Market Commentary: Stellar Leaves Earth Behind, As Ethereum Overtakes Bitcoin

Ethereum miners are now collecting as much fee revenue as their BTC cousins.

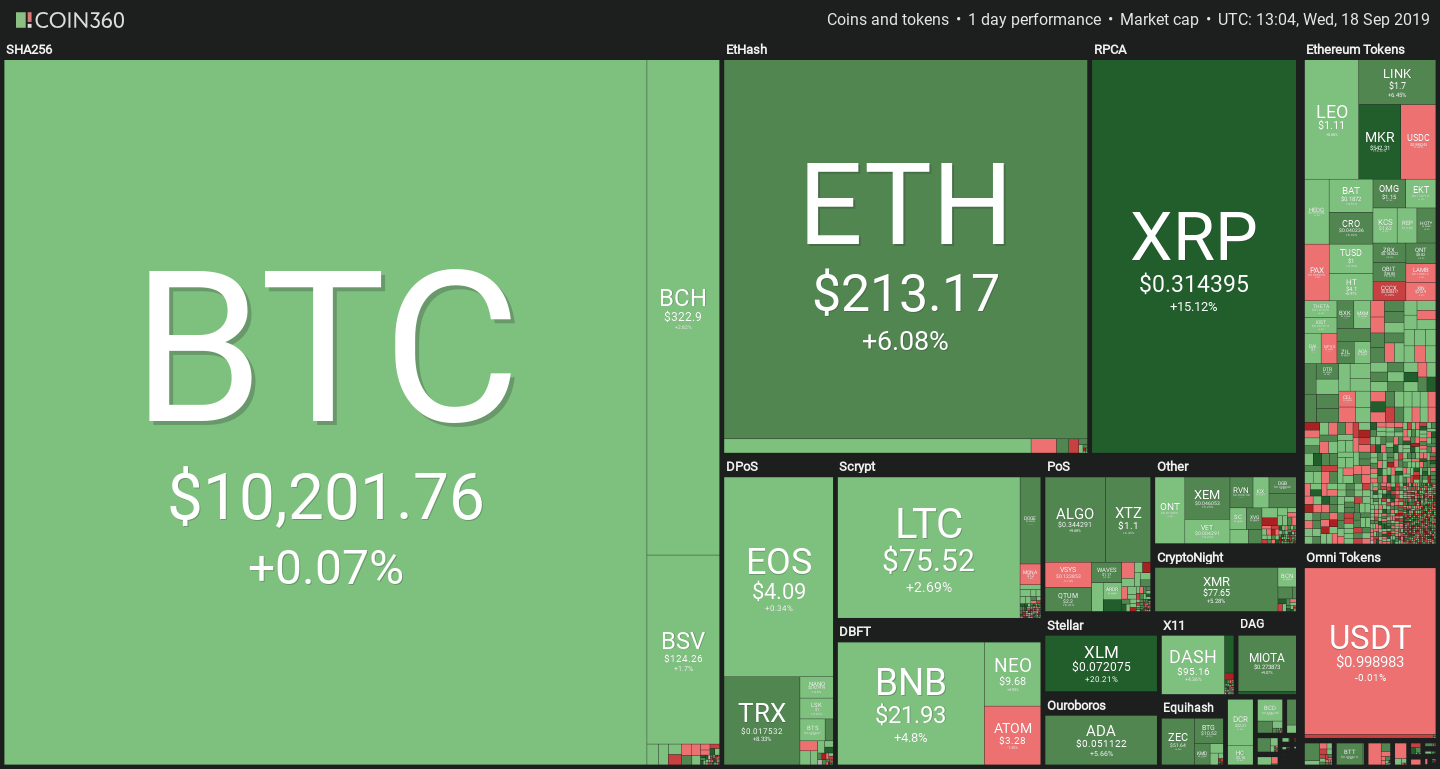

Altcoin season may be upon us, after all. Prices for almost all non-Bitcoin currencies are posting strong single and sometimes double-digit gains, while BTC’s stability could make a few smaller stablecoins envious.

Stellar had by far the highest growth among market leaders, while Dogecoin, Maker, Ravencoin and Waves saw daily gains above 10%.

