Avalanche's AVAX Token Primed For Steep Correction

Avalanche appears to have entered a corrective trend after enjoying an impressive bull run.

Key Takeaways

- Avalanche took a 22% nosedive, dropping to a low of $54.84.

- The TD Sequential indicator anticipated the bearish price action.

- Further selling pressure could push AVAX down to $34.91.

Share this article

Investors appear to be booking profits after seeing Avalanche’s price skyrocket by a whopping 720% in the past two months.

Avalanche Hits Local Top

Avalanche has seen its price drop by nearly 22% since the weekly trading session began. The so-called “Ethereum killer” shed over 15 points in market value, going from a high of $70 to a low of $54.84 before recovering. AVAX is currently trading at $62.27 at the time of writing.

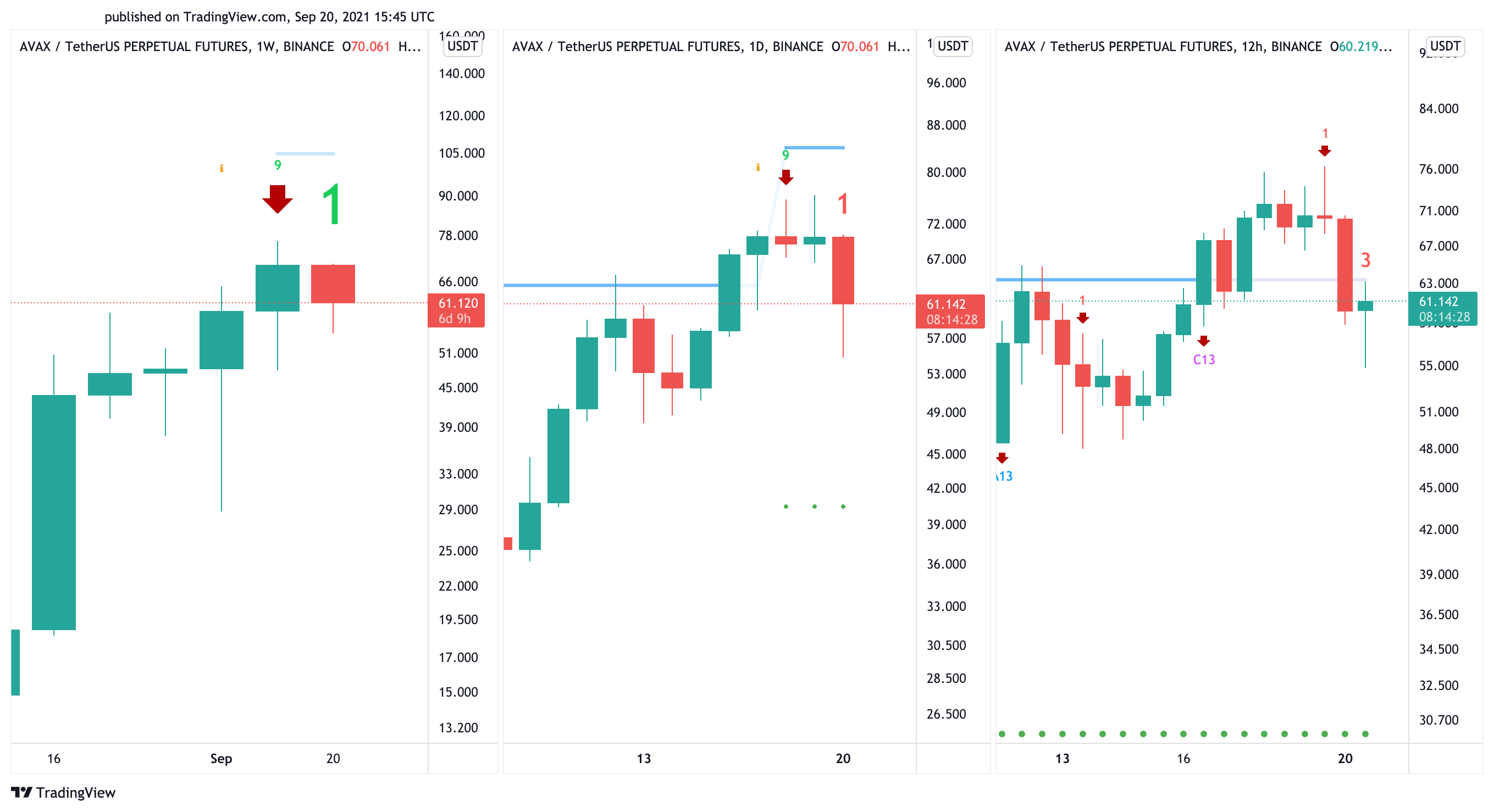

The downward price action appears to have been anticipated by the Tom DeMark (TD) Sequential indicator. This technical index presented sell signals in the form of green nine candlesticks on AVAX’s 1-week, 1-day, and 12-hour charts. The bearish formations forecasted that Avalanche was bound for a steep correction, which seems to have been validated today.

