Crypto Correlations Change As Ethereum Becomes Benchmark, and Bitcoin Analysis Today

It's not just Bitcoin vs. the rest anymore.

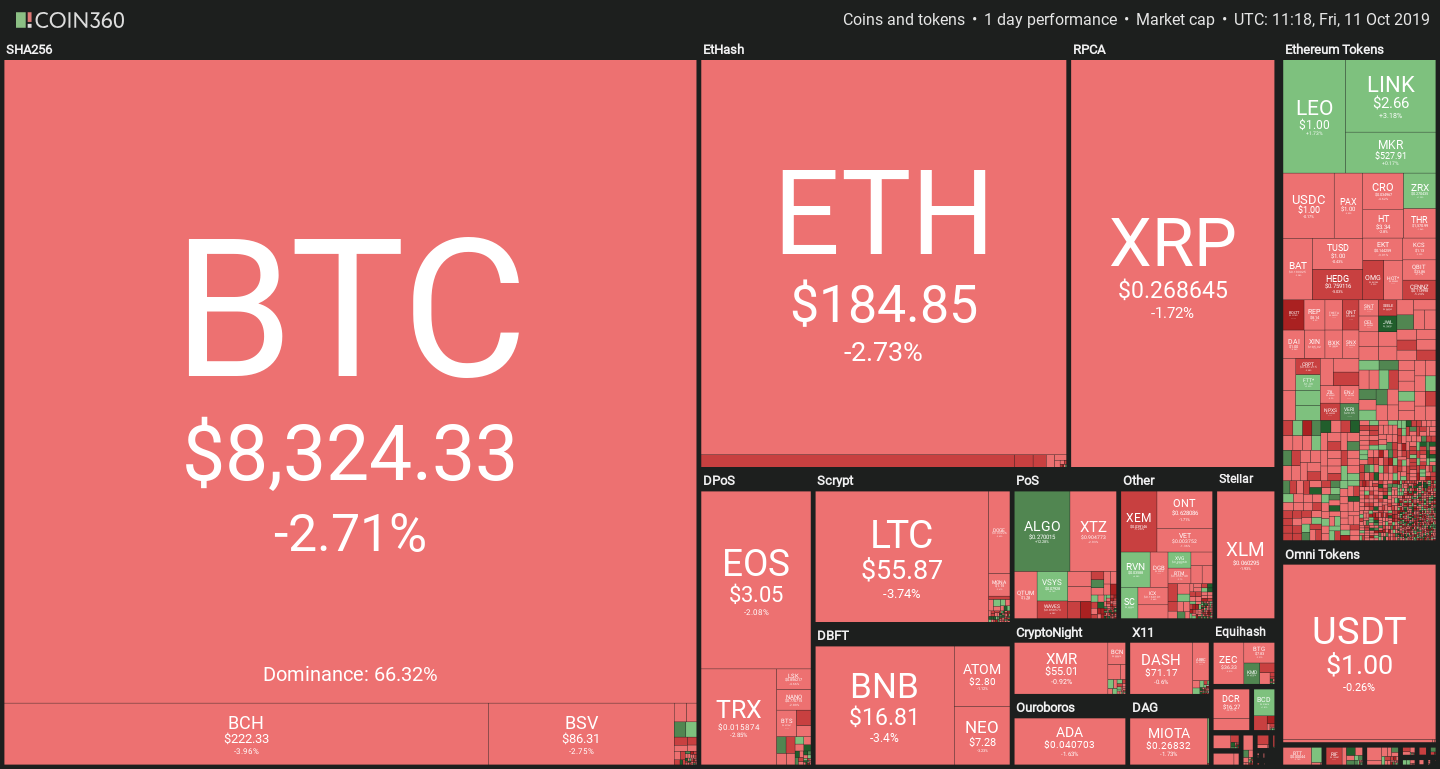

The cryptocurrency markets are seeing a small retracement today. Bitcoin continues its low-volatility trading around the $8,400-8,500 level, while altcoins are still pulling back from their previous gains.

