Bitcoin slides, Ether, XRP, Dogecoin move lower ahead of Fed Chair’s final Jackson Hole speech

US equity markets also struggled today, with the S&P 500 falling 0.6% and the Nasdaq Composite dropping 1.5%.

Bitcoin slipped under $113,000 on Tuesday, triggering a market-wide downturn that sent Ethereum, XRP, and Solana lower. The total crypto sector fell to $3.8 trillion, down 3.5% on the day.

The price of Bitcoin dropped nearly 3% in the last day to $112,696, marking a return to levels not seen since the beginning of the month, CoinGecko data shows.

Ether dropped more than 4% to $4,100 after flirting with record highs in the past few days. Losses are spread across major altcoins, with XRP down nearly 6%, Dogecoin and Chainlink off over 5%, and Sei and Cardano plunging 8%.

The pullback comes ahead of the Fed’s Jackson Hole symposium on Friday, where Chair Jerome Powell is scheduled to deliver his keynote address. Markets are bracing for whether he signals a September rate cut or doubles down on inflation concerns, especially after US inflation data offered mixed signals in July.

The headline CPI slowed to 2.7% but core inflation edged up to 3.1% and PPI climbed 3.3%. The combination of weakening job growth and persistent price pressures has raised stagflation fears, which could complicate the Fed’s decision-making.

“Higher‑than‑expected PPI numbers (producer prices jumped 0.9% month‑on‑month against a 0.2% forecast) have complicated the Fed’s policy framework, so the market will be looking for hints on the Fed’s thinking ahead of its September policy meeting,” said QCP Capital analysts in a statement. “Last year, Powell used Jackson Hole to telegraph an easing bias; this year, Trump’s tariffs and political pressure create a much more contentious backdrop.”

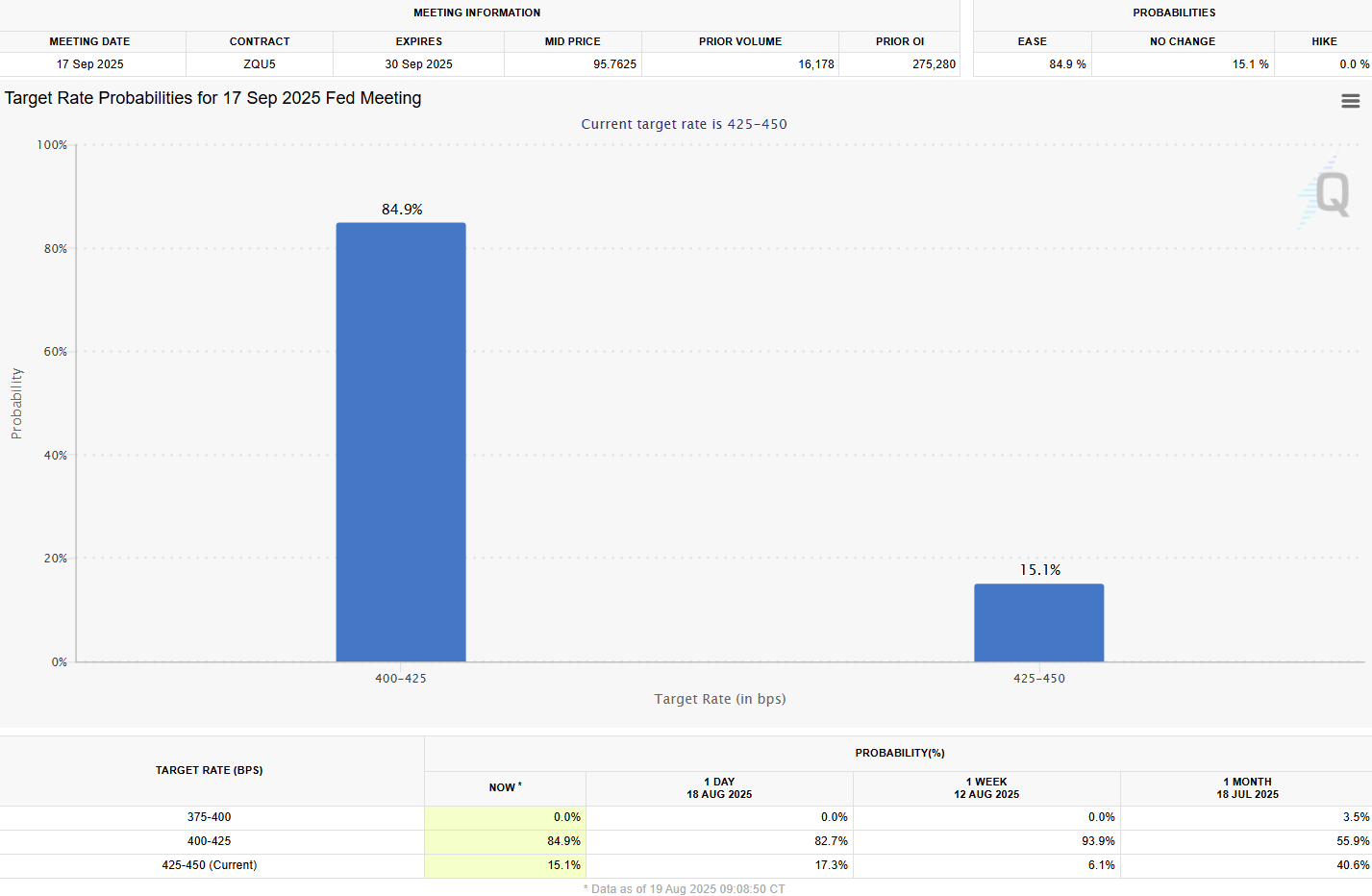

Traders are still pricing in a 25-basis-point cut at the September 17 FOMC meeting, though odds have eased following hotter-than-expected inflation readings.

Analysts predict Powell will be cautious during his final Jackson Hole speech. The Fed Chair may acknowledge that risks to employment and inflation are balancing, suggesting a cut could be appropriate if trends continue, but he is unlikely to commit to a specific policy action.

Since expectations for a September cut are already priced in, any hint that action might be delayed could feel like a tightening of policy for investors.

However, signals that quantitative tightening may end or that regulatory shifts are coming could boost liquidity and potentially reignite Bitcoin’s rally toward year-end, analysts suggest.

Elsewhere, US stocks also reflected uncertainty at Tuesday’s market close.

The S&P 500 fell nearly 0.6% and the Nasdaq Composite dropped around 1.5%, while the Dow Jones Industrial Average edged up.

Tech and chipmakers led losses, with Nvidia down 3.5%, AMD off 5.4%, and Broadcom lower by 3.6%. Palantir sank 9%, the worst S&P 500 performer, while Tesla, Meta, and Netflix also slipped.