DeFi Staple Aave Hits Key Record Highs as Niche Breaches $26 Billion

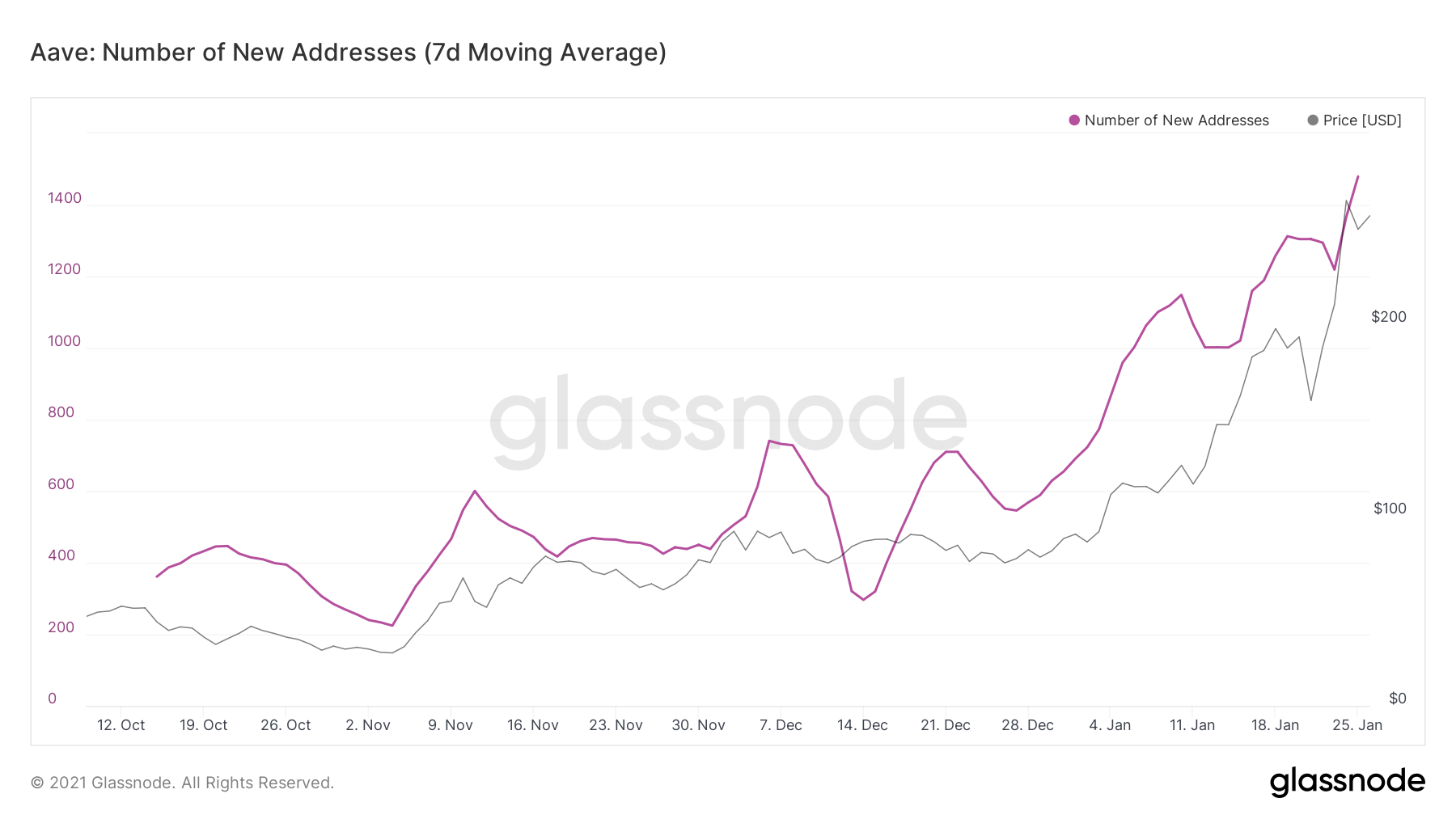

Along with the Aave’s price, the number of new and active addresses has also surged.

Key Takeaways

- With Aave registering major gains throughout January, the number of new addresses holding the protocol's native token has hit a new record high.

- The number of active addresses is also at an all-time high.

