What Is Ampleforth? How AMPL Is Redefining Decentralized Money

Ampleforth is redefining how money works, combining the best of Bitcoin, cryptocurrency, and stablecoins.

Ampleforth is a cryptocurrency attempting to reinvent money. The protocol’s native token, AMPL, is designed to be used as collateral for decentralized banking systems and as an alternative base-money for the crypto-economy. AMPL operates as an ERC-20 token on top of the Ethereum blockchain.

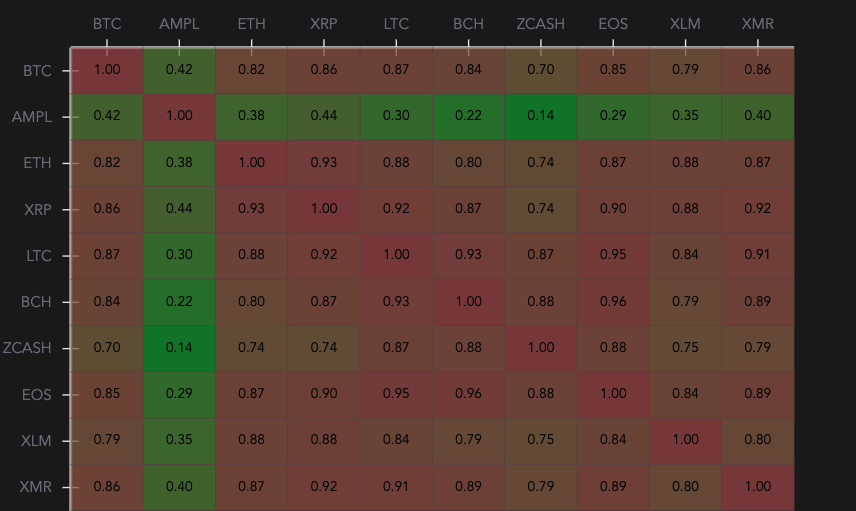

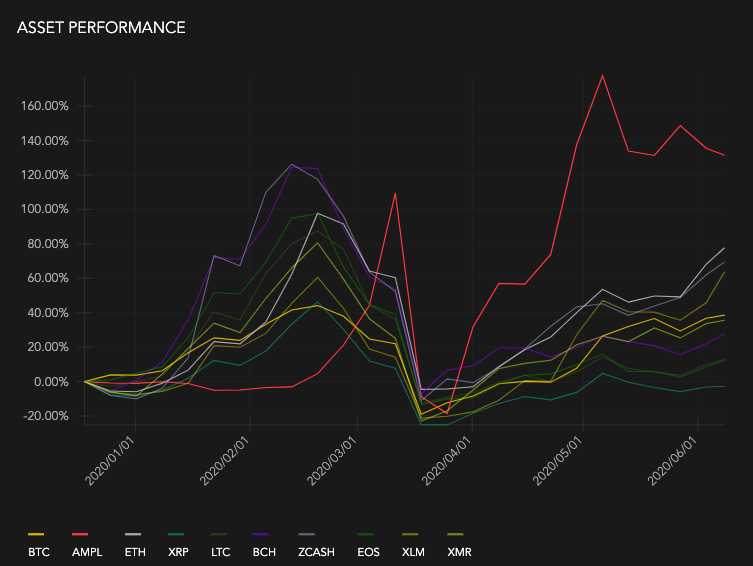

The Ampleforth protocol’s implementation of “countercyclical” economic policy sets it apart from other DeFi protocols. Simply put, this means if the demand for AMPL increases, the supply of the tokens also increases to offset changes in price. This countercyclical nature is desirable from an investment perspective, as it gives AMPL a low correlation to the likes of BTC and ETH.

A system like this is optimal in establishing a stable price medium of exchange over long time frames. Ampleforth’s goal is to bring back commodity money without the hard limitations imposed by commodities with capped supply and issuance, like BTC and gold.

Unique Token Dynamics

What makes AMPL unique next to other crypto primitives is the demand-supply mechanics of the token. A primitive is a base for building a complex system. Bitcoin is the base primitive for a censorship-resistant payment rail; Ethereum took that primitive on step further by allowing smart contracts to run over the network.

In economics, equilibrium is defined as a state where demand and supply in a market find the perfect balance with each other. For Ampleforth, equilibrium is a state when a change in demand results in a one-for-one change in supply.

For example, if there are 100,000 AMPLs and price increases from $1 to $2 as a result of explosive market demand, then the network will set its target price at $1 and expand supply by 100,000 AMPL. The supply would increase from 100,000 AMPLs to 200,000 AMPLs in a process known as a rebase.