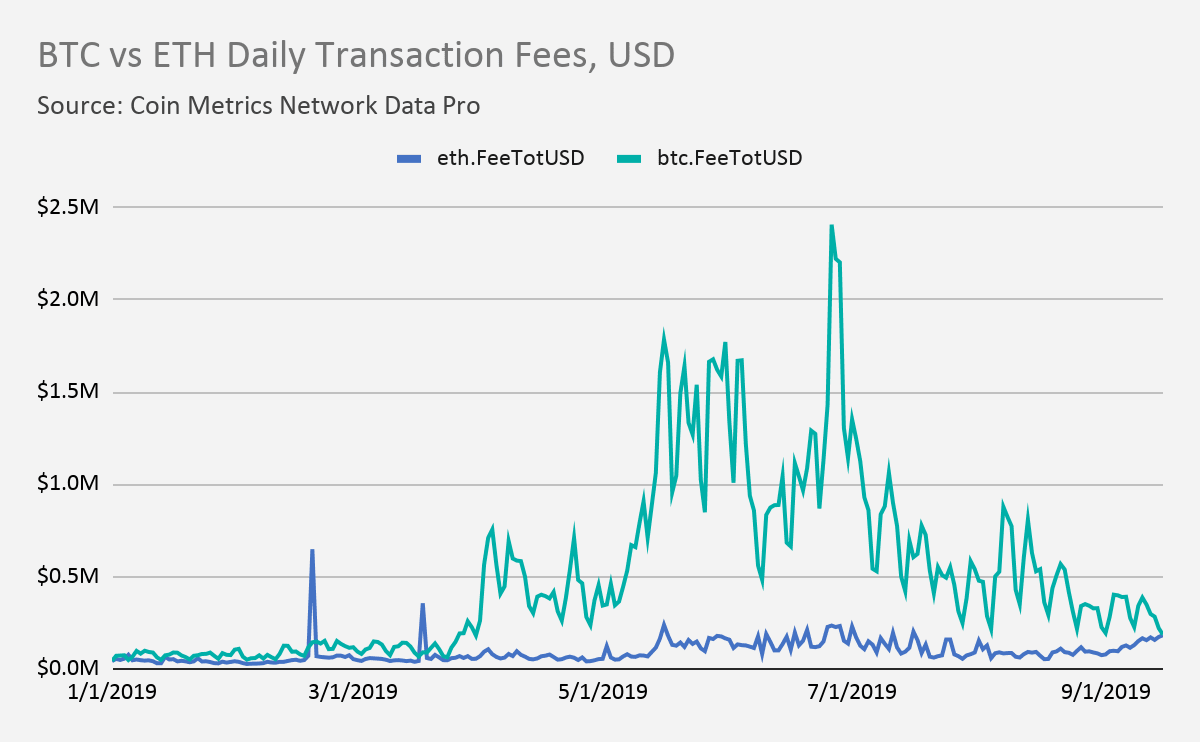

Ethereum about to overtake Bitcoin In Transaction Fees

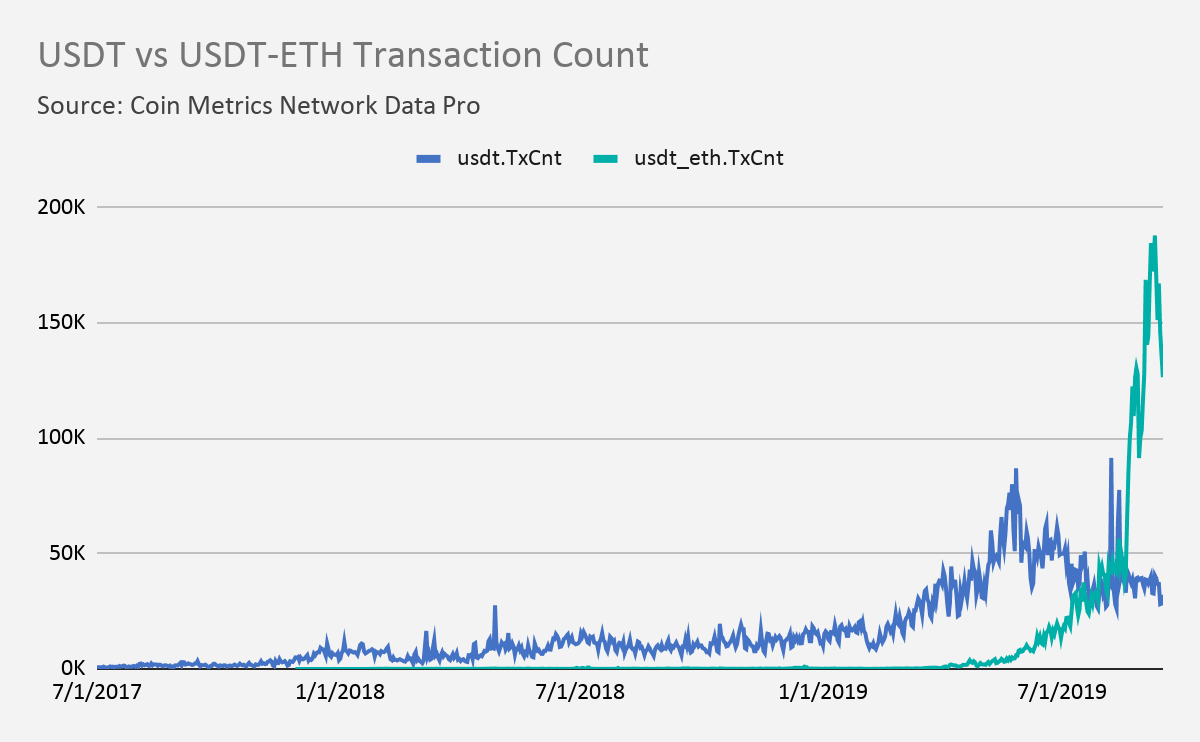

As previously reported by Crypto Briefing, the Bitcoin-based USDT, powered by the Omni protocol, is quickly giving way to ERC-20 USDT on Ethereum. A new report by Coinmetrics shows that the rapid change is starting to affect fundamental figures for both leading currencies.

The chart shows that the total amount collected in miner fees between BTC and ETH is now almost equal. The figure is even more impressive in light of the fact that Ethereum’s average transaction fee is less than a third of the average fee for a Bitcoin transaction, according to data from ethgasstation.info and bitcoinfees.info.

As Coinmetrics explains, the root cause lies primarily in increased USDT usage on Ethereum, where it now accounts for as much as 20% of all transactions.

Ethereum-based USDT (green) has gained tremendously since the beginning of the summer, while Omni USDT has been on a downward trend. It’s worth noting that the overall transaction count has grown significantly, with ERC-20 transactions growing far faster than the decline in OMNI transactions.

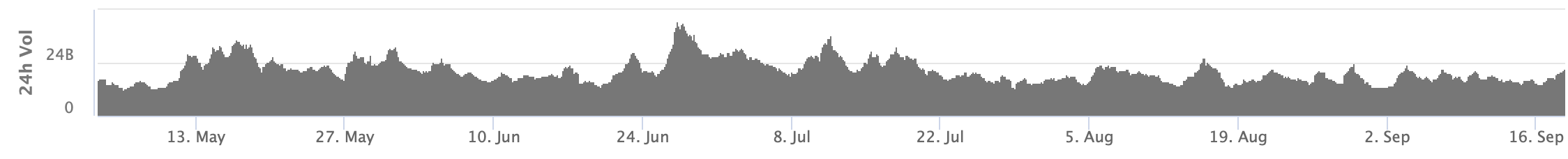

What’s even more impressive is that this transaction growth hasn’t corresponded to growth in trading volume, which likely signifies that Tether is now used for far more than a simple USD placeholder in exchanges.

VanEck withdraws ETF

A filing from the SEC revealed that Cboe BZX has withdrawn the application for the Bitcoin ETF issued by VanEck and SolidX. According to the filing, VanEck notified the SEC on September 13, with the decision made public only now.

The filing does not reveal any information as for the possible reasons. The government agency was supposed to deliberate on the proposed ETF on October 18, after repeated delays.

VanEck recently launched a ‘limited ETF’ for institutional clients, mimicking a similar offering from Grayscale that has been available for 6 years, which seems to be at least part of the reason why the firm decided to withdraw the actual ETF. It can be speculated that the firm knew that the proposal would get rejected, thus creating a Bitcoin Trust and marketing it as a limited ETF to cut their losses.

Gabor Gurbacs, digital asset strategist and director at VanEck, gave a humorously evasive response when directly asked about it.

> At the poker table…can you show me your cards?

> …— Gabor Gurbacs (@gaborgurbacs) September 17, 2019

Stellar sees massive surge

As of writing, Stellar’s price passed from a 20% surge to topping out at +95% at Coinbase.

There doesn’t seem to be any discernible cause for the pump, as there were no announcements from Stellar today.

