Bitcoin’s L2 structure Stacks show significant Q4 growth: Messari

Messari’s report reveals a 3,386% revenue jump for Stacks, with its native token STX reaching a $2 billion market cap.

Share this article

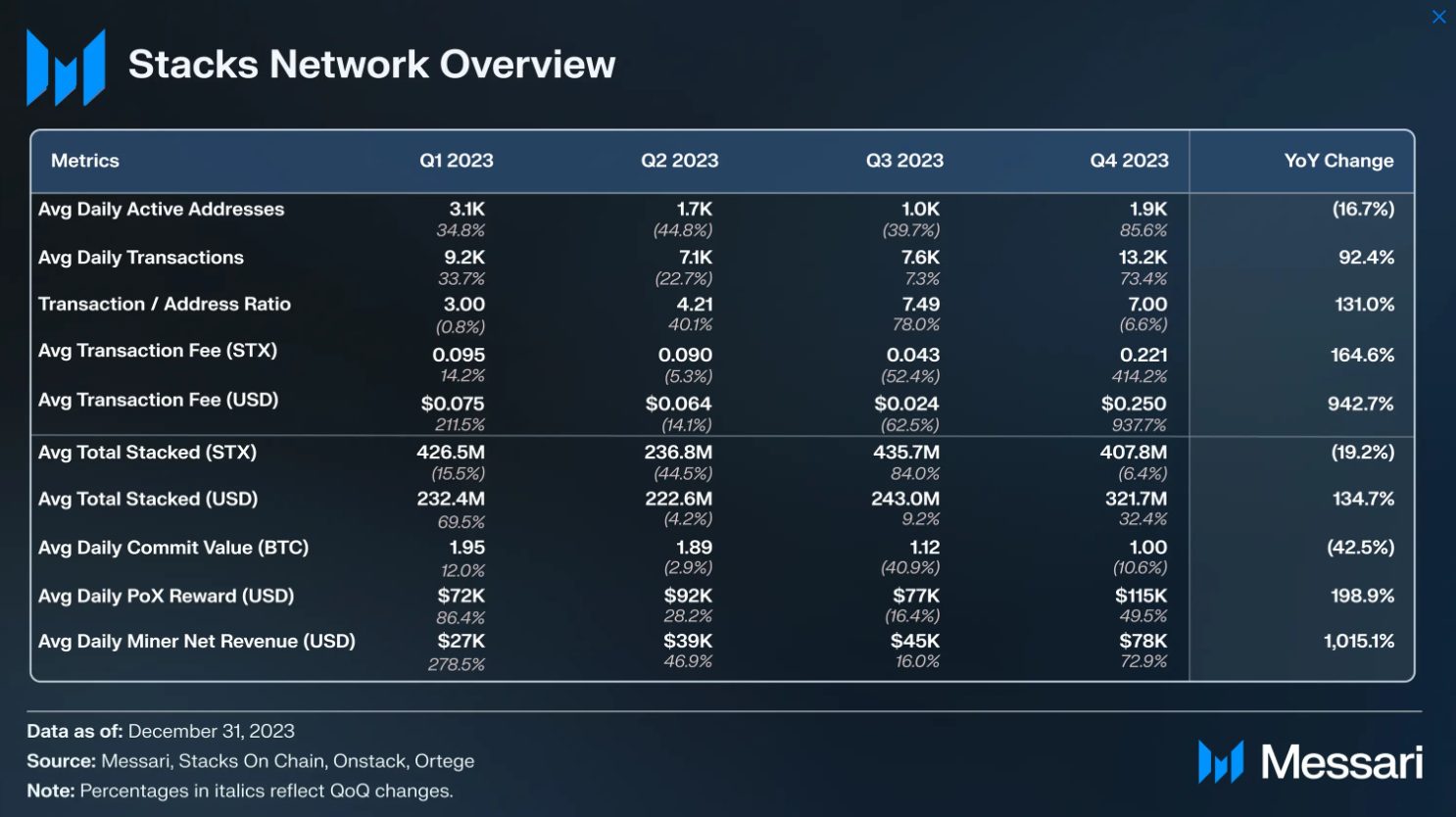

Messari’s “State of Stacks Q4 2023” report has unveiled significant growth and advancements in the Stacks ecosystem, a Layer-2 solution for Bitcoin. Key findings from the report include a 3,386% quarterly and 3,028% annual increase in Stacks’ revenue, reaching $637,000. The market cap of its native cryptocurrency, STX, surged 203% quarterly and 598% annually to $2 billion.

The report also points to a 363% quarterly leap in total value locked (TVL), which amounts to a 773% annual rise to $61 million, with average daily miner revenue up 1,015% annually to $78,000.

The report emphasizes Stacks’ leadership in Bitcoin’s Layer-2 space and its potential to solidify this position with the upcoming Nakamoto upgrade in April 2024. This upgrade introduces, according to the project’s white paper, faster blocks, Bitcoin finality, removal of fork chances, and reduced maximal extractable value (MEV) for Bitcoin.

Another important change to be brought by the Nakamoto upgrade is the introduction of sBTC, a trust-minimized bridged BTC, which will be able to be used on Stacks. All those changes will turn the decentralized finance (DeFi) experience on Stacks “more comparable to other DeFi platforms,” according to the report.

Stacks’ financial growth, driven by the Inscription protocol STX20, has outpaced both Bitcoin and the broader cryptocurrency market. STX20 is an inscription protocol on Stacks, inspired by Bitcoin inscriptions (specifically BRC-20 Ordinals). Over 10,000 transactions were included in a single block in December due to STX20 activity, the largest Stacks block ever.

The growth can also be attributed to platforms like ALEX, Arkadiko, and StackingDAO, which also reflects a growing DeFi ecosystem within Stacks, as the report also notes a surge in network usage, with a 52% quarterly increase in daily transactions and a 65% rise in active addresses.

The integration of Stacks with Bitcoin combines Bitcoin’s security and capital with enhanced programmability, thanks to the Proof-of-Transfer (PoX) consensus mechanism and the Clarity programming language. This integration expands Bitcoin’s utility beyond a mere store of value.

Projects built on top of Bitcoin are seen as a ‘hot narrative’ for crypto in 2024 by different industry players. On-chain research firm Nansen chose this topic as one of four ‘high-conviction bets’ for 2024, and Brazilian asset manager Hashdex pointed to the ‘industrial era of Bitcoin’ as something to keep an eye out for.

Share this article