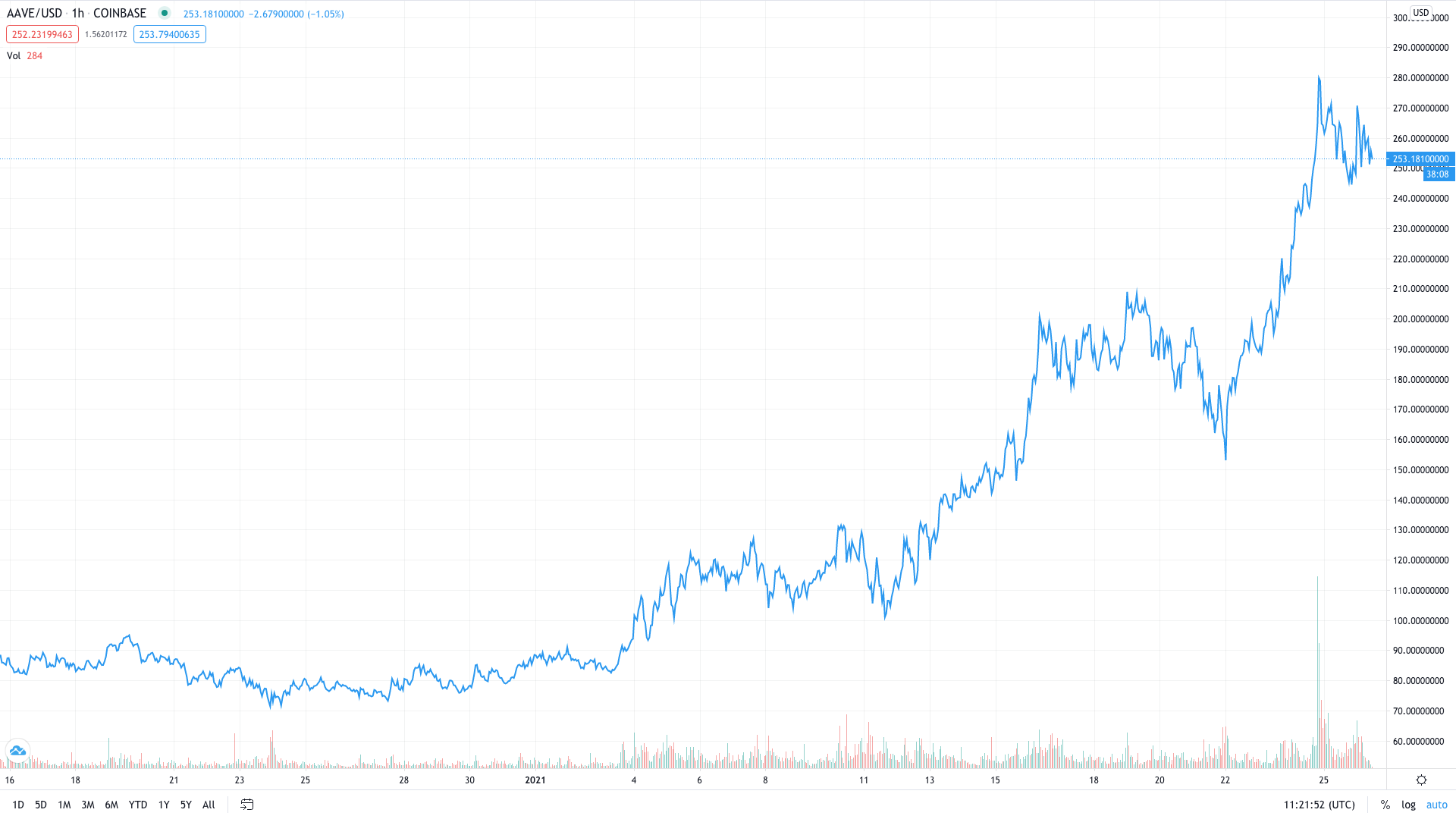

- Aave is up 185% year-to-date, as interest surrounding DeFi continues to grow.

Share this article

Aave is up 185% this year. Following the rise, the number of new addresses holding the AAVE token is at an all-time high.

Aave Moons on Multiple Metrics

Activity related to Aave is at an all-time high on several key metrics.

According to data from Glassnode, the number of new addresses holding the protocol’s native token just hit an all-time high of 62.22, on a seven-day moving average. It puts the total number of new addresses at 1,479.57.

Glassnode also notes that the number of active addresses has hit a record high of 185.63 on a seven-day moving average, putting the total number at 2,722.14.

The number of transfers and transaction volume is at an all-time high too.

Aave has had a strong start to 2021. On Sunday, the native token breached $280 for the first time on multiple exchanges. It’s trading at around $247.94 at the time of press.

The DeFi Blue Chip

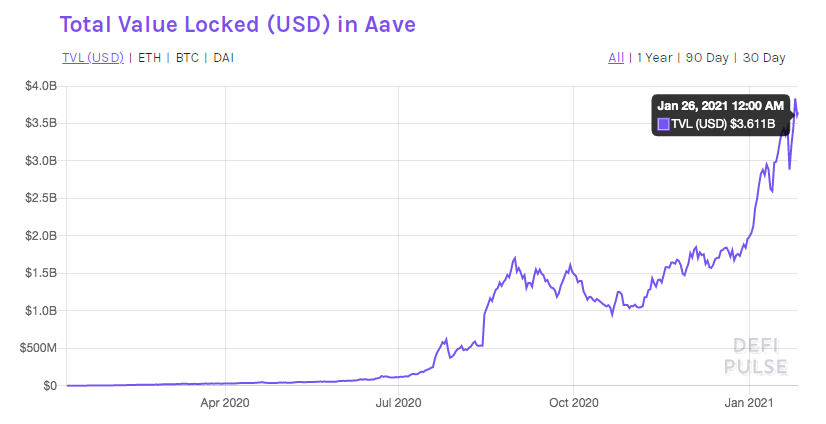

The protocol itself is hitting new peaks alongside the token’s price.

Today, there’s $3.61 billion locked in Aave, according to DeFi Pulse, up from $4.12 million this time last year. That puts it second behind only MakerDAO, which has been in operation since 2015 (the two protocols have interchangeably held the top spot at various points over the last year or so).

Aave is a liquidity protocol that enables DeFi users to lend and borrow digital assets like DAI and LINK. It’s one of the most popular DeFi apps, widely considered a “blue chip” of the industry.

The project’ss recent updates have included enabling collateral swapping and credit delegation, which were added with the launch of Aave V3. In November, it was revealed that the protocol would be partnering with the Swiss banking company CrescoFin.

Though the project has consistently been one of the leaders of DeFi, its token took a slump when the rest of the DeFi market did in November. AAVE was trading at only $27.60 on Nov. 5, 2020, meaning it was up over 1,000% at this weekend’s peak.

Other DeFi tokens have also performed well in recent weeks.

Alongside AAVE, SNX, and UNI now also feature in the top 25 cryptocurrencies by market cap, according to CoinGecko. The total value locked in DeFi hit $26 billion yesterday, also a new peak.

Disclosure: At the time of writing, the author of this feature owned AAVE and SNX. They also had exposure to UNI and MKR through a cryptocurrency index.

Share this article