News from the previous days include a new CEO at the Interstellar DEX, as well as a partnership with Keybase.io to deliver the announced airdrop for its users. None of them are earth-shattering, suggesting that today’s pump could be a product of market manipulation. Alternatively, it could be a long-overdue corrective recovery after Stellar’s recent heavy losses.

Bitcoin Commentary By Nathan Batchelor

Bitcoin is still trading in an incredibly narrow range on Wednesday, despite the recent surge in the value of many major altcoins. The news that the VanEck-SolidX Bitcoin ETF proposal has been withdrawn from the U.S Securities and Exchange Commission’s consideration has made no real impact on the BTC / USD pair.

The fact that Bitcoin has not shown a negative reaction to the VanEck-SolidX announcement is certainly bullish for the cryptocurrency. In bull markets, bearish news with have a smaller impact than it would have in an actual bear market.

With Bitcoin’s closest rivals posting impressive double-digit gains, the spotlight has definitely moved away from the BTC / USD pair. Cryptocurrency traders are wondering whether this is the start of ‘alt-season,’ when major coins start to march higher regardless of the performance of Bitcoin.

Should Bitcoin continue to ‘play dead’ and underperform the broader cryptocurrency market, it is worth considering how the BTC / USD pair would act once we see a corrective move lower in the altcoin space.

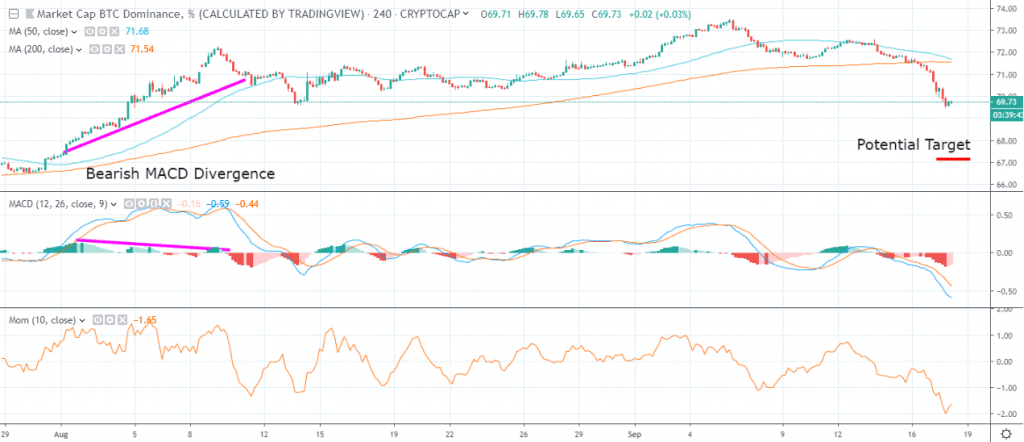

The four-hour time frame chart of Bitcoin’s overall market dominance suggests that number one cryptocurrency will continue to underperform its rivals in the short-term.

The chart shows negative MACD price divergence extending towards the 67.00 percent mark, which implies another four percent drop to come in Bitcoin’s overall market dominance over the coming sessions.

Once the MACD divergence is reversed I expect Bitcoin to pick-up again. The BTC / USD pair may well gain back lost ground back in terms of overall market dominance.

With Bitcoin trapped within a daily trading range that is slightly larger than $100.00, the short and medium-term technicals remain unchanged. It is certainly apparent that until BTC / USD buyers clear the $10,260 level, the cryptocurrency is going to have a slightly negative intraday bias.

* Technical analysis shows that the BTC / USD pair needs to clear the $10,260 level in order to encourage fresh buying interest. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has picked-up from yesterday, at 56.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency remains the same, at 65.80 % positive.

UPSIDE POTENTIAL

As previously stated, with the pair trading in such a narrow range the technicals remain largely the same. BTC / USD bulls need to break through the weekly pivot point, around the $10,260 level, to encourage further buying towards Bitcoin’s monthly pivot point at the $10,420 level.

The long-term technicals show that if bulls can force price above the $10,700 level, the BTC / USD pair will break free from a long-time triangle pattern. Once above the $10,960 level, it should be a one-way ride before strong resistance kicks-in around the $12,400 technical area.

DOWNSIDE POTENTIAL

Sellers have failed to breach the $10,000 level, with the $10,070 level providing a floor so far this week. The $9,850 and $9,700 levels remain the key support areas prior to the $9,300 and $9,100 levels.

The RSI and MACD indicators continue to issue bearish signals on the lower time frames, while indicators are largely flatlined across the medium-term.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.