Can Zcash Blossom Revitalize ZEC’s Price Trend?

The ZEC all-in doesn't seem to be working out.

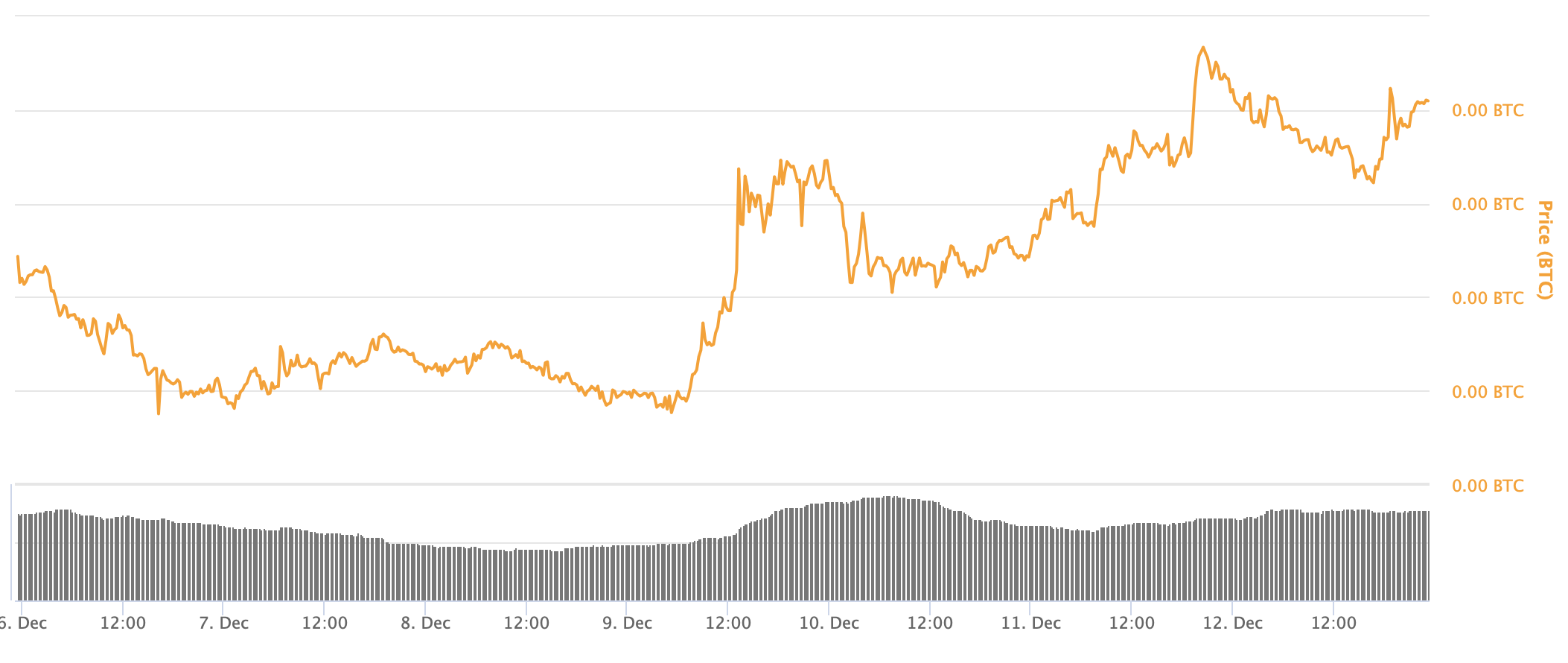

On Dec. 11 Zcash activated the Blossom network upgrade. Announced last year, the upgrade halved the block time to 75 seconds to increase throughput. Markets responded positively, but can that last?

The Blossom upgrade is a fairly simple change that doubles the throughput of the Zcash blockchain. Blocks are produced twice as fast while maintaining the same capacity, which allows more transactions to be processed in the same amount of time. Mining rewards were adjusted to maintain the same emission schedule, along with a few other accommodating changes.

Blossom is the first iteration of a new Network Upgrade Pipeline developed by Electric Coin Co., the for-profit company developing Zcash. It was initially supposed to include two other proposals: Harmony Mining and Split Founders’ Rewards.

Harmony is a dual-mining algorithm that would give equal strength to ASIC and GPU miners while not penalizing either, and will be implemented some time in April 2020. Split Founders’ Rewards, an in-blockchain separation of mining rewards between Electric Coin and Zcash Foundation, was later scrapped altogether.

Zcash Price Suffering

Though the Blossom upgrade remains a significant increase in Zcash’s transaction rate, it is hardly revolutionary. Despite this, its price in BTC rallied by approximately 14 percent in the past week. Using this metric allows to eliminate most of the wider market’s fluctuations that could influence its USD price.

However, this does little to fix a lackluster performance this year. After reaching a capitalization high of almost $800 million in June, it has since tumbled to about $250 million — significantly lower than even at the start of 2019.

The market capitalization figure is influenced by the significant supply dilation that occurred in the past few years. The price is faring even worse — the last time ZEC traded for $30 was around Feb. 2017.

This in stark contrast with its competitor Monero, which currently has about $1 billion market capitalization — losing “just” half of its value since summer.

The causes are likely a combination of factors. The supply dilation could’ve had an outsized effect on its value — losing more in price than it gained in the amount of coins. Zcash also had a fairly tumultuous year, as conflicts between Zcash Foundation and Electric Coin emerged. Regulatory pressure increased this year as well, which may have had a stronger effect on Zcash for its ambiguous statements on the privacy it affords.

Nevertheless, Electric Coin achieved a significant research breakthrough this year with Halo, a new technique that could be used to scale Zcash. It allows to create trustless “proofs of proofs” where the validity of the previous transactions can be verified through zero knowledge cryptography. That could, in theory, allow nodes to only maintain the latest block information — significantly boosting their performance possibilities.

Issues With Funding

While promising, Halo-based upgrades may be years in the future. Until then, Electric Coin’s all-in strategy may put it at significant risk, as the Founders’ Reward will finish in late 2020. The 26 months runway calculated in the summer assumed a ZEC price of $90. Under the same forecasts, it’d now be closer to eight.

Zcash will need to find a way to reignite the interest of the community — in a market that is clearly losing traction.

In a conversation with Crypto Briefing, Electric Coin VP Marketing Josh Swihart revealed that the company will soon release a transparency report with updated financial information. Commenting on concerns for the long-term sustainability of Electric Coin, he added:

“I’m highly optimistic for the future of Zcash based on the current community governance and funding conversations.”

Earn with Nexo

Earn with Nexo