Rebases do not dilute existing token holders. Think of it as owning a fixed percentage of the network rather than a fixed amount of tokens. Further, it is executed in a decentralized manner using the unique capabilities of ERC-20 tokens.

Thus, without Ampleforth stealing market share from any token holders, these 300,000 AMPLs that were just created by the protocol will be credited proportionally to existing addresses holding AMPL. Equilibrium is achieved when the 2x increase in supply is met by a 2x decrease in price, keeping the market capitalization stable at $200,000, as per this example:

Ampleforth builds in a financial incentive for users to help the network reach equilibrium. The network depends on profit-seeking traders to restore equilibrium on the demand side once the change in supply goes through. As an asset whose price is determined by the free market, arbitrageurs can sell their newly credited AMPLs for $2, creating market pressure and bringing AMPL’s price back to equilibrium at $1.

But AMPLs price targeting should not be confused with the concept of a stablecoin. While stablecoins have pegged prices and aim to eliminate volatility, AMPL simply targets lower volatility than the likes of BTC and ETH using set rules.

For the most part, the protocol enforces adequate incentives to ensure users play according to the rules and establish equilibrium. Putting demand in the hands of the market ensures AMPL price discovery is engineered by the free market, but it also imperils equilibrium until market cap grows.

But as market cap grows and AMPL becomes more liquid, trading activity will rise and traders will fight to settle orders and become the arbitrageurs that help align price with the algorithmically set target.

AMPL’s Use Cases

The core utility of AMPL is to serve as a medium of exchange. Ampleforth can scale supply to meet the demands of billions of users, but it can also contract supply if it’s only serving 1,000 users.

AMPL’s elastic supply movements make it an ideal asset to build a digital economy around. For this reason, it has the ability to become the perfect form of collateral for DeFi. Its countercyclical behavior also makes it a good addition to a crypto portfolio.

But the project has another, broader goal: to provide an independent alternative to central bank money. This is a target for the long-term, as Ampleforth must first gain the trust of the community and prove its utility as a reliable medium of exchange and store of value first.

What’s the Goal of Ampleforth?

In 1944, the face of money changed forever. At a conference in Bretton Woods, New Hampshire, the countries that make up the United Nations decided to abolish the gold standard, leading to the introduction of the exchange rate regime in place today.

The U.S. dollar was chosen to become the world’s reserve currency. Under this system, the dollar was pegged to a certain amount of gold, and other currencies were pegged to the dollar. This was done with the goal of economic stability.

The formal implementation of the agreements from the conference marked the beginning of a 25-year process of dismantling gold’s role in the global economy. By 1971, gold was just another commodity.

Pushing gold out of the picture was the primary reason growth continued at a rapid rate. Gold was limited in supply and was unable to scale supply issuance to the pace of growth. It was a poor global reserve currency for this single reason.

Separating gold from money, however, gave governments the power to inflate money supply as and how they saw fit, rather than expanding and contracting it as per market demand.

This is where Ampleforth comes in. AMPL takes the concept of flexible supply from fiat currencies and eliminates the totalitarian control over this supply.

“Volatility for fixed supply assets like gold, silver, and Bitcoin result in volatility. Sudden shocks in demand can destabilize ecosystems supported by fixed supply assets. For this reason, sudden shocks in demand can destabilize ecosystems supported by fixed supply assets,” said Ampleforth CEO Evan Kuo. “The greater the complexity of an ecosystem built on fixed supply assets, the greater the risk of cascading failure. AMPL was designed to be the simplest, direct solution to the supply inelasticity problem.”

Think of it as gold that increases and decreases in supply as and how the market dictates. The key aspect of Ampleforth is that the market, not the founders or a government, gets to decide what supply should look like.

Imagine if the world was never taken off the gold standard. Gold’s limited issuance per year would’ve limited growth because its price can only scale so much. Now imagine if gold was a digital commodity whose supply expands in times of high demand and shrinks in times of muted demand. All while using data and sentiment as a yardstick rather than the opinions of experts who make up a “board of directors.” That’s Ampleforth in a nutshell.

Further, by creating an asset whose value counters traditional boom-bust cycles, AMPL can become a crucial addition to cryptocurrency portfolios—and one day, perhaps even global macro portfolios.

Ampleforth Is Still an Experiment

Crypto projects have a grey area in between the bootstrapping phase and achieving product-market fit. While at this juncture, the possibility of failure is high.

Ampleforth is in this phase. It’s a novel idea, but not without a set of trade-offs. The way to exit this grey area and attain product-market fit is for the broader crypto market to accept that it is a primitive that provides users with value and is worthy of sticking around.

The market cap is still below $10 million, making it a high-risk play with an immense payoff in the event that the network achieves its vision.

Disclosure: This article was sponsored by our DeFi partner, Ampleforth.