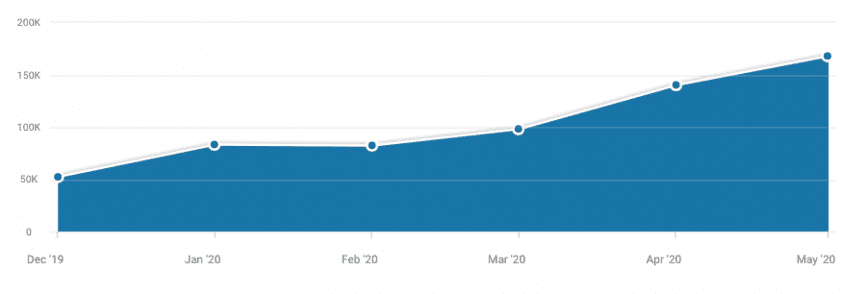

But alternatives to CoinMarketCap, such as CoinGecko, CryptoCompare, and Nomics, have witnessed strong growth in preceding months, indicating users are gradually shifting away from CoinMarketCap.

If this behavior continues, CoinMarketCap could see its market share decline. And since it relies on traffic for advertising revenue, this could end badly for the firm.