An Alleged Ponzi Scheme Makes up 40% of Paxos' Stablecoin Activity

Alleged ponzi scheme dominates Paxos transactions.

Key Takeaways

- Paxos is the third-largest stablecoin by market cap.

- 40% of all PAX transactions relate to a Ponzi scheme called MMM BSC.

- Ethereum-based USDT is the most broadly used stablecoin.

Share this article

Paxos, a stablecoin with a market cap around a quarter of a billion dollars, is under siege by transactions relating to the alleged Ponzi scheme called MMM BSC.

Crypto Briefing will refrain from linking to the MMM BSC website.

MMM BSC Makes PAX the Standard

Paxos (PAX) is the 35th largest cryptocurrency by market cap and the third-largest stablecoin after Tether and USDC.

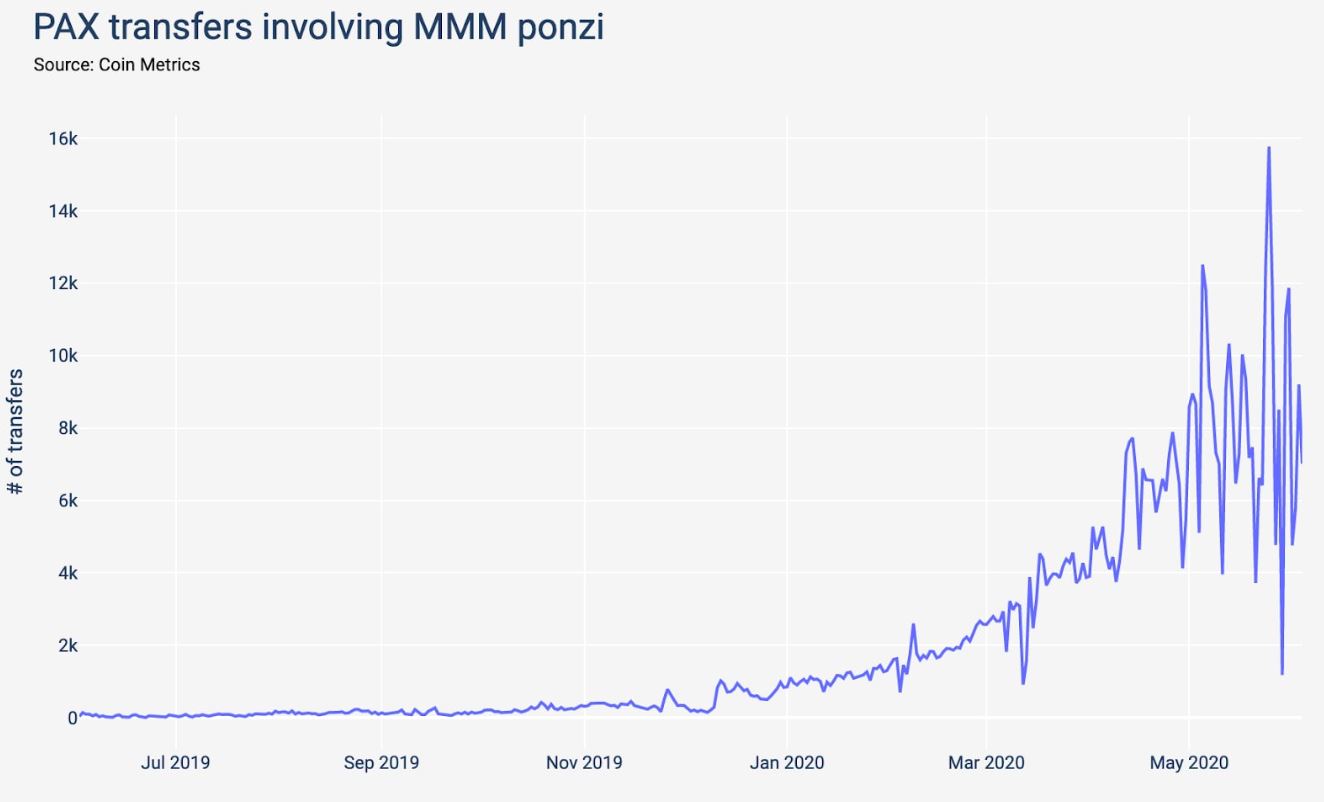

Unfortunately, a recent report from Coin Metrics revealed that 40% of all PAX transfers relate to the MMM BSC scheme.

