Market Commentary: Bitcoin Falls As Fed Lowers Interest, Privacy Coins Face Scrutiny

Could this fall have anything to do with the global economy?

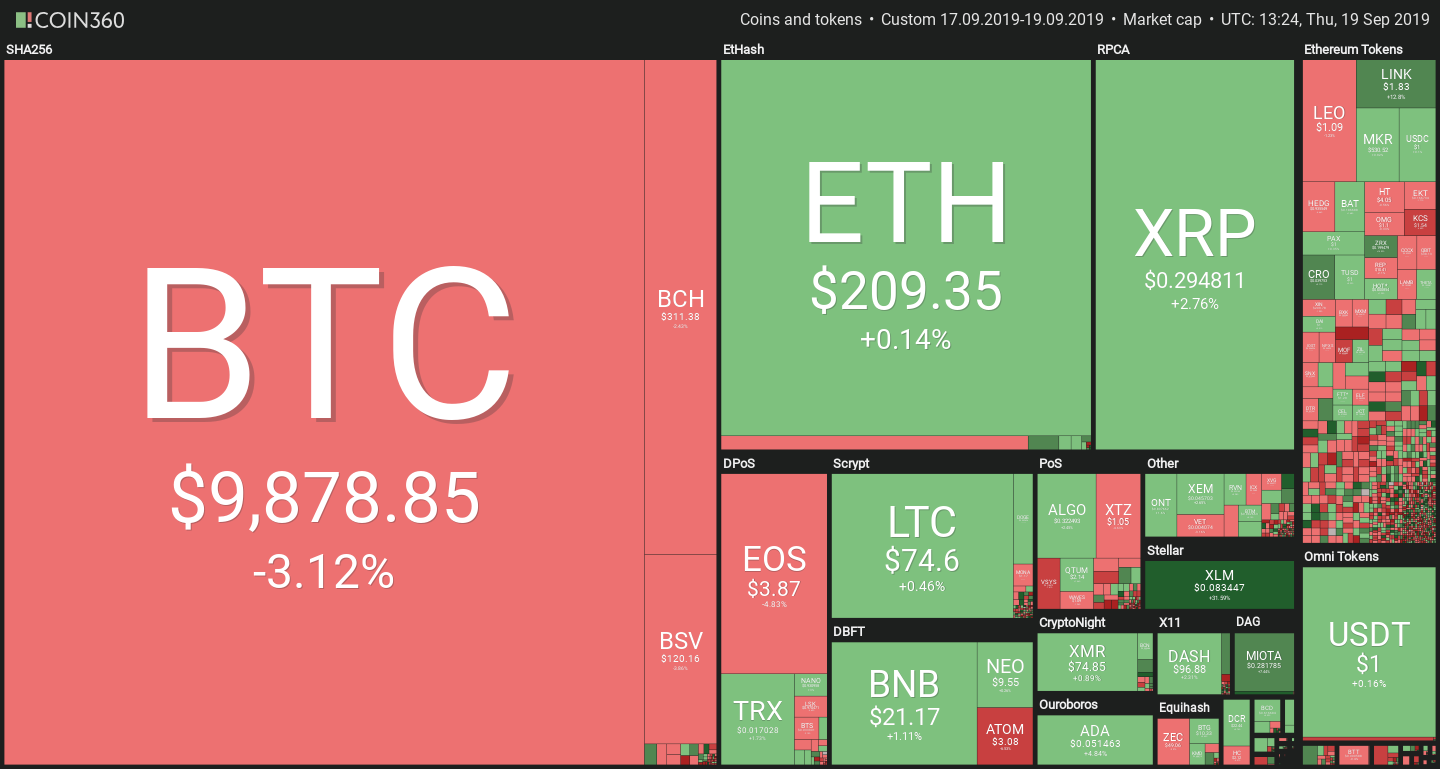

Cryptocurrency markets are back in the red after yesterday’s meteoric rise. With some experts suggesting that yesterday’s rally was nothing more than a short squeeze, a retracement was to be expected. Investors can take solace in one circumstantial anomaly: historically, Bitcoin dumps have tended to pull altcoin markets lower.

Instead, today’s fall saw Bitcoin decisively break past the $10,000 price level, losing a few percent in a single take. Meanwhile, the rest of the market is holding steady at nearly the same levels as two days ago.

What’s next for Bitcoin?

