Crypto investment products draw over $1 billion in investments as momentum builds

Ethereum and Cardano see significant inflows as crypto market expands.

Share this article

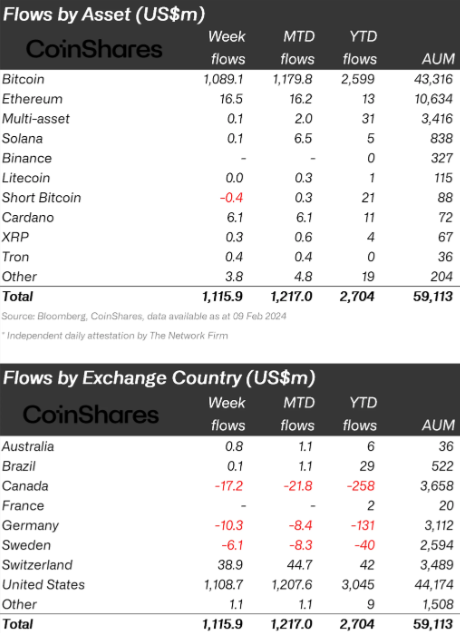

Crypto investment products have garnered over $1 billion in inflows, raising the total for the year to $2.7 billion, as reported by asset management firm CoinShares. This surge has propelled assets under management (AUM) to a peak not seen since early 2022, now standing at $59 billion.

In the US, newly launched spot Bitcoin exchange-traded funds (ETFs) have been a major draw, contributing significantly to the inflow with $1.1 billion last week alone. Since their inception on Jan. 11, these ETFs have amassed almost $3 billion in investments. This trend indicates a growing investor interest in crypto-based financial products.

Bitcoin has been the primary beneficiary of these inflows, capturing nearly 98% of the total. The rise in Bitcoin prices has also positively influenced the market sentiment towards other digital currencies like Ethereum and Cardano, which experienced inflows of $16 million and $6 million, respectively.

While the focus has been on the US, other regions have seen mixed movements. Canada and Germany experienced minor outflows amounting to $17 million and $10 million, respectively. Conversely, Switzerland reported positive inflows of $35 million last week.

Despite the overall positive trend, certain areas have seen withdrawals. Uniswap and funds short positions on Bitcoin-indexed investment products faced slight outflows of close to $1 million. Meanwhile, blockchain equities saw a net outflow, driven by a significant $67 million withdrawal from one issuer, though this was partially offset by $19 million in inflows to other issuers.

Although the market’s momentum appears robust, the potential sale of Genesis holdings of Grayscale Bitcoin Trust, valued at $1.6 billion, looms as a factor that could influence future outflows.

Share this article