2017-Era Layer 1s Are Showing Signs of Life (Somewhat)

EOS, Zilliqa, and Internet Computer look primed for an upward impulse as multiple technical indicators turn bullish.

Key Takeaways

- EOS, Zilliqa, and Internet Computer have all rallied today amid renewed strength in the market.

- The three early Layer 1 assets look ready to resume their uptrends.

- Other cryptocurrencies like Bitcoin and Ethereum have also posted gains today as the market picks up.

Share this article

EOS, Zilliqa, and Internet Computer, three early Layer 1 crypto networks, are gaining bullish momentum. The recent gains could extend over the week as resistance weakens.

EOS Makes a U-Turn

2017-era projects are making attempts to come back to life.

EOS, Zilliqa, and Internet Computer are all up today amid renewed strength in the market.

EOS, one of the first “Ethereum killers” that rose to prominence in crypto’s 2017 bull cycle, is showing momentum in the market for the first time in months. Block.one memorably raised over $4 billion for EOS in a year-long ICO, but the project failed to deliver on its promises. The EOS Foundation has since broken off from Block.one and recruited early EOS architect Dan Larimer to lead the project.

Although EOS failed to hit new highs as the wider market soared in 2021, it appears to have rebounded from a crucial area of support that could see it rally. The Layer 1 token has risen by more than 26% over the past 36 hours. The sudden bullish impulse appears to have been generated after Block.one co-founder Brock Pierce revealed on Twitter that he had sold his Block.one shares and 24,000 Bitcoin to buy EOS. The move may have been Pierce’s attempt to generate trust in the community following months of controversy.

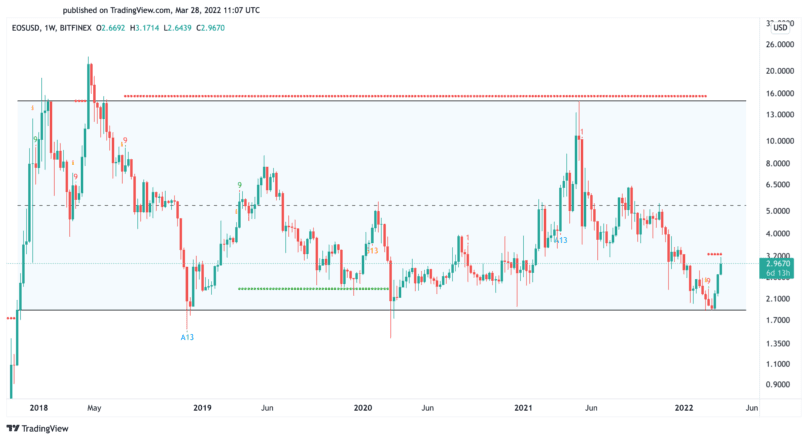

From a technical perspective, EOS appears to have bounced off the lower boundary of a parallel channel its price has been contained in. Price history shows that the asset has rebounded from this support level every time it has hit it since late 2018. Similar price action could result in a bullish impulse to the pattern’s middle trendline at roughly $5.

It is worth noting that EOS must remain trading above $2 for the optimistic outlook to be validated. Failing to do so could generate panic selling among investors, leading to a correction toward $1.10.

Zilliqa Joins Layer 1 Rally

Alongside EOS, Zilliqa is skyrocketing as its network utility increases. The sharding pioneer emerged back in 2017 during a boom in the cryptocurrency market. It hit an all-time high of $0.19 in May 2018 then suffered from a brutal sell-off until the market picked up in 2021.

Now, Zilliqa’s ZIL token has gained over 160% in market value after scoring a key partnership with Agora for its upcoming Metaverse as a Service (MaaS) platform, Metapolis. The global talent awards app will “bring not only creativity to life within the Metaverse but also open borderless access for creatives worldwide to connect in the digital world,” said Sandra Helou, Zilliqa’s Head of Metaverse and NFTs.

