Argentina devalues peso by 50%, crypto offers a way out

Crypto provides options in Argentina amid Peso volatility and inflation.

Share this article

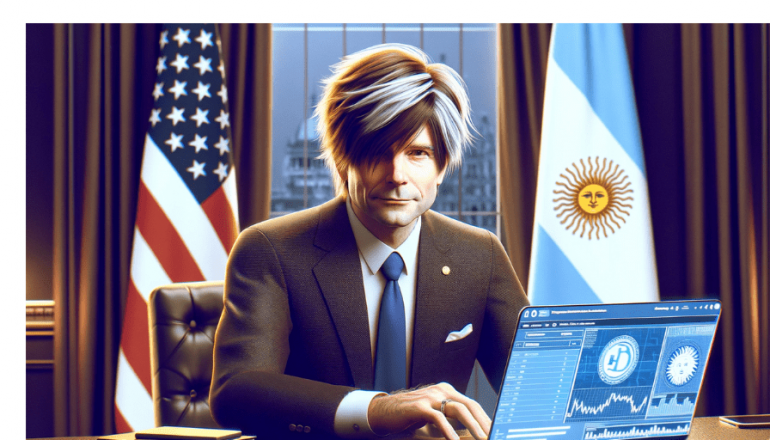

Argentina’s new President, Javier Milei, announced a 50% devaluation of the Argentine peso and cuts to energy and transportation subsidies. The peso’s value has been reduced from 400 to 800 pesos per U.S. dollar, which Economy Minister Luis Caputo warns will initially worsen the country’s economic situation.

In this context, the role of cryptocurrencies, particularly Bitcoin and stablecoins, could be pivotal. Milei, a self-described anarcho-capitalist, has supported Bitcoin, viewing it as a tool to counter the inefficiencies and corruptions of centralized financial systems.

With the Argentine peso’s volatility, the country’s economic downturn, and high inflation, crypto offers an alternative for wealth preservation and monetary transactions. More than 2.5 million Argentinians, or 5.6% of the population, own crypto.

Javier Milei has expressed favorable opinions about Bitcoin in various interviews but has not suggested making it legal tender. He has also referred to Bitcoin as the “natural answer” to the Central Bank “scam.”

By accepting crypto, Argentina could unlock new finance options to address its $45 billion debt to the International Monetary Fund. The first $10.6 billion payment comes due in April, triggering urgent action from Milei’s economic team. The IMF welcomed the peso devaluation and subsidy cuts, but skeptics question whether deregulation will be effective.

Share this article