Arbitrum whales accumulate ARB tokens amid price correction

ARB dipped 20% following a major token unlock last Saturday.

Share this article

Arbitrum (ARB) has entered a sharp correction following a recent token unlock, which released 1.1 billion ARB tokens worth over $2 billion last week. According to data from CoinGecko, ARB is trading at around $1.6, down 20% in the last seven days and 30% lower than its record high of nearly $2.4 in January. Despite the price correction, on-chain insights suggest Arbitrum whales press on with ARB purchases.

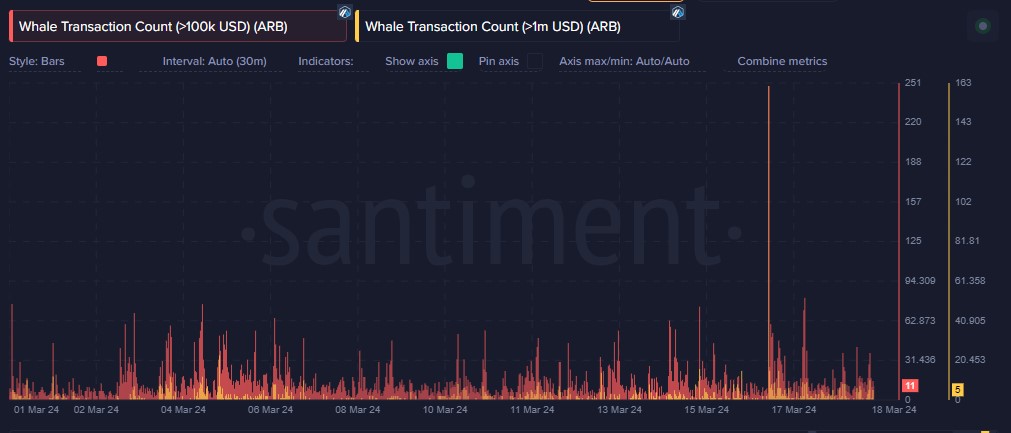

According to data from Santiment, transactions worth over $1 million surged on March 16, the day of the ARB token unlock. While this might suggest selling pressure, wallets holding between 100,000 and 100 million ARB tokens were on the rise on the same day. This indicates that major whales were likely accumulating ARB despite market concerns.

Notably, these whales began stockpiling tokens in the days leading up to the unlock, a period coinciding with a downward trend in Arbitrum’s prices.

The recent Arbitrum token unlock, distributing a significant portion of the circulating supply, triggered a surge in on-chain activity. Over 330,000 unique addresses interacted with the network that day, a 13,000 increase from the previous day. Furthermore, the number of new addresses joining the network jumped 77%.

Meanwhile, on-chain analysis from Spot On Chain revealed that six wallets linked to ARB vesting contracts recently transferred approximately 8.9 million ARB tokens, worth around $16 million, to Binance. These wallets reportedly possess nearly 33 million ARB tokens, though their profit-taking activities remain uncertain.

The $ARB price dropped 11% (12H) amid a market downtime and a major unlock!

In the past 12 hours, 6 wallets, which just received tokens from vesting contracts, have deposited 8.95M $ARB ($16.4M) to #Binance.

They still hold 32.95M $ARB ($56.7M) and may deposit out more tokens!… pic.twitter.com/165fOuMpvh

— Spot On Chain (@spotonchain) March 17, 2024

Data from Token Unlocks shows that Arbitrum is set to release another 92.65 million tokens, valued at around $160 million at current prices, on April 16. This distribution to the team, advisors, and investors could cause additional price volatility in the coming weeks.

Share this article