Arizona revives Bitcoin reserve bill and passes it in Senate

House Bill 2749 remains the first and only Bitcoin reserve bill signed into law by Governor Katie Hobbs to date.

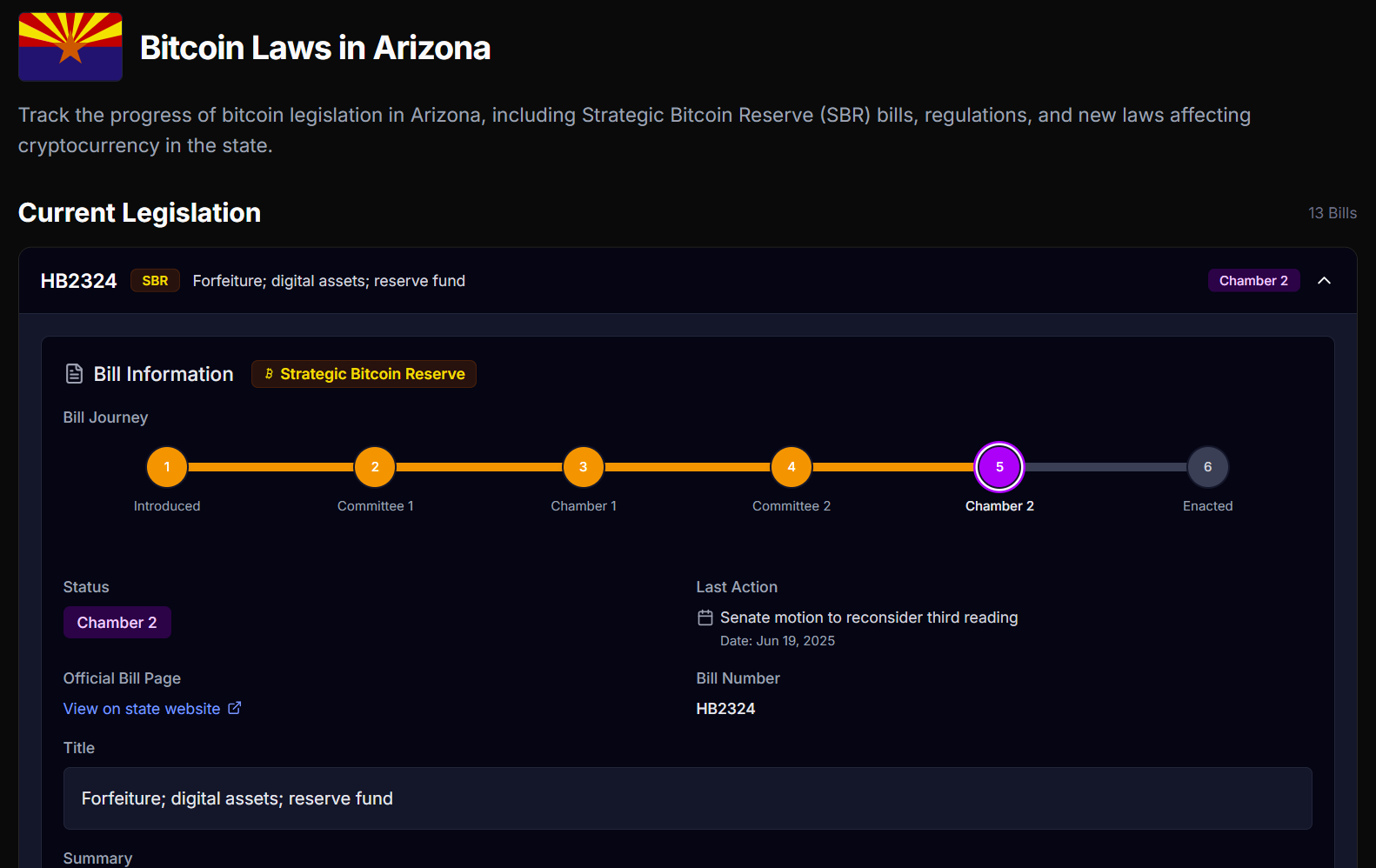

Arizona lawmakers revived and voted to advance House Bill 2324 (HB2324), proposed legislation to create a state-managed fund for Bitcoin and other digital assets seized through criminal forfeiture, according to a Thursday update from Bitcoin Laws.

HB2324 was introduced in the Arizona House of Representatives in February and passed the Senate in early May. However, the House failed to approve the bill in its final vote, effectively halting its progress.

Through a series of procedural motions to reconsider in both chambers, the bill was revived in mid-June, cleared the Senate in a narrow 16–14 vote on Thursday, and is now in the House for a final vote.

HB2324 seeks to establish a Bitcoin and Digital Assets Reserve Fund under the state treasurer’s oversight. The fund would manage digital assets confiscated through criminal asset forfeiture.

The proposed legislation outlines three options for handling seized digital assets, including storage in state-approved digital wallets, sale through licensed crypto exchanges, or retention in native form based on market and security factors.

The bill modifies Arizona’s forfeiture laws to include digital assets and establishes modern custodial standards, incorporating blockchain-based access protocols and qualified third-party custodians.

Under the proposed distribution structure, the first $300,000 from seized digital asset sales would go to the Attorney General’s Office. Additional proceeds would be split, with 50% going to the Attorney General, 25% to the state general fund, and 25% to the new Bitcoin and Digital Assets Reserve Fund.

The legislation would allow fund assets to be invested in digital assets or crypto ETFs, with earnings returning to the state.

Several crypto bills were rejected in Arizona

Arizona has taken some significant steps toward integrating digital assets into its financial infrastructure, though not without political friction.

On May 7, the state welcomed its first Bitcoin reserve bill with the signing of House Bill 2749 (HB2749). The legislation establishes a state-managed Bitcoin and Digital Assets Reserve Fund, composed of digital assets acquired through airdrops, staking rewards, and interest.

HB2749 remains the first and only Bitcoin reserve bill signed into law by Governor Katie Hobbs to date.

Earlier that month, Hobbs vetoed Senate Bill 1025, a proposal that would have authorized state officials to invest up to 10% of the treasury and pension assets in digital assets like Bitcoin.

On May 12, she issued more vetoes, rejecting Senate Bill 1373, which sought to create a Digital Assets Strategic Reserve Fund, and Senate Bill 1024, which would have allowed state agencies to accept crypto payments for taxes, fees, fines, rent, and penalties.

Despite these vetoes, the governor signed House Bill 2387 the same day, introducing consumer protection rules for crypto kiosks, commonly known as crypto ATMs, operating in Arizona.