Notable exceptions are 0x (ZRX), Algorand (ALGO) and Chainlink (LINK), which gained 3%, 10% and 5% over yesterday respectively.

Correlations, correlations everywhere in crypto

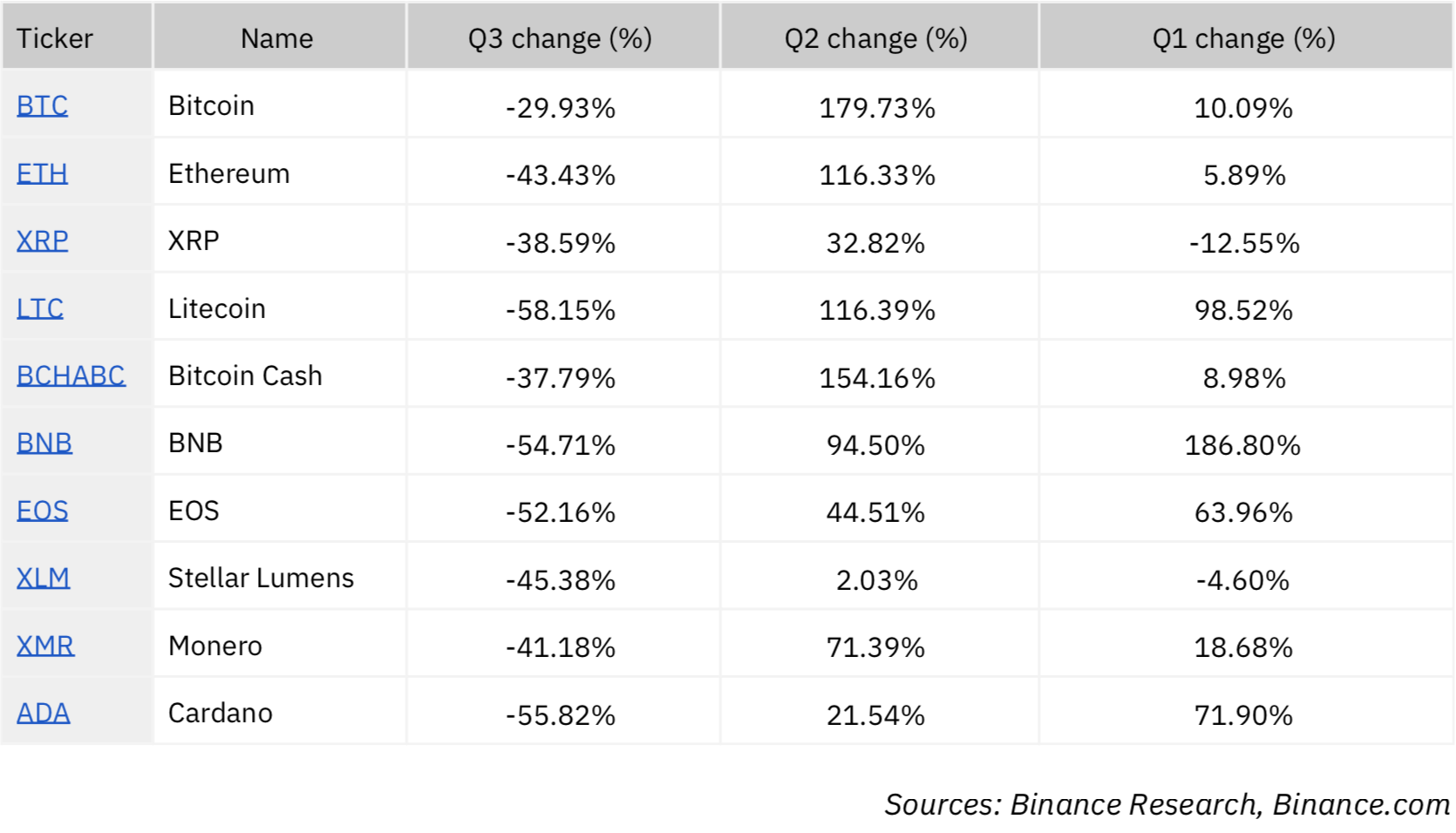

A report by Binance Research analyzed the relative performance of cryptos in Q3. As markets slid downwards from their yearly high in the summer, large market-cap coins did so in unison.

