CB10 Index Rebalancing Makes Room for More Ethereum, DeFi Tokens

January has come to an end, meaning it’s time to rebalance Crypto Briefing’s CB10 Index.

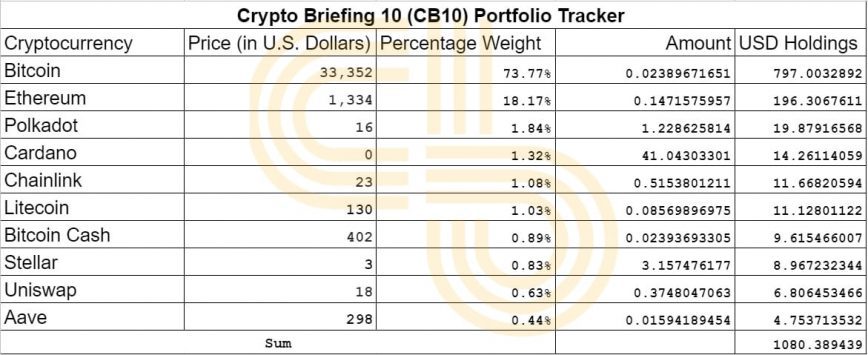

The biggest winner of Crypto Briefing’s CB10 Index in January was Ethereum’s native token, ETH. The rebalancing witnessed a positive addition of 2.15% for Ethereum, whereas Bitcoin’s share decreased the most with a negative 5.55% change.

A decision to include two more U.S.-based crypto exchanges Kraken and Gemini, allowed Ethereum’s competitors Polkadot and Cardano to enter the Index. Aave and Uniswap’s governance tokens feature as well.

Consequently, four altcoins in EOS (EOS), Tezos (XTZ), Synthetix Network (SNX), and Cosmos (ATOM) were removed from the index of ten cryptocurrencies.

Performance of CB10 Index

In crypto markets, altcoins have a higher beta compared to Bitcoin. Hence, during bullish phases, the performance of altcoins is better as well. The same holds for downtrends; altcoins tend to plunger lower than BTC.

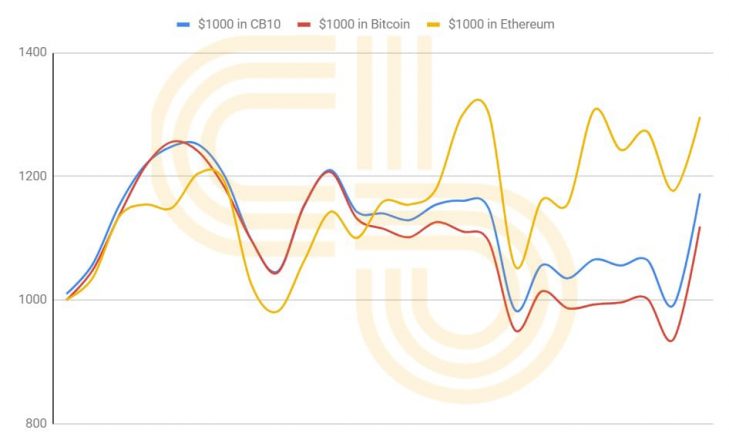

This dynamic is evident in Ethereum’s rise (in yellow), which increased by 28.8% compared to Bitcoin’s 5% and CB10’s 8% since the index launched on Jan. 5.

Ethereum’s rise has, however, been far more volatile than that of Bitcoin and the CB10 Index.

The crypto markets are highly volatile, with Bitcoin’s 30-day volatility at 5.6%. The corresponding volatility in altcoins is much higher; Chainlinks’ 50-day historical volatility is 99%. Still, with a small allocation to altcoins, the CB10 index has yielded higher returns than Bitcoin with comparatively low risk.

Crypto Briefing CB10 Index’s First Rebalance

The first rebalancing of the CB10 index was performed at 10 am ET on Jan. 31.

The previous composition was nearly 80% BTC, 16% ETH, and the final 4% was divided among eight different altcoins. The drop in Bitcoin’s market dominance from 69.3% to 63.2% has made more room for altcoins in the Index.

Ethereum’s 2.15% increase in allocation is the largest positive change in the index, followed by Chainlink (LINK) token and Stellar (XLM), which saw a rise of 0.31% and 0.27%, respectively. Payment protocols Litecoin and Bitcoin Cash continued to suffer, changing negatively 0.34% and 0.12%, respectively.

In retrospect, limiting the Index to Coinbase Pro only focuses on a small set of users—primarily high-volume American investors. If the last week has revealed anything, it’s that the retail crowd holds as much explosive power.

Therefore, the renewed Index will add tokens from both Kraken and Gemini exchange. It allows the inclusion of two of the top Ethereum competitors and complementary scaling solution in Polkadot and Cardano.

This implies letting go of the bottom four cryptocurrencies in the list, however.

While EOS (EOS), Tezos (XTZ), Synthetix Network (SNX), and Cosmos (ATOM) are promising blockchain projects, they will not feature the weighted index of ten cryptocurrencies until next month’s reconstitution.

Instead, DOT, ADA, UNI, and AAVE entered the index with the following distribution.

Notably, Dogecoin ranked higher than AAVE. However, the team’s analysts have decided to exclude DOGE due to the massive volatility last week and failed pump attempts from r/wallstreetbets. DOGE gained 1,120% in the pump and is currently most susceptible to a correction.

How to Perform the Rebalancing on Exchanges?

One of the easiest ways to rebalance the portfolio is to sell the cryptocurrencies for a stablecoin and repurchase according to the new weightage.

Essentially, this method teaches users about compound interest. An investor could either realize monthly gains and reinvest the original portfolio amount or go for compound earnings.

For instance, Crypto Briefing’s hypothetical $1,000 portfolio has yielded $80 so far. An investor could either reinvest the initial $1,000—keeping $80 as profit—or reinvest the entire $1,080.

Compound interest yields higher returns than realizing the gains every month. For instance, if the portfolio gains 2% per month, the effective annual compounded return is 26.7%, whereas if the profit is taken out every month, it will be 24%.

The annual compounded returns rise by nearly 20% if the monthly rate rises by just 1%. If the monthly returns are 3% effective annual return would be 42.5% and 60% with 4%.

However, the same is true for downtrends, causing greater losses. While compounding sounds lucrative in a bull market, realizing monthly gains can also be an effective strategy for overall better annual returns.

For reference, the CB10 Index rose by 8% in January.

Rebalancing the CB10 Index

The buy and purchase of these tokens, nonetheless, presents a particular challenge on crypto exchanges. Portfolios in the range of $500 to $1,500 have allocations that do not qualify the minimum order size for trading. For instance, the minimum USD order on Kraken is $10, and even $1,000 portfolios could have tokens of less than $10 slice.

A cheeky trick is to buy 11+X quantities and then sell back 11 units. It is done for both purchase and sells—adding a dollar to the minimum limit allows for a deduction of trading fees.

The trading fees are usually around 0.02%. Traders executing $2,000 orders will incur a fee of less than $1.

Investors could also use Bitcoin or Ethereum pairs on exchanges and perform trades based on the percentage differences in the rebalancing table.

Disclosure: The author held Bitcoin at the time of press.

Earn with Nexo

Earn with Nexo