Ethereum Market Cap Now Half the Size of Bitcoin

Ethereum is now worth over $478 billion. That’s just over half the size of Bitcoin in market cap terms.

Key Takeaways

- Ethereum's market cap is now half the size of Bitcoin's. The ratio between the assets is 0.08.

- Many crypto followers believe that Ethereum could overtake Bitcoin to become the largest cryptocurrency by market cap in the future.

- Ethereum's roadmap for the coming months includes EIP-1559 and "the merge" to Proof-of-Stake, which could bode well for ETH's price action.

Share this article

The recent Ethereum rally has raised calls for what the crypto community has dubbed “The Flippening.”

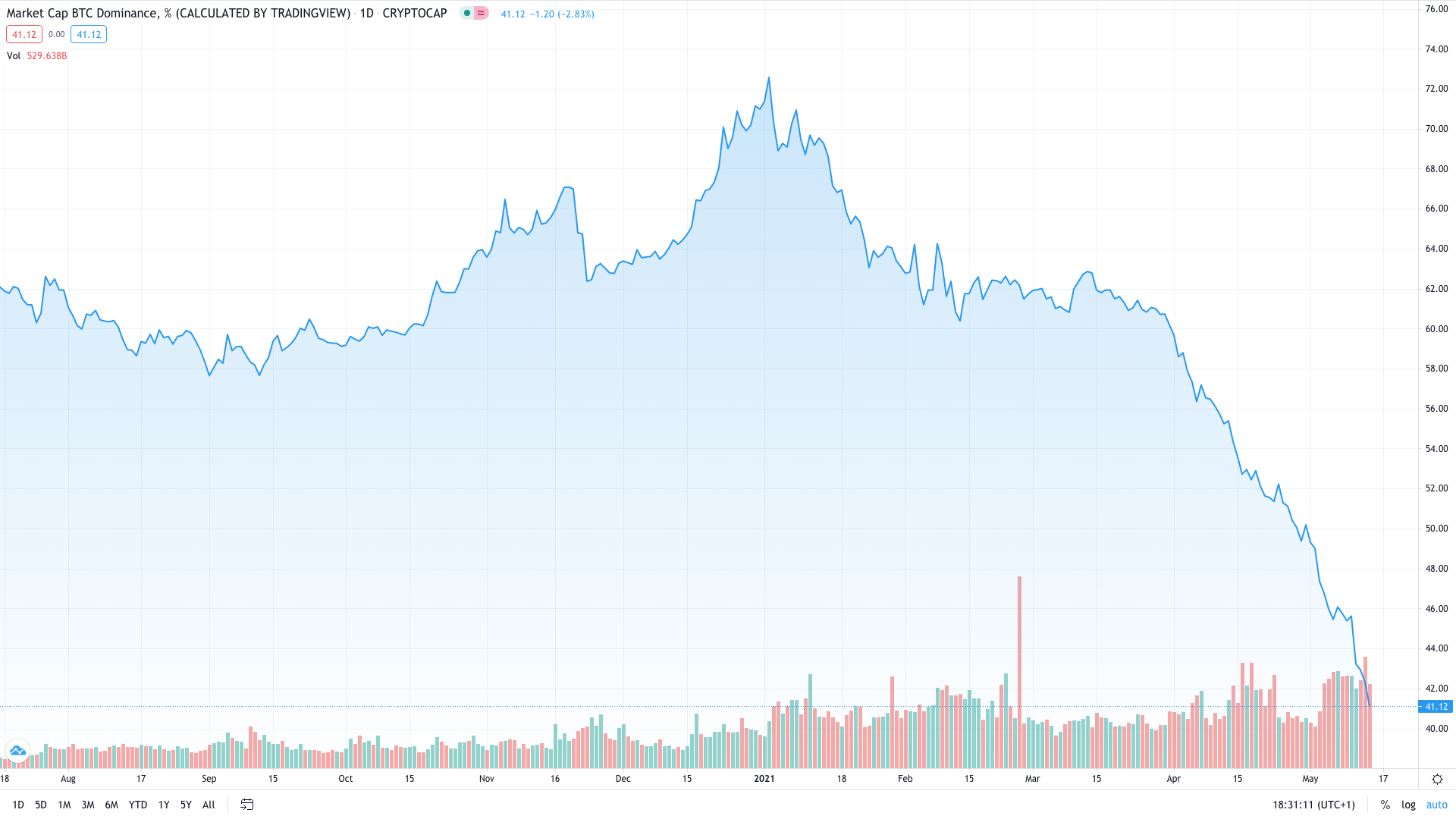

Bitcoin Dominance Plummeting

Ethereum is catching up with Bitcoin.

The second-ranked cryptocurrency hit a market cap of $478.5 billion today, which is just over half that of Bitcoin. ETH has trended back over $4,000 in the last 24 hours, while BTC is trading just at $50,938—over 20% off its all-time high. ETH has been rallying against BTC for weeks now. The ratio between the two assets has hit 0.08, and Bitcoin’s market cap dominance has slid to around 41%.

One of the strongest narratives in the crypto community of recent weeks has been the possibility of an event that’s been called “The Flippening.” Ethereum believers have long discussed the possibility of the number two network overtaking Bitcoin in market cap terms. Ethereum would need a ratio of 0.016147 to overtake Bitcoin today, which equates to an ETH price of around $8,224. The event has often been described as improbable.

That’s changed this year, with Ethereum regularly hitting new record highs amid surging demand. In the last few weeks, legendary crypto traders like Cobie and Su Zhu have shared the view that Ethereum taking the top spot is likely.

On many metrics, Ethereum already ranks ahead of Bitcoin. It processes about 1.5 million transactions daily while Bitcoin does about 250,000. Ethereum’s daily fees significantly eclipse Bitcoin’s. Ethereum also has a vast ecosystem that’s home to DeFi apps like Aave, Uniswap, and Compound.

Crucially, Ethereum still has a big few months of development ahead. On Jul. 14, the protocol will ship EIP-1559, which will add deflationary pressure to ETH by introducing a gas fee burn on transactions. EIP-1559 inspired the “ultra sound money” meme that Vitalik Buterin and others have discussed recently. After it ships, “the merge” to Proof-of-Stake is due to follow. Certain signs suggest that institutions are starting to take an interest in ETH.

With Elon Musk helping to resurface the environmental debate surrounding Proof-of-Work, Ethereum’s scheduled Proof-of-Stake update could also strengthen its narrative. Should the interest in Ethereum continue, Bitcoin may need a new wave of institutional adoption to hold onto its crown.

Disclosure: At the time of writing, the author of this feature owned ETH, FLI, AAVE, and several other cryptocurrencies. They also had exposure to UNI and COMP in a cryptocurrency index.

Share this article