An Introduction To Staking in Crypto

Staking is an incentive system that allows correct and secure functioning of a blockchain while rewarding its users.

Key Takeaways

- Staking is a way to earn rewards that promotes long term holding of a particular coin.

- Even those who aren’t tech savvy can benefit from different staking strategies to earn rewards.

- Phemex, one of the most popular exchanges in the industry, lowers the barrier to entry and offers a simple way to earn yield from staking.

Share this article

No matter what level of experience you have in crypto, there’s a chance you’ve heard about the concept of staking. Similar to a savings account or a bank certificate of deposit, staking lets you earn interest on your cryptocurrency.

Similarly, Stakers earn interest payments (known as staking rewards) after locking their tokens for a set time. The higher the stake, the higher the crypto rewards.

The comparison with a savings bank account only goes so far, as the purpose of putting your coins at stake is to help run the normal functioning and security of a blockchain through a system called Proof-of-Stake.

The Ups and Downs of Staking

Without getting too technical, there are different ways one can participate in staking.

As mentioned, stakers must lock up a minimum amount of coins to run a “solo” (individual) node, a computer that verifies the authenticity and approves transactions happening in the blockchain.

To run the software in a solo node, one has to have a certain amount of time, skill, and capital, and not everyone can meet all three requirements. For example, in the case of staking on Ethereum, running a node requires an upfront commitment of 32 ETH, or approximately $50K.

If someone who operates a node cannot keep the software running continuously, they risk losing part of their stake (a process also known as slashing). Another way to get penalized while staking is by approving dishonest transactions.

However, for those who cannot meet the solo staking requirements, they can also stake by delegating their coins to a larger group of participants. This is also known as staking pools, where you can earn rewards.

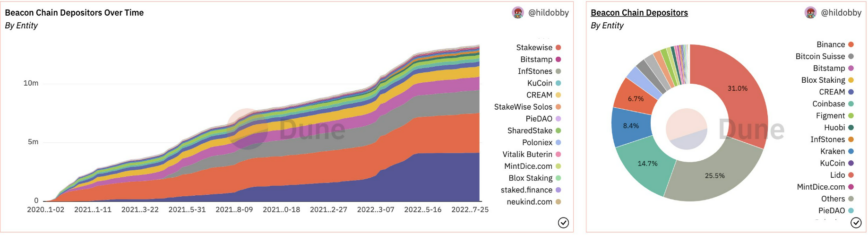

The benefit of pooled staking is that participation is cheaper and simpler. The downside however, is that the more people delegate, the more centralized blockchains become, making them more vulnerable to attack.

One of the benefits of pool staking is that you can pull out your tokens at any point in time, and there is no penalty for that; your stake just becomes liquid in the form of a token that represents your staked assets.

For example, when staking ETH on the Rocket pool project, users obtain an equal amount of liquid rETH tokens. Alternatively, when solo staking, users get rewarded with the same version of the staked token.

DeFi staking

We’ve mentioned applications that offer pooled or liquid staking as a solution for users who don’t have enough tokens or don’t feel comfortable staking individually.

Liquid staking is as easy as connecting a self-custodied wallet to a DeFi exchange and making a swap. Now users have a way to hold custody of their assets while earning income from staking, in addition to the possibility of earning more rewards through activities like yield farming.

Staking via a DeFi project means sending those tokens to a smart contract (a piece of software running on the blockchain where no central party can control the execution process). Examples of these DeFi staking services would be Lido, which supports many different blockchains, or Rocketpool on Ethereum.

Staking on Centralized Exchanges (CEX)

Many popular crypto exchanges offer staking rewards for those who are not comfortable taking the DeFi route and don’t want to deal with constant oversight.

Although it’s a more convenient option, exchange staking has its potential drawbacks, the main one is that the exchange takes a portion of the staking yields and may not offer a substitute liquid token. This means that users allow the exchange to take full control of the tokens during the staking period.

Just as one would do in choosing a DeFi option, when choosing a CEX to stake, one should consider the yields on offer, lock-up terms, the number of supported tokens, and the platform’s security.

Not sure about which exchange to choose for staking? Learn about Phemex’s LaunchPool, an option that allows users to get high staking rewards on various coins, unstaking without penalties at any time, and enjoy hourly payouts.

Staking is an excellent way for investors to earn yields on their inactive crypto, mainly if they’re not concerned with short-term volatility and have longer time horizons.

However, if the industry has taught us something in the past is to be careful if the yields are excessively high and look too good to be true. Always do your own research before staking your crypto in any platform, centralized or decentralized, and understand that any funds can be lost.