Dogecoin Prepares for a Bullish Impulse Towards New All-Time Highs

Dogecoin looks poised for another leg up as long as it holds above the $0.046 support level.

Key Takeaways

- Following a 40% correction, Dogecoin looks primed to rebound towards new all-time highs.

- Trading veteran Peter Brandt suggests that DOGE is forming a bullish continuation pattern.

- Transaction history shows this cryptocurrency sits underneath a formidable resistance.

Share this article

Dogecoin entered a consolidation period after surging by nearly 1,100% in late January. Despite these gains, one of the most prominent technical analysts in the industry believes that DOGE has room for growth.

Dogecoin May Resume Uptrend

Peter Brandt, CEO of Factor LLC, recently commented on Dogecoin’s price action for the first time. Although the trading veteran maintains that Bitcoin and Ethereum are the only cryptocurrencies with real utility, it seems like DOGE could be about to provide an opportunity to profit in the near-term future.

According to Brandt, Dogecoin’s price appears to be developing a cup and handle on its 4-hour chart. This technical formation indicates a bullish continuation pattern and is mostly used by traders to enter long positions.

DOGE is currently creating the pattern’s handle after being rejected by the $0.082 resistance level. A spike in buying pressure around the current price levels could see this cryptocurrency restest the overhead barrier and slice through it. If this were to happen, the cup and handle formation forecasts a 75% target that might take this altcoin to $0.144.

This target is determined by measuring the height between the bottom of the cup and the overhead resistance level, then adding that distance upward from the breakout point.

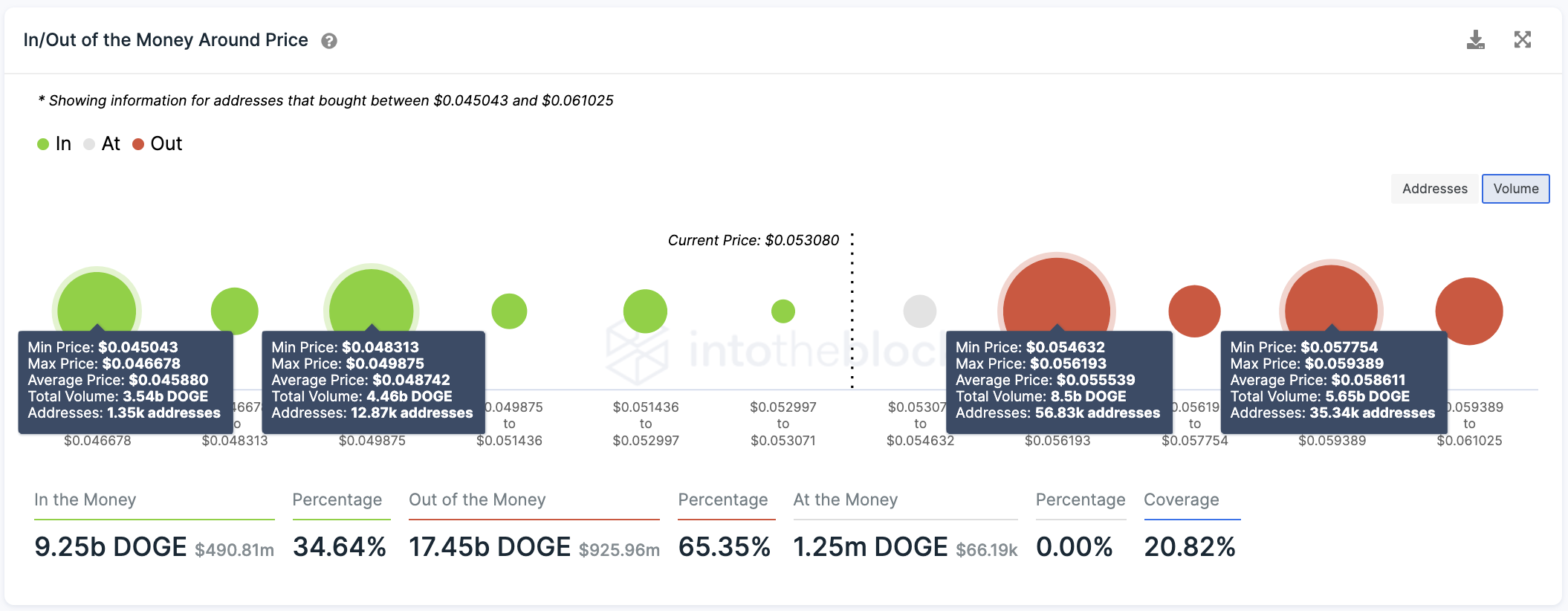

Regardless of the optimistic outlook, IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model reveals that Dogecoin sits underneath a massive supply barrier. Nearly 57,000 addresses had previously purchased 8.50 billion DOGE between $0.055 and $0.056.

As such, further price appreciation may prove challenging unless the meme coin can close above this price range. Breaking through will increase the odds for an upswing to $0.082 and eventually to $0.144.

It is worth noting that when considering the strength of the overhead resistance, Dogecoin is trading on top of weak support. Therefore, investors must pay close attention to the $0.046 hurdle.

A sudden increase in selling pressure that pushes DOGE’s price below this demand wall could trigger a sell-off towards the next critical interest area at $0.030.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

Share this article