Bitcoin sinks under $60,000 as $157 million in long positions are liquidated

Concerns over Mt. Gox sell-off and Powell's economic remarks contribute to market uncertainty.

Key Takeaways

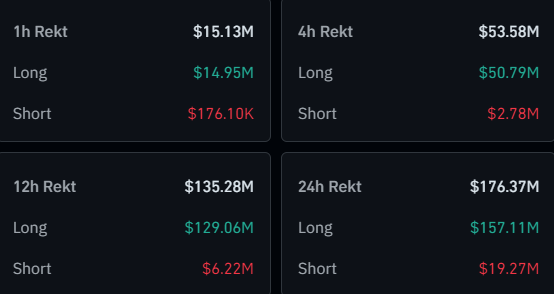

- Bitcoin fell 4.4% in 24 hours, dropping below $60,000 and triggering $157m in long position liquidations.

- Market concerns stem from potential Mt. Gox creditor sell-offs and Fed Chairman Powell's remarks on US economic instability.

Share this article

Bitcoin (BTC) is down 4.4% in the past 24 hours after losing the $60,000 price floor today, according to data aggregator CoinGecko. This movement prompted a price slump in the whole market, resulting in nearly $157 million in long positions being liquidated intraday.

The negative performance of Bitcoin and other crypto could be tied to the looming fears of a Mt. Gox creditors’ sell-off this month, and a potential negative reaction to Jerome Powell’s remarks yesterday about the US economy.

As reported by Crypto Briefing, a CoinShares study highlights that the fear of a huge BTC sell-off by the repayment of Mt. Gox creditors might be exaggerated. The worst-case scenario shared in the study reveals a single 19% daily drop in price, although CoinShares analysts find this outcome to be unlikely.

Moreover, the speech by the Chairman of the Federal Reserve yesterday, in Portugal, raised some concerns among investors. Highlights from Powell’s remarks are the budget deficit being “very large and unsustainable,” the unemployment rate at 4% is still very low, and the Fed is not confident enough to cut interest rates.

This paints a picture of continuous economic instability in the US and leaves the market wondering how long it will take for the first interest rate cut. Therefore, this impacts crypto directly, as risk assets need both smaller interest rates and an optimistic landscape to become more attractive.

Share this article