Argo Blockchain Ranks Among Fidelity’s 5 Most Actively-Traded Stocks

Crypto mining company Argo Blockchain has ranked amongst the top five most actively-traded stocks by Fidelity customers in 2021.

Key Takeaways

- Argo Blockchain was the third most actively-traded stock by Fidelity customers in 2021.

- The crypto mining firm has recorded higher trading volumes than either BP and or Lloyds Banking Group, despite being a much younger and smaller company.

- Argo is currently trading at a $450 million valuation.

Share this article

Fidelity Investments, one of the largest asset management firms in the world, revealed today that Argo Blockchain has been the third most actively-traded stock by the firm’s customers in 2021.

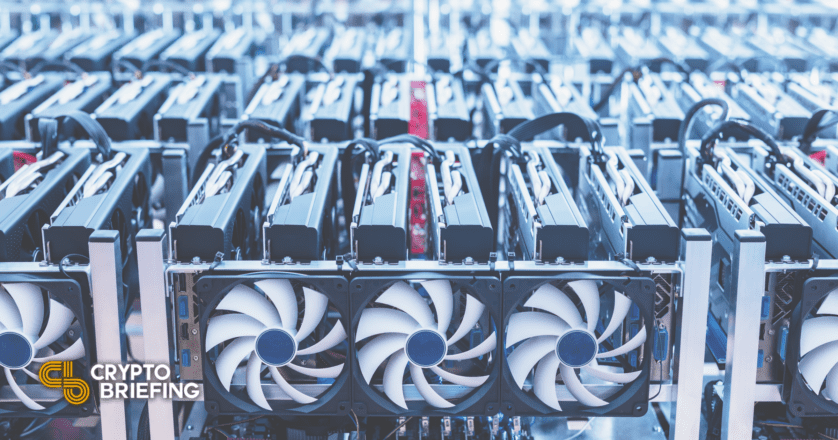

Increased Appetite for Crypto Mining Stocks

Argo Blockchain, the first cryptocurrency mining company to list on the London Stock Exchange, has ranked as the third most actively-traded stock by Fidelity customers over the last twelve months.

Today, Fidelity Investments shared a list of its customers’ most actively-traded stocks over the last year. Ranked in descending order by trading volume, the list includes aircraft engine manufacturer Rolls-Royce, British Airways owner International Consolidated Airlines, crypto mining company Argo Blockchain, oil giant BP, and the Lloyds Banking Group.

Argo Blockchain was the first cryptocurrency mining company to be listed on the London Stock Exchange. According to data shared on its website, the firm’s facilities, based in North America, expend 45 megawatts of electricity to generate over 1.6 EH/S of Bitcoin and 280 Megasols of ZCash in mining power. This puts Argo’s capacity in the top-tier of global mining operations, accounting for around 0.6% and 5% of the total worldwide mining capacity for Bitcoin and ZCash, respectively.

The company has a current market capitalization of around $450 million with its stock trading at approximately £97 per share, down significantly from its all-time high price of £282 in February. Interestingly, despite being a significantly younger and smaller company than either BP or the Lloyds Banking Group, Argo’s stock recorded more trading volume among Fidelity customers for the last year.

In November, Argo announced the construction of a $2 billion crypto mining facility in Texas. Following a ban on cryptocurrency mining in China, the U.S. has emerged as the new global leader in crypto mining, accounting for roughly 35.4% of the worldwide Bitcoin hashrate as of August. Several U.S. states, including Texas, Kentucky, and Wyoming, have been especially welcoming to cryptocurrency miners, offering lower electricity rates to attract and retain them.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.

Share this article