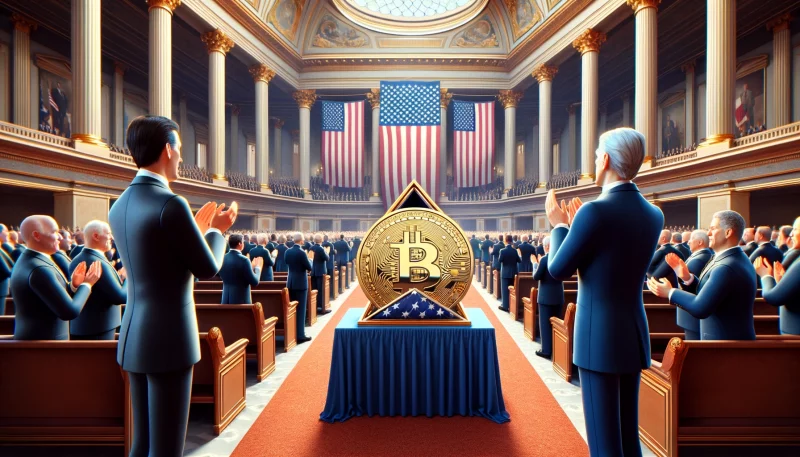

Satoshi Nakamoto honored with US flag ceremony by anti-crypto Senator Warren

<p class="ml-rte-text">Despite having been known to hold "anti-crypto" views, Senator Elizabeth Warren just signed a certificate praising Bitcoin's creator, Satoshi Nakamoto.

Powered by Gloria

Despite having been known to hold “anti-crypto” views, Senator Elizabeth Warren just signed a certificate praising Bitcoin’s creator, Satoshi Nakamoto. The ceremony honored Bitcoin’s 15th anniversary by flying a flag over the US Capitol calling and Satoshi’s efforts at creating a “truly inclusive financial system.” Did she just do a 180-degree turn to support crypto?

In regulatory news, the SEC just slapped a $1.75 million fine on spot Bitcoin ETF issuer VanEck for keeping an influencer deal secret back in 2021. The firm neither admitted nor denied the allegations, but agreed to settle the fine.

On the tech side, Tron has announced progress in developing a Bitcoin L2 solution, aiming to improve interoperability between Bitcoin and the Tron network, while also supporting growth in DeFi and Ordinals.

Today’s Newsletter

- Satoshi Nakamoto honored with US flag ceremony by anti-crypto Senator Warren

- VanEck to pay $1.75M SEC fine for not disclosing influencer’s role in ETF launch

- Tron unveils development roadmap for Bitcoin layer 2 solution

a

Markets

|

Data powered by CoinGecko.

|

a

Top Stories

BITCOIN

Satoshi Nakamoto honored with US flag ceremony by anti-crypto Senator Warren

Warren signed a certificate honoring the anonymous creator of Bitcoin, Satoshi Nakamoto. The celebratory document praised Satoshi’s initiative, calling crypto a “truly inclusive financial system” that provides “new economic freedoms” for “previously ignored” populations.

Warren holds well-known anti-crypto views, backing and proposing stricter laws against the industry, making her symbolic signature somewhat startling. While the reasons remain unclear, theories suggest an intern presented the document for a routine signature. Did Warren have a change of heart? Her public stature could influence the crypto community’s perception if her gestures match future policies. [cryptobriefing]

REGULATION

VanEck to pay $1.75M SEC fine for not disclosing influencer’s role in ETF launch

ETF power player VanEck got slammed with a $1.75 million fine by the SEC tied to shady influencer ties around a previously launched fund’s promotion. Regulators said VanEck failed to disclose to its board that an unnamed social media persona received growing payments for hyping the financial product back in 2021.

The fund in question? An ETF meant to track hot stocks based on bullish online chatter, fittingly called the BUZZ fund. While regulatory action centers on a lack of transparency, power dynamics lurk beneath the surface.

As investment firms increasingly turn to trendy e-celebs for marketing kicks, lines blur on independence versus advertising. Would such a bad history affect VanEck’s standing in the crypto ETF markets? We’ll have to wait and see. For one, VanEck is among the applicants for a new Ethereum ETF. The SEC has until May 23 this year to decide whether they’d approve another ETF from VanEck. [decrypt]

ALTCOINS

Tron unveils development roadmap for Bitcoin layer 2 solution

Tron founder Justin Sun is building out a Bitcoin layer 2 solution to bridge their network and facilitate access to over $55 billion in value on the Bitcoin network. According to the project’s roadmap, the new L2 will help drive interoperability and enable DeFi and NFT growth for Bitcoin users.

The project will also support Bitcoin Ordinals, a new market adjacent to NFTs that Tron has been actively exploring. Sun says that the project will set standards for the entire industry, with high transaction speeds and low fees, hallmark features of a proof-of-stake network. As a new layer 2 solution, the project will likely unlock and extend new functionalities for Bitcoin. [cryptobriefing]

a

Other News

Next Week’s Token Unlocks

- AVAX has an upcoming unlock of $415.8M, amounting to a 2.8% increase in supply, against a market cap of $14.8B.

- APE will experience an unlock of $25.4M, increasing supply by 2.6%, with a market cap of $966M.

- MANTA’s unlock of $23.4M represents a 3.1% supply boost, with a market cap of $745M.

- IMX will unlock $26.8M, a 0.6% supply increase, with a market cap of $4.2B.

- ROSE is set to unlock $20.8M, corresponding to a 2.5% supply increase, and holds a market cap of $814M.

- ID will unlock $10.9M, increasing supply by 4.3%, and has a market cap of $253M.

- DYDX will see $6.8M unlocked, equating to a 0.7% rise in supply, with its market cap standing at $943M.

Data powered by Token.unlocks.

Diego & Vince