Meme coin trading volume skyrockets despite market turbulence

Meme tokens maintain market strength with $11 billion weekly volume.

Share this article

Meme tokens are defying the typical market downturn behavior, maintaining their position as some of the year’s top performers, according to a report by research firm Kaiko. Despite a recent market correction, these tokens have seen year-to-date returns ranging from 80% to 1,800%.

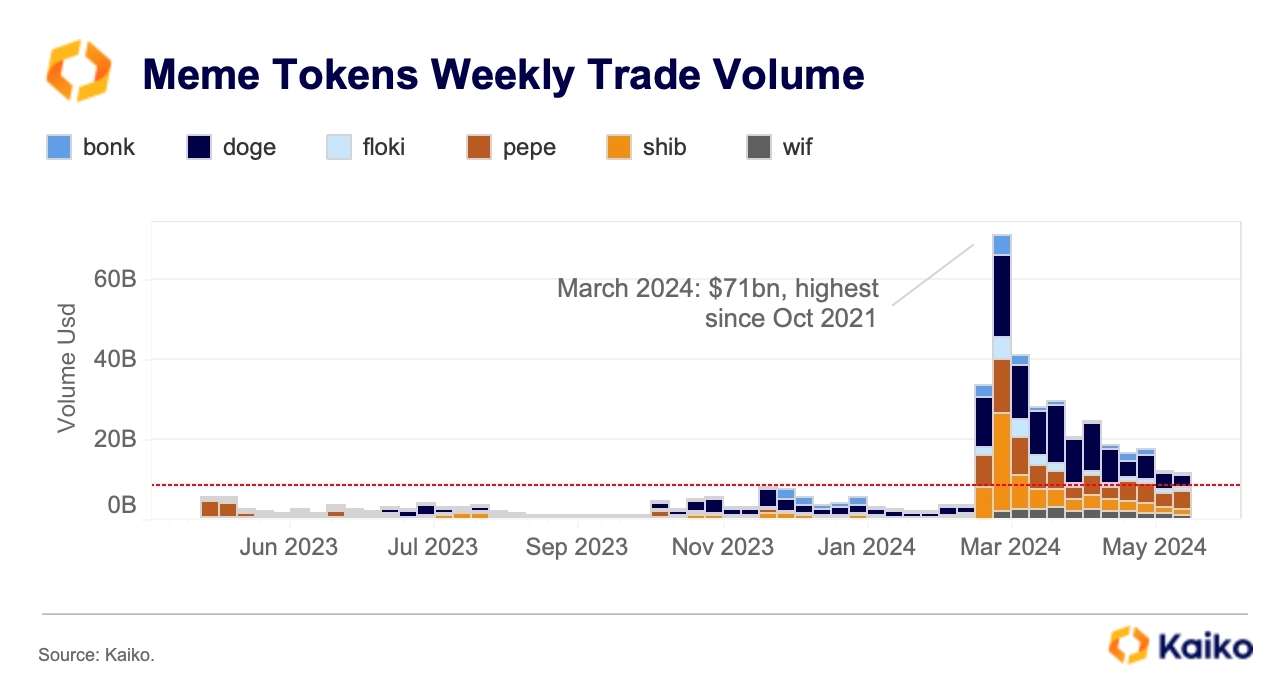

Moreover, meme coin trading volume remains strong, with a more than 200% increase year-to-date, totaling around $11 billion weekly.

The sustained interest in meme tokens may stem from their adaptability to market trends and accessibility, which continues to draw substantial community engagement, highlights the report. Yet, it’s crucial to acknowledge the higher leverage meme coins carry compared to most altcoins, often fueled by speculative trading.

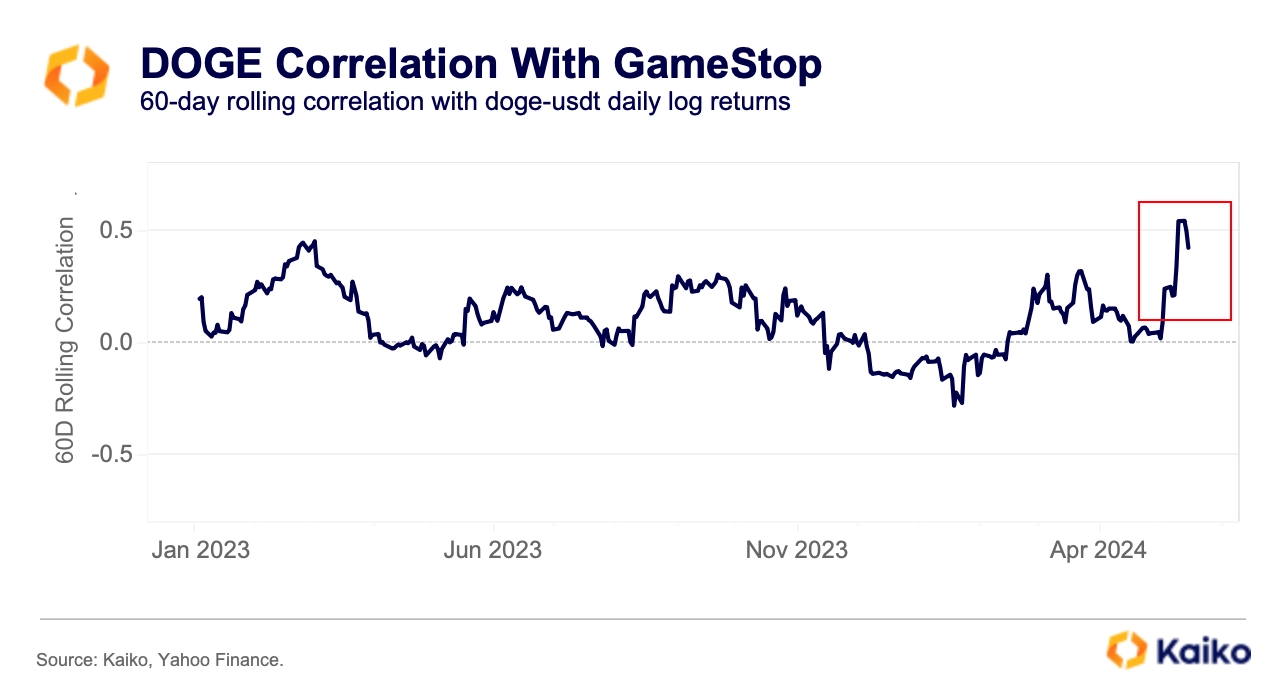

In an interesting twist, the correlation between meme coins and other speculative retail assets, such as meme stocks, has been inconsistent and volatile. For example, the 60-day rolling correlation between DOGE and GameStop (GME) has generally stayed below 0.3 over the past year.

Last week, meme stocks like GME and AMC Entertainment saw unexpected gains, which led to a spike in the correlation between DOGE and GME, marking the highest point in over a year.

The sudden spike in GME and AMC stock prices is related to the return of RoaringKitty, one of the key figures behind the GME pump seen in late 2020.

Crypto liquidity remains divided among exchanges and assets, with Bitcoin and Ethereum holding the lion’s share. In 2024, Bitcoin’s average daily 1% market depth was over $270 million, dwarfing the liquidity of most top altcoins by more than tenfold. Ethereum followed as the second most liquid asset, with an average market depth of $190 million.

However, the landscape is shifting. Altcoin liquidity, in comparison to Bitcoin’s daily market depth, has been on the rise for the past two years. This change aligns with a decrease in Ethereum’s liquidity relative to Bitcoin’s, dropping from 83% in 2022 to 72% in 2024.