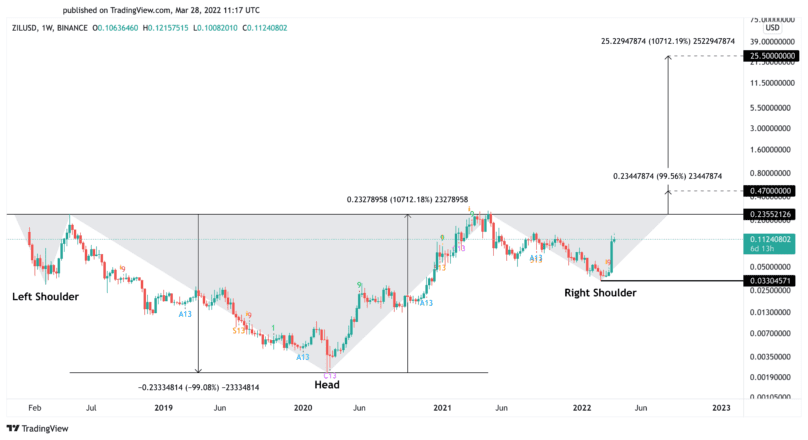

Over the past few days, the rising price action appears to be forming the right shoulder of a head-and-shoulders on Zilliqa’s weekly chart. Further buying pressure could push ZIL toward the pattern’s neckline at $0.234. Breaching this critical resistance level could result in a 100% price increase to $0.47 or even a 10,712% rally toward $25.

The discrepancy between both optimistic targets results from measuring the distance between the pattern’s neckline and head compared to measuring this distance from the pattern’s head to the neckline. In traditional markets, the most conservative target tends always to be validated. However, in the cryptocurrency markets, it’s not uncommon for assets to confirm the most optimistic targets.

Internet Computer Gathers Pace

Internet Computer appears to be on the brink of breaking out after slicing through critical resistance.

Internet Computer was founded in 2016 and saw years of development ahead of its first launch in October 2019. After several major updates, the project commenced its highly anticipated ICP token unlock in May 2021, but the asset tanked 95% within a month. Arkham research suggested that the sharp price decline was the result of the Dfinity team dumping tokens on the community. It’s since endured a rough few months, continuing to bleed.

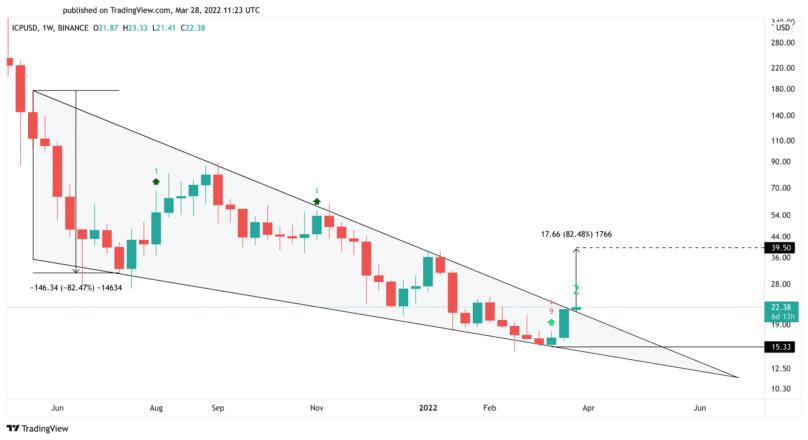

Now, ICP is showing signs of life. Its market value has increased by more than 24% over the past three days to test the $23 resistance level. This hurdle is significant to ICP because it sits around the descending trendline of a wedge that has been forming on its weekly chart.

A decisive candlestick close above $23 could signal a breakout from the consolidation pattern. Under such circumstances, sidelined investors could re-enter the market, pushing ICP by roughly 82.5% toward $39.50.

Still, Internet Computer is yet to print a weekly close above $23 to confirm the bullish thesis. If it fails to break this resistance level, the asset could suffer a correction to the wedge’s descending trendline at $15.30. Even if it does hit $39.50, it will still sit roughly 94% of its $700 all-time high recorded in May 2021.

EOS, Zilliqa, and Internet Computer are not the only Layer 1 crypto projects to rally today. Bitcoin, Ethereum, and many other networks are also trading in the green, suggesting that the market could be ready for a new uptrend.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article