Uniswap Hits $20 Billion in Monthly Volume, Eyes New Record

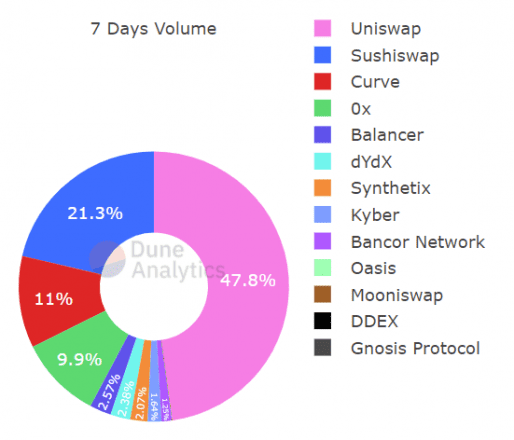

Uniswap is growing rapidly, consistently enjoying 50% or more market share across the entire DEX space.

Key Takeaways

- The leading decentralized exchange, Uniswap is on track to achieve a monthly volume of $25 billion.

- Uniswap is now the 4th largest spot exchange in the world, outpacing many centralized counterparts.

- Despite the end of its incentives program, LPs on the platform continue to increase.

Share this article

Uniswap, the leading decentralized exchange, is on track to set an all-time high for monthly volume at $25 billion.

Uniswap Shows No Sign of Slowing Down

Uniswap is now the fourth largest spot exchange globally, consistently earning the majority market share across all DEXes. It beats popular centralized exchanges like Gemini, Bittrex, Poloneix, and Bitstamp.

Uniswap surpassed 300,000 Monthly Active Users (MAUs) in December 2020, and the median trade size has risen to ~$1,300, according to the protocol’s strategy lead, Teo Leibowitz.

Uniswap routers account for more than 20% of all transactions taking place on the Ethereum blockchain. Uniswap has also decided to use Optimism as their Layer-2 solution to combat high gas fees, joining Synthetix and ChainLink in adopting OVM.

On Jan. 16, 2021, Optimism soft-launched OVM on the Optimistic Ethereum mainnet. Along with scalability improvements, Uniswap also boasts an incredibly loyal community of liquidity providers (LPs) to keep trading costs and slippage fees low.

On Nov. 17, 2020, the protocol saw a sharp decline in its liquidity due to the liquidity incentives program ending on that day. Despite the lack of incentives, however, liquidity on the platform continues to increase. Currently, the protocol has $3.36 billion in liquidity.

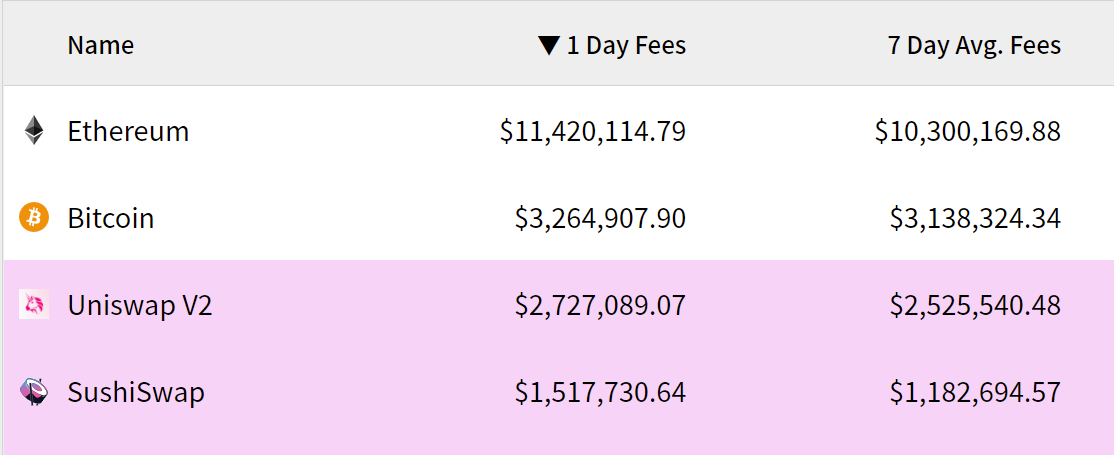

The protocol has more than 72,000 LPs at the time of press. These LPs are expected to receive $75 million in fees for January 2021. Uniswap earns the third-most in transaction fees, after Ethereum and Bitcoin.

Hayden Adams, Uniswap’s creator, stated that since the inception of Uniswap V2, the protocol has seen a trading pair get deployed every 12 minutes. This equates to roughly 115 new trading pairs per day for the last 249 days.

Uniswap Grants Program (UGP) is now live, too. The deadline for Wave 1 is Feb. 28, 2021, while the deadline for Wave 2 is slated for May 31, 2021.

UGP became the first governance proposal to pass successfully. Before this, the first two proposals failed to meet quorum.

The first proposal aimed to lower the UNI required to submit a proposal and lower the threshold required to reach a quorum. The second proposal aimed at distributing UNI tokens to users who interacted with the platform via proxy contracts.

On Sept. 17, 2020, Uniswap airdropped their native governance token called UNI. Eligible participants received 400 UNI, which amounted to $1,376 at the time. Today, this sum has increased substantially and now amounts to $5,056.

The team is keeping the updates of Uniswap’s upcoming V3 under tight wraps, and thus not much is known about the upgrade.

However, the team was spotted hiring four engineering personnel, including a senior frontend engineer, smart contract engineer, full-stack engineer, and software engineer intern.

Share this article