Bitcoin Market Eyes Grayscale Premium as Unlock Looms

The Grayscale effect on Bitcoin faces a vital test beginning this week as a major tranche of GBTC shares unlock.

Key Takeaways

- A large tranche of Grayscale Bitcoin Trust Shares (GBTC) will unlock on Feb. 5, according to recent inflows.

- Historically, GBTC unlocking has been bullish, followed by a dull period of correction or consolidation.

- Bitcoin’s price has stayed true to the analysis so far. Now, BTC faces a challenge as low premiums may dissuade institutions from reinvesting in the asset.

Share this article

The premium for Grayscale’s Bitcoin Trust (GBTC) shares slid into the negative territory yesterday, a rare occurrence for the asset. With another unlock coming up, the premium could face further downside.

Grayscale at a Critical Juncture

GBTC shares representing 20,000 Bitcoin (worth nearly $700 million) will be unlocked beginning this week. However, a discounted price of GBTC shares threatens to disrupt the “Grayscale effect,” where price surges follow unlocking events.

This week, GBTC shares turned negative for the first time.

Grayscale’s $GBTC premium turns negative for the first time since the launch. pic.twitter.com/xckXT4rEQO

— unfolded. (@cryptounfolded) February 1, 2021

Grayscale share unlocking has previously had a positive impact on the price, as institutional investors have been known to re-buy the asset. The primary driver of the investment in the past has been its “premium.”

In 2020, GBTC shares traded at a premium of roughly 15-20% to Bitcoin’s Net Asset Value price.

Institutional investors have been known to use the premium to their advantage by executing low-risk arbitrage trades since Grayscale’s launch—the average premium on the product since launch is 38%.

Hence, when GBTC shares unlock, investors sell their shares at a premium on brokerages like Fidelity, Charles Schwab, and TD Ameritrade to reinvest in the trade again, causing an uptrend in price.

The trend first discovered by Jarvis Labs’ Ben Lilly followed perfectly during the last unlocking.

The premium reached a peak of 40% on Dec. 21. Lily predicted that the premiums would drop when the unlocking had run its course on the price. Following Lily’s analysis, the drop in GBTC premiums may have been due to “no unlockings” of Grayscale’s shares. Still, a discount on GBTC raised apprehensions of reduced institutional demand.

The second-factor affecting Grayscale premiums is the availability of similar products.

Traders and analysts alike have been aware that as competition increases, the premiums will subside. Notable Grayscale competitors include Bitwise’s Crypto Index, the Bitcoin ETF filing by VanEck, and regulated products found in Canada and Europe.

Crucial Unlocking Begins

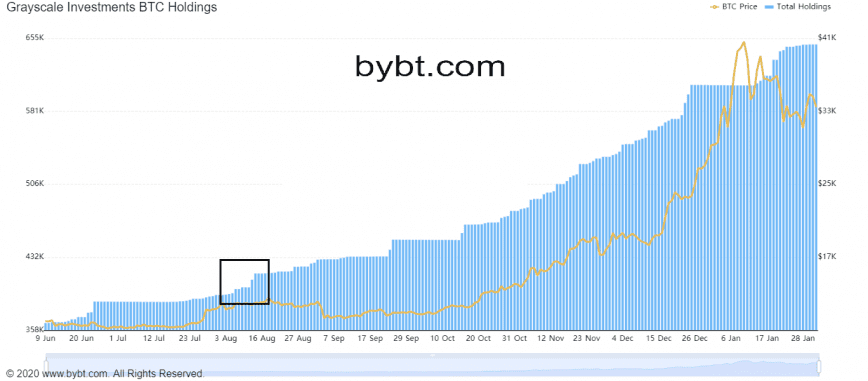

Last summer, Grayscale’s total Bitcoin holdings increased from 395.41K BTC on Aug. 5 to 415.43K BTC by Aug. 14, a jump of $480 million in U.S. dollar terms. The investment is worth $700 million at Bitcoin’s current trading price.

The premium on GBTC is 11.94% at the asset’s current trading price, according to YCharts.

If the premiums continue to slide, institutions may begin to seek other investment opportunities in place of GBTC.

Three Arrows Capital dominated the last unlocking event. It was identified as the leading investor in June 2020, scooping 21 million GBTC shares. After the share unlocks six months later, the investment firm acquired 38.8 million GBTC shares.

The co-founders of Three Arrows Capital, Su Zhu and Kyle Davies, have been bullish on the asset lately.

Next key lvls are 48k then 72k$BTC

— 朱溯 🐂 (@zhusu) February 1, 2021

However, not every institutional investor who invested in Grayscale Bitcoin Trust may be as bullish as Three Arrows. As new tranches of shares unlock from inflows during Q3, the premiums going forward will gauge the demand for these products at retail brokerages.

Disclosure: The author held Bitcoin at the time of press.

Share this article