Bitcoin funds’ weekly trading volume shows a sevenfold growth

New low-cost ETFs draw over $4B, outpacing traditional, higher-cost crypto funds in the US.

Share this article

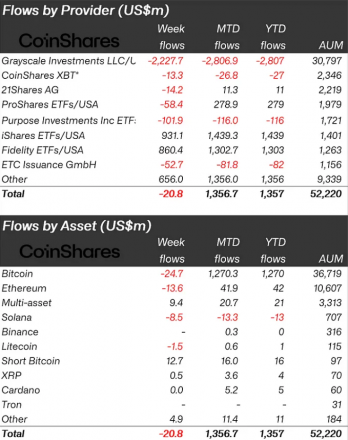

Crypto-indexed funds saw minor outflows amounting to $21 million last week, according to a report by asset manager CoinShares. However, this figure contrasts the leap in Bitcoin funds’ trading volumes, which reached $11.8 billion, representing a sevenfold increase over the weekly average seen in 2023.

This surge in trading volume was predominantly concentrated on Bitcoin transactions, which captured 63% of all BTC volumes on trusted exchanges. This indicates that Exchange-Traded Products (ETP) activity is currently a major driver in the overall trading activities in crypto.

The report also highlights regional investment patterns, with an inflow of $263 million in the United States met with a total outflow of $297 million registered in Canada and Europe. This suggests a subtle shift of assets towards the US market, likely attributed to more competitive fee structures in the region.

Despite the high trading volumes, Bitcoin itself saw minor outflows, amounting to $25 million. This highlights a nuanced investment strategy among traders, focusing more on trading activity rather than holding the asset.

The landscape for incumbent, higher-cost issuers in the US has been challenging. Since the launch of the new spot-based Exchange-Traded Funds (ETFs) on Jan. 11, these issuers have seen substantial outflows of almost $3 billion.

In contrast, the newly issued ETFs have attracted significant interest, with total inflows reaching more than $4 billion since their inception. This shift indicates a preference among investors for lower-cost investment options in the digital asset space.

Moreover, the recent price weaknesses in crypto markets have not deterred investors. Instead, they have capitalized on these moments to increase their investments in short-Bitcoin products, which saw inflows of $13 million.

Altcoins, however, have not fared as well. Leading alternatives such as Ethereum and Solana experienced outflows of $14 million and $8.5 million, respectively.

Another noteworthy trend is the sustained interest in blockchain equities. These equities have continued to attract significant investment, with inflows of $156 million last week. This brings the total for the past nine weeks to $767 million and might suggest a growing trust from investors in blockchain technology beyond just crypto assets.

Share this article