Yesterday’s sell-off occurred a few hours after the Federal Reserve announced what the majority of the market had come to expect: another interest rate cut.

The S&P 500 and other major indices registered a peculiar pattern in response, ultimately rising by more than 1.5% on Wednesday (and in traditional markets, unlike crypto, that’s actually a lot).

A few hours later, after U.S. markets closed, Bitcoin began its precipitous fall to below $10,000. The move is unexpected, as it pits two narratives against each other. On one hand, Bitcoin’s price falling as the stock market rises concurs with the safe haven hypothesis, which would see BTC move in opposition to the stock market.

However, a fall in interest rates is positive for Bitcoin, too. With President Trump calling for the introduction of negative interest rates in the U.S., cryptocurrency could become a more attractive proposition as the government discourages holding money in a bank. It’s worth noting that the effective interest rate is now extremely close to 0%, due to inflation.

The upcoming launch of Bakkt, scheduled for Monday, is the next catalyst for Bitcoin’s price. The derivatives exchange will give more Bitcoin exposure to institutional investors, potentially strengthening Bitcoin’s performance trends within the global economy.

Privacy coins pressured by FATF Travel Rule

Zcash, Monero and other privacy coins are coming under fire from regulatory bodies for their defining feature.

After Zcash was delisted from Coinbase UK due to a request from its banking partner, OKEX Korea has doubled down by delisting all coins with a semblance of privacy on its platform, citing FATF guidelines compliance.

A report by Bloomberg published today cautions that this may be just the beginning: for many exchanges, dropping privacy coins could be easier than going out of their way to ensure compliance.

Representatives from privacy coin projects have assured that their coins are fully compliant with FATF rules, but some could see it differently. It will be interesting to observe if any differential treatment will occur: Dash, for example, puts very little emphasis on its PrivateSend feature, while Monero wouldn’t have it any other way.

Market sentiment

Not all coins have fallen today, with Stellar, ChainLink and Dash posting daily gains of 5.52%, 4.33% and 0.4% respectively.

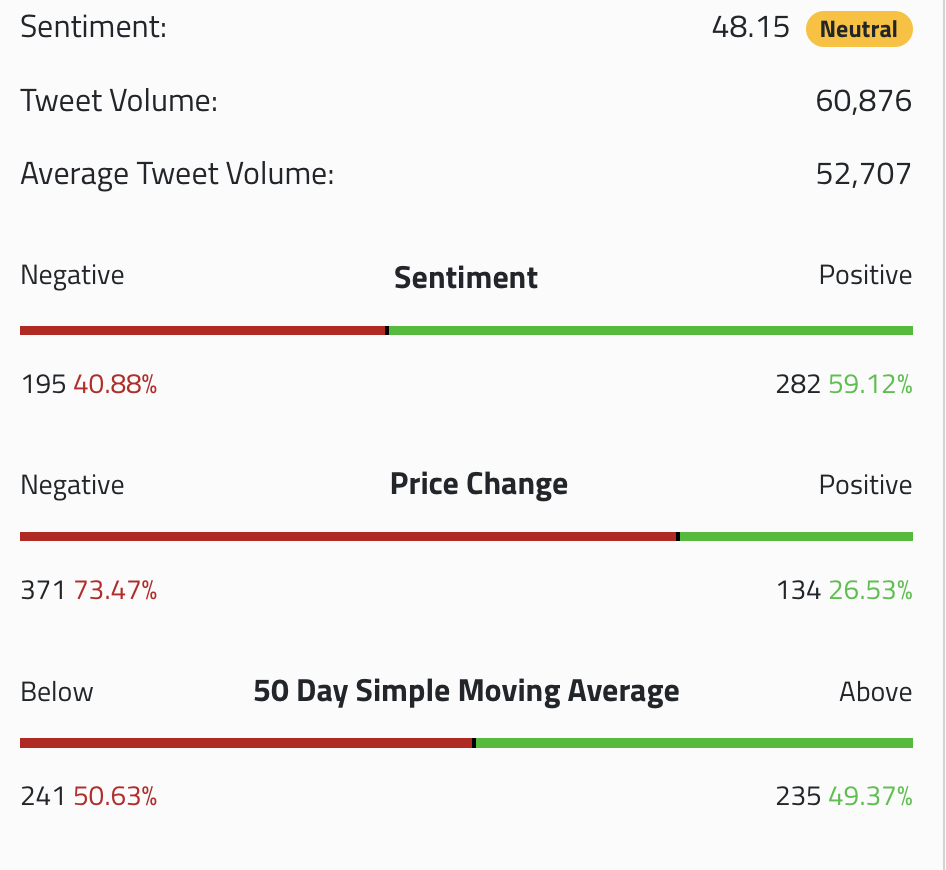

Overall sentiment as measured by theTIE.io is still close to the 50% threshold.

