Avalanche's Ava Labs Set to Hit $5.25B Valuation: Report

Avalanche's Ava Labs Inc. is reportedly looking to raise additional capital to improve the network's scalability.

Key Takeaways

- Ava Labs Inc. is reportedly raising $350 million at a $5.25 billion valuation.

- Institutions such as Grayscale have signaled their belief in Avalanche.

- AVAX could rise to $100 after rebounding from vital support.

Share this article

Ava Labs, the development company behind the Avalanche blockchain, is reportedly set to raise $350 million at a $5.25 billion valuation.

Avalanche Developer Plans Raise

Ava Labs Inc., the development company behind the Avalanche blockchain, is reportedly raising fresh capital in a move that could position it as one of the world’s most valuable crypto startups.

According to a Thursday Bloomberg report, the firm is looking to raise $350 million at a $5.25 billion valuation. The goal is to continue improving Avalanche’s subnet functionality to offer high speeds and low transaction fees for dApps to scale.

At a $5.25 billion valuation, Ava Labs would become one of the world’s most highly valued crypto startups, trailing only a handful of giants like Polygon and Circle. In recent months, institutional players like Grayscale have signaled their belief in Avalanche amid growing interest in alternative Layer 1 networks looking to compete with Ethereum.

As the buzz surrounding the Avalanche ecosystem ensues, the network’s AVAX token could soon benefit and resume its uptrend.

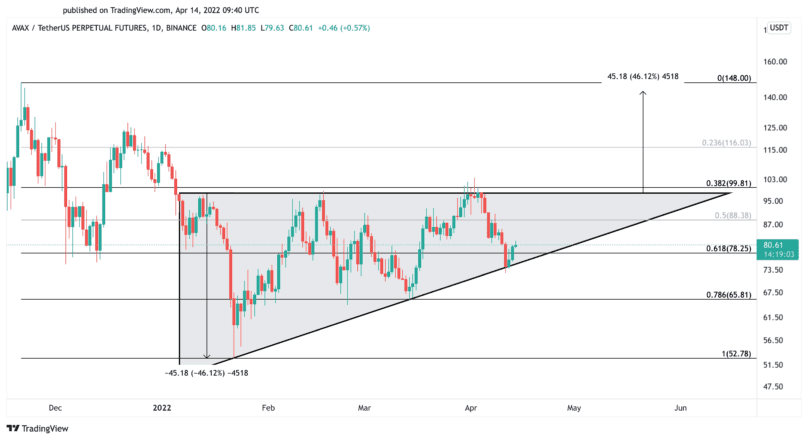

AVAX appears to be forming an ascending triangle on the daily chart, which can be considered a bullish technical formation. Prices have rebounded from the pattern’s hypotenuse and could march toward the X-axis at nearly $100. A sustained daily close above this resistance level could result in a 46% rally to $150.

Still, the $74 support level is crucial given the geopolitical and macroeconomic factors that have recently shaken the market. Slicing through this vital demand zone could result in a correction to $66 or even $53.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article