Paxos transactions appear retail-like at first, but upon closer inspection, the two most active accounts on Paxos are linked to a Ponzi scheme, which promises:

“Yes, it’s possible to get the monthly income of up to 40% or 50%, but this is not a high-risk investment project!”

Those transfer figures represent an increasing number of transactions relating to the scheme, which now dominate 40% of the activity on the network.

Paxos Suffers Centralization of Use as a Result

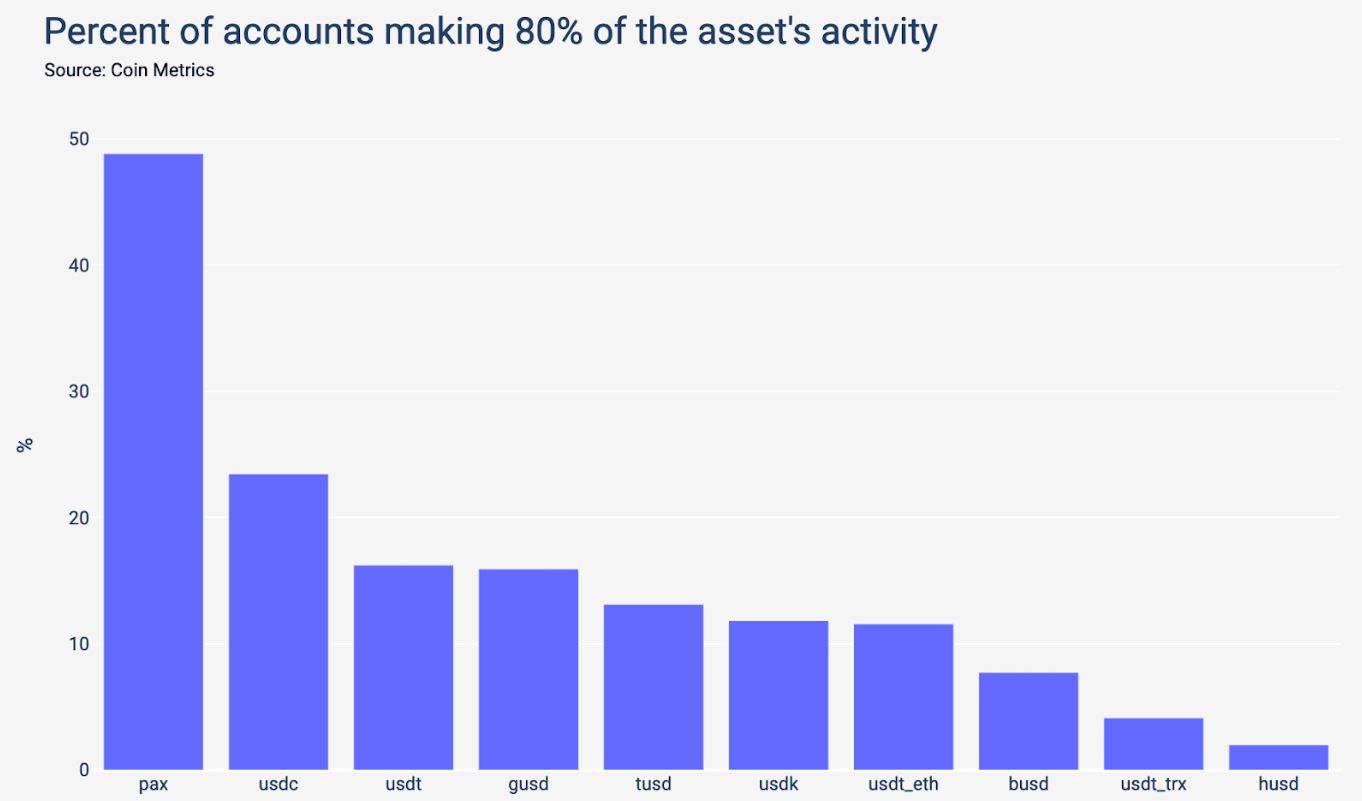

The graph below would initially suggest Paxos is used more widely by more users than any other stablecoin. Almost half of the transactions on the Paxos network represent 80% of activity. PAX’s daily volume is over $170 million.

In comparison, Circle’s USDC has just over 20% of accounts responsible for 80% of its network’s transactions. ERC-based Tether is far more centralized, with only 10% of accounts responsible for 80% of network activity.