Further selling pressure might lead to further losses as the TD setup projects a retracement that lasts one to four candlesticks on any of the time frames previously mentioned.

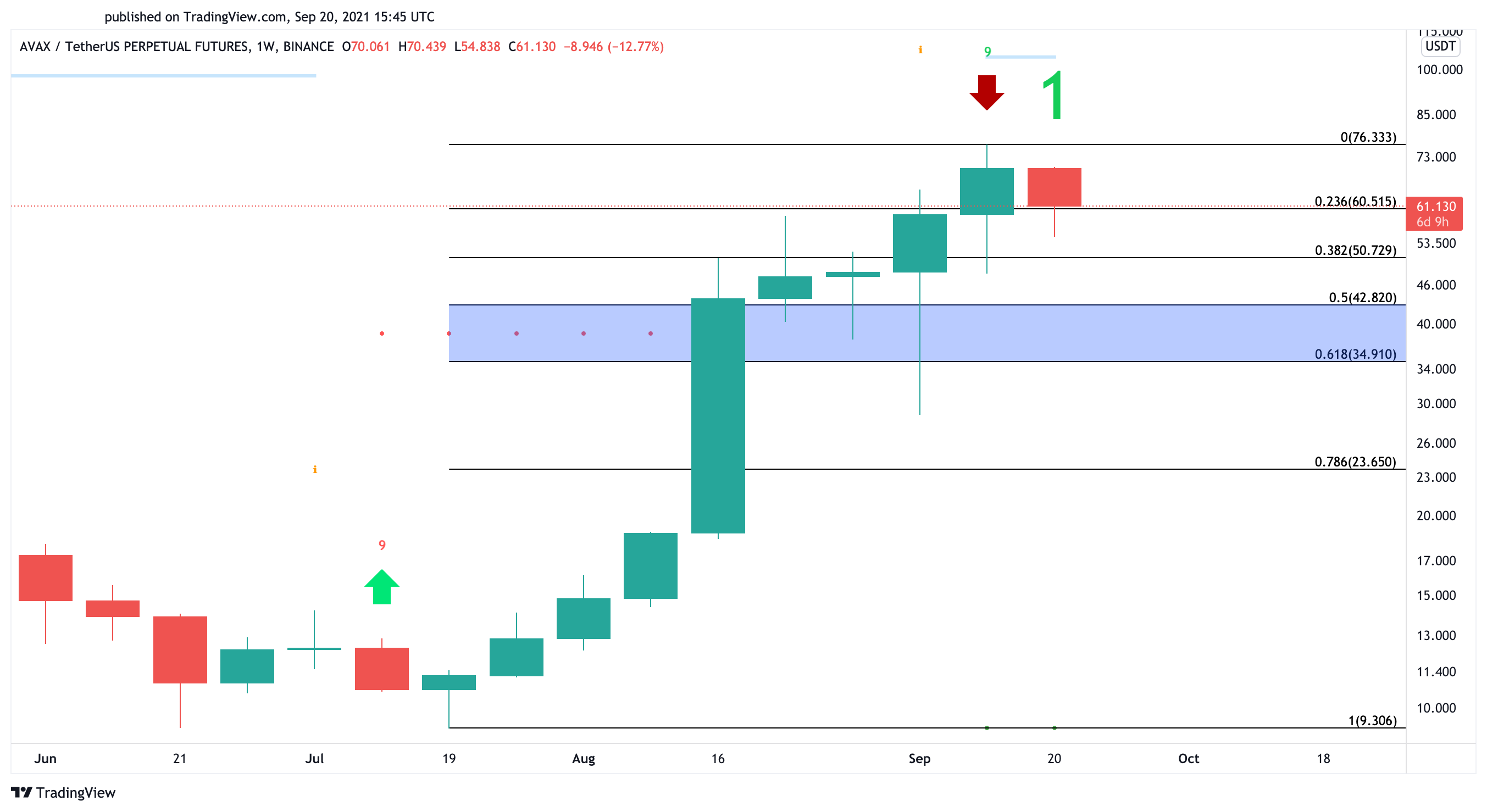

The Fibonacci retracement indicator, measured from the Jul. 20 low of $9.31 to the all-time high of $76.33, suggests that Avalanche has plenty of room to go down before it finds a stable support.

A spike in sell orders behind this cryptocurrency could push prices toward the 50% or 61.8% Fibonacci retracement level. These critical support levels sit at $42.82 and $34.91, respectively.

Despite the pessimistic technical analysis, it is worth considering the growing activity on the AVAX network. There has been a steady migration of dApp users from other networks like Ethereum to Avalanche over the past few weeks as it offers cheaper and faster transactions.

On-chain data from DeFi Llama shows that the total value locked (TVL) on Avalanche has skyrocketed since Aug. 19, reaching a new record high of $2.96 billion on Sep. 9.

Further network growth could translate into more upward price action for Avalanche. Therefore, market participants should pay close attention to the $76.33 resistance level. Slicing through this barrier might propel AVAX toward $100 or higher.

Share this article