Solana ETF applications fail to boost market enthusiasm: Kaiko

Derivative markets show minimal reaction to ETF news, with open interest still 20% below early June levels.

Last week, VanEck became the first US asset manager to file for a spot Solana (SOL) exchange-traded fund (ETF), with 21Shares following suit. The news initially boosted SOL’s price by 6%, but the market impact has been limited overall, according to recent research by on-chain analysis firm Kaiko.

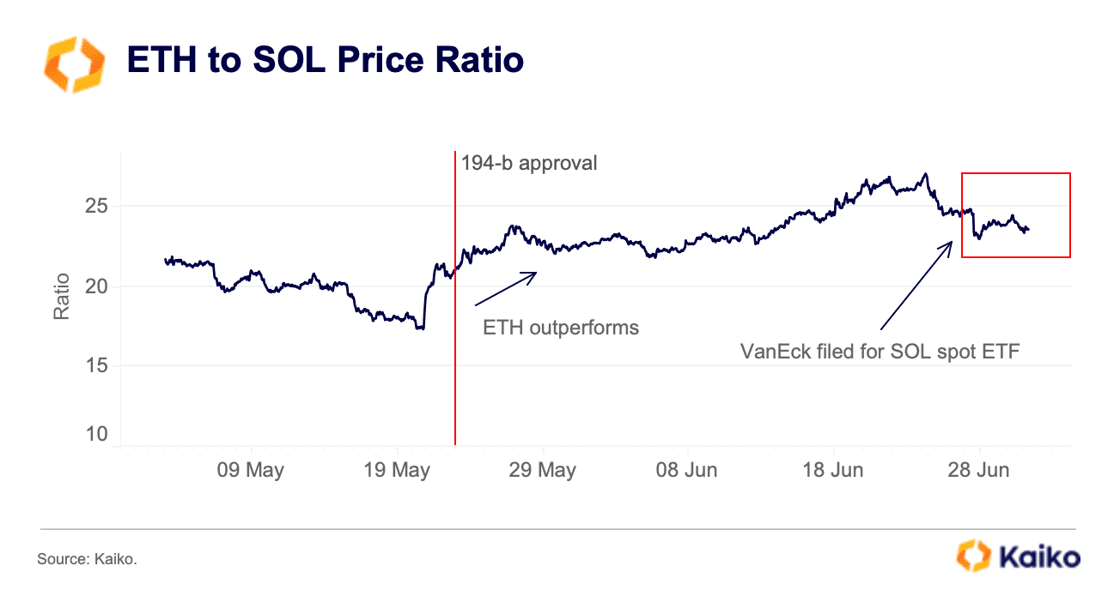

SOL registered a net positive Cumulative Volume Delta (CVD) of $29 million over the past week, with significant spot buying on Coinbase contributing to this surge. However, after an initial drop in March, the ETH to SOL ratio has remained mostly flat despite the SOL ETF filings.

The derivative markets showed minimal reaction to the ETF news. SOL’s volume-weighted funding rate briefly rose on June 27 but quickly returned to neutral levels, indicating a lack of bullish demand. Open interest remains 20% below early June levels.

Market skepticism regarding SOL ETF approval odds may be due to the derivative market’s insufficient size and regulatory challenges, as SOL has been mentioned in several SEC lawsuits.

Moreover, asset manager Hashdex filed for a combined spot Bitcoin (BTC) and Ethereum (ETH) ETF last week, as reported by Crypto Briefing. This is a movement that follows the HashKey filing for the same product last month.

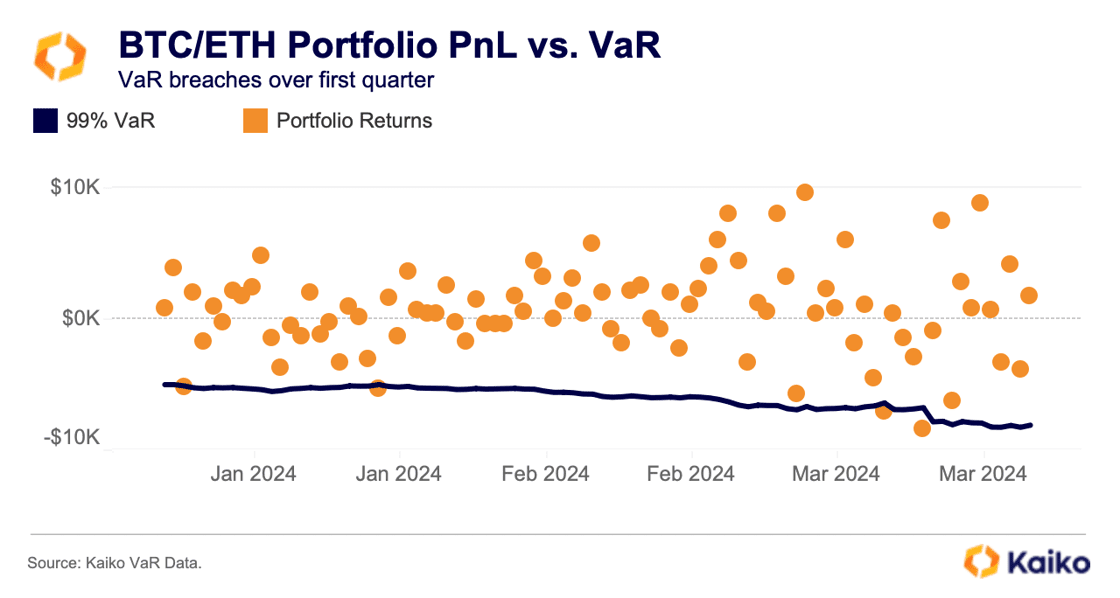

Kaiko’s Value at Risk (VaR) tool suggests that an equally weighted Bitcoin and Ethereum portfolio would have yielded 58% in 2024, compared to 20.6% in 2021.

Traditional investors may be attracted to these ETFs for returns and the improved risk profile of a BTC/ETH portfolio. Using a 99% confidence interval for VaR, the BTC/ETH portfolio maintains a manageable risk level and a balance of gains and losses during the first quarter bull run.