“Over the third quarter of 2019, the average correlation between Bitcoin and most other large cryptoassets remained in line with the previous quarter,” the report notes. “However, the average correlation among large cryptoassets increased in Q3 2019 with a significant positive increase in the correlations of BNB, ChainLink, and Bitcoin SV with other cryptoassets.”

An important change from Q2 is a gradual ‘flippening’ of Ethereum and Bitcoin. As the #1 cryptocurrency began increasing its dominance, Ethereum became the benchmark asset for the rest of the market, with most cryptocurrencies showing higher correlation with it than Bitcoin. But correlation with Ethereum Classic was surprisingly among the lowest, amounting ‘only’ to 0.69.

The report also highlighted the significant correlation between XRP and Stellar, previously noted by Crypto Briefing.

Lastly, cryptocurrencies appear to be specializing in distinct branches. Proof-of-Work assets such as Bitcoin, Litecoin and Bitcoin Cash exhibited higher correlation between each other than median. The same can be said for privacy coins such as Monero, Zcash and Dash, as well as programmable blockchains including EOS, NEO and Ethereum.

But while some of these trends have a logical underpinning, the report cautions that the future is unknowable. “Yet, past empirical results are not representative of the future of this industry. Hence, it remains to be seen whether some of these findings will repeat in the fourth quarter of 2019,” analysts conclude.

Daily Bitcoin Commentary With Nathan Batchelor

Bitcoin is under downside pressure as we head into the U.S trading session, after the BTC/USD pair reversed sharply from just above $8,800 level earlier this morning.

Around $10,000,000,000 was wiped off the total market cap of the entire cryptocurrency market in just under one-hour. Interestingly, the total market cap of the cryptocurrency market hit its highest level in two-weeks before reversing.

No apparent fundamental catalyst has been attributed to the news. The only real bearish news is that one of the largest payment systems in China, Alipay, has recently promised to ban all payments related to Bitcoin.

From a technical perspective, traders will likely continue to fade rallies until the market cap of the entire cryptocurrency starts to trade comfortably above its 200-day moving average.

Traders are currently selling advances towards the $230,000,000,000 level, as it represents the 61.8 Fibonacci retracement of the September monthly trading low to the September 24th swing-high.

As far as Bitcoin is concerned, the cryptocurrency is back under short-term selling pressure while trading below the $8,500 level, with its 200-day moving average currently located around the $8,660 level.

According to short-term technical analysis, the BTC/USD pair can expect to find support from the $8,215 and $8,100 levels if the reversal continues.

If there is a sustained loss of the $8,100 level, we should expect short-term bulls to capitulate, leaving the door-open for further decline towards the $7,715 level.

* ‘The weekly time frame is showing that a bullish falling wedge is forming. A move away from the $9,780 to $7,500 price range will trigger the pattern’. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has fallen, to 51.50%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is unchanged, at 61.50%.

UPSIDE POTENTIAL

Buyers need to move price back above the $8,500 level to stabilize the BTC/USD pair today. A multi-day price close above its 200-day moving average is currently needing to encourage a technical test of the $9,000 level.

The daily RSI indicator is starting to roll over and now trades below 40, while the Choppiness indicator on the mentioned time frame is showing that the market is still lacking a strong trend.

DOWNSIDE POTENTIAL

The loss of the $8,500 level has encouraged traders to test towards the $8,300 level. A loss of the $8,300 level later today may lead to a key test of the BTC/USD pair’s weekly pivot point, at $8,100.

Extended intraday technical support for the BTC/USD pair is currently located at the $7,715 and $7,500 levels.