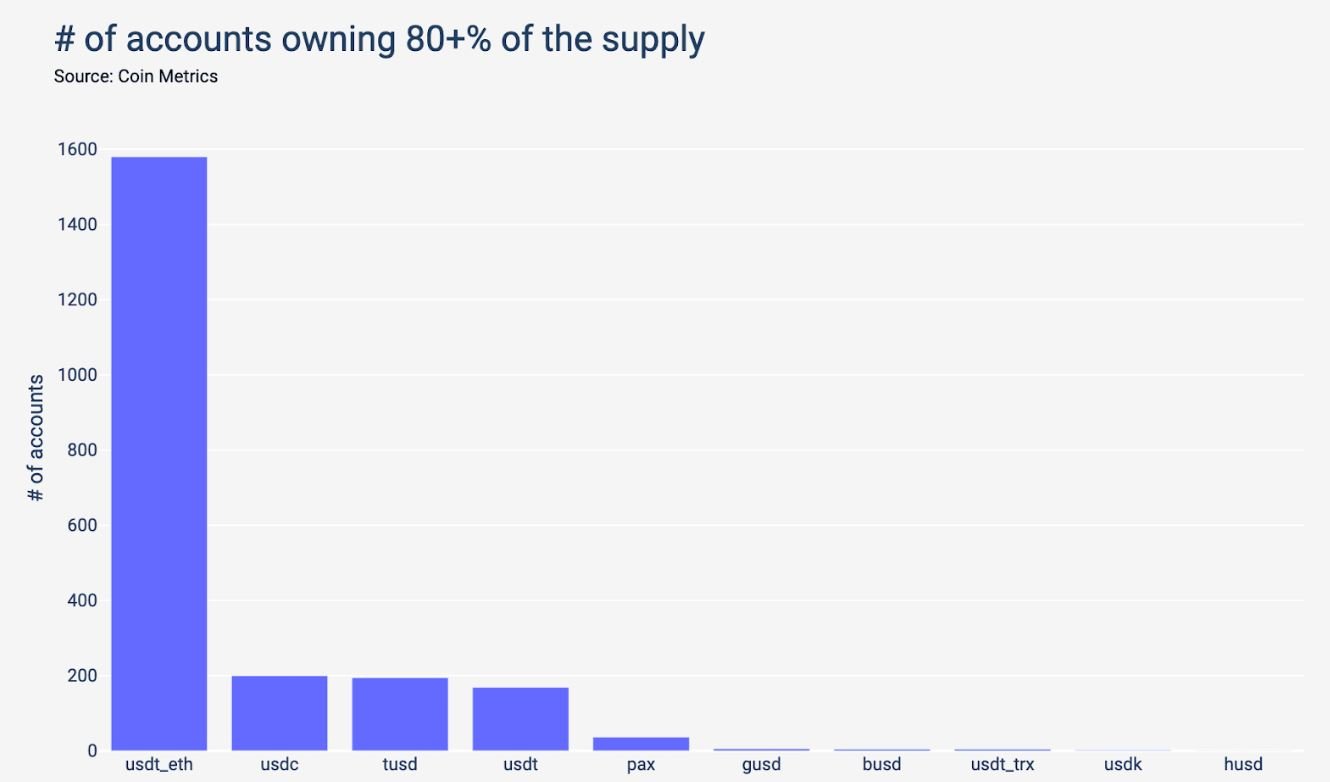

Yet the following charts reveal that network activity changes dramatically after excluding the Ponzi-related transactions. Paxos ranks low in terms of how many accounts own what percentage of supply.

In that graph, Ethereum-based Tether demonstrates much broader usage than any other stablecoin.

Paxos is regularly audited and boasts instant convertibility to fiat, making it a highly trusted stablecoin. It would also appear that the project is well aware of the Ponzi scheme and has already notified its users on Twitter.

Paxos is a trust company and committed to acting with transparency. We are not affiliated with MMM Global in any way. Any PAX users should do careful analysis and not interact with Ponzi schemes and affiliated organizations. Please be cautious with your trust and funds.

— Paxos (@Paxos) May 7, 2020

Though an alleged Ponzi scheme is leveraging the network does not indict the Paxos project, it does paint a picture of how malicious forces can influence a project’s metrics.

Share this article