Compared with the beginning of the month, average sentiment is significantly improved as the moving average hovers close to 50%. Will this momentum be enough to begin a real recovery?

Bitcoin Price Commentary By Nathan Batchelor

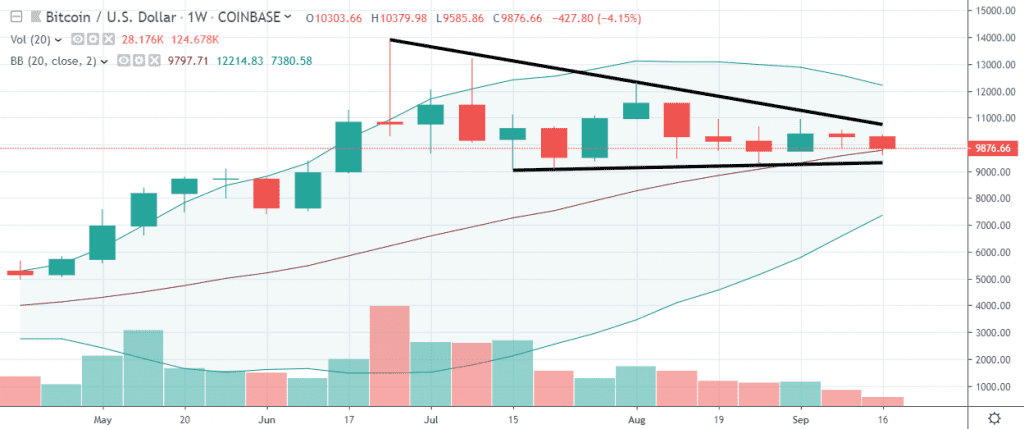

Bitcoin has tumbled below the $10,000 level at relatively high trading volume after flashing a series of bearish warning signs over the last few days. The decline has so far found strong technical support from the $9,600 level and rebounded back towards the $9,900 level.

At the time of writing, there is no apparent fundamental reason for the quick $500.00 sell-off in the BTC / USD pair, although a number of key short-term technicals are suggesting that the latest decline could be quickly reversed.

The four-hour time frame shows that the latest move lower has helped to complete the right-hand shoulder of a large inverted head and shoulders pattern. This pattern will remain valid while bulls hold price above the $9,300 level.

Sellers have also been unable to maintain price below the $9,700 support level for longer than a three-minute basis, which is bullish in the short-term. Furthermore, the rapid five-hundred point decline has generated significant pockets of un-tested demand around the $10,100 and $10,180 levels, which suggests that the price could soon reverse higher.

With this in mind, the BTC / USD pair should rebound back above the $10,000 level if sellers are unable to hold price under $9,700. The $9,700 level was the previous monthly trading low for the BTC / USD pair, and a pivotal technical area that bulls must continue to defend.

The weekly time frame chart further highlights the likely path ahead for the BTC/ USD pair once a breakout from the triangle pattern occurs. The 20-period bollinger bands show the $12,300 level as the bullish target, while the bearish target is located around the $7,200 level.

* If bulls can rally price back above the $10,000 level the latest decline could form an important technical low before the next BTC / USD rally. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has taken a hit, at 42.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is unchanged, at 65.80 % positive.

UPSIDE POTENTIAL

The $10,000 level remains key when looking at the short-term upside for the BTC / USD pair. A degree of confidence will return to the cryptocurrency if stabilization does occur above the psychological $10,000 level.

Key resistance above the $10,000 level is located at the $10,100 and $10,180 levels. Once above the $10,180 level, the $10,260 and $10,420 levels are absolutely key.

DOWNSIDE POTENTIAL

The $9,700 level is key for BTC / USD bears when it comes to encouraging the next round of the technical selling. Sustained weakness below the $9,700 level is likely to be the bearish trigger for a sell-off toward the $9,300 level.

Short-term technical indicators are currently oversold. The daily RSI indicator has turned distinctly bearish and fallen towards the 40 levels and has significant scope to turn lower.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Earn with Nexo

Earn with Nexo