Late Bloomer: Why Bakkt's Slow Start Is No Surprise

Comparisons to CME are inaccurate.

Share this article

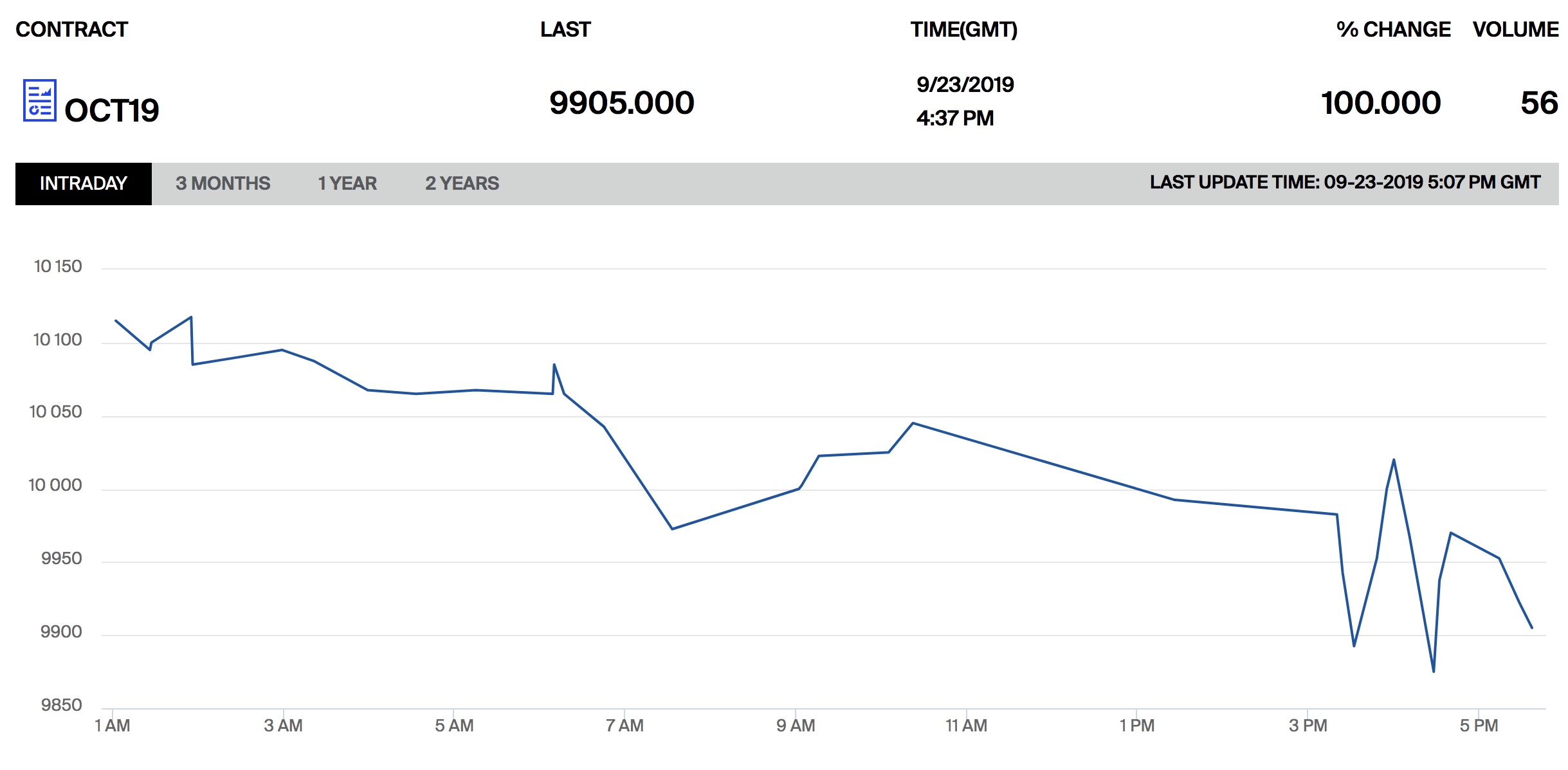

Bakkt has finally opened its platform for physically-delivered Bitcoin futures, but the response has been underwhelming. Nearly a year after the owners of the New York Stock Exchange announced their foray into cryptocurrency, markets responded to the new institutional trading venue with another 1.8% price drop.

First announced last August, the long-delayed launch “was an important step toward bringing trusted infrastructure to digital assets,” wrote CEO Kelly Loeffler. The physically-settled futures platform is expected to provide a crucial infrastructure for institutional trading in cryptocurrencies.

But some pundits have expressed disappointment at today’s volumes. Four hours before the market closes, only $550,000 worth of BTC futures have exchanged hands.

One well-known cryptocurrency analyst described volumes as “not great,” while CoinDesk said trading on Bakkt was off to a “slow start.”

At face value, these low volumes might suggest that institutional investors aren’t very interested in cryptocurrencies. Based on today’s activity, Bakkt volumes are unlikely to rival the futures product from CME Group, which traded $470M in its first week.

But there’s an important distinction. CME’s futures are all cash-settled, meaning that all the trading is done in fiat currencies. The underlying asset may be Bitcoin, but at no point does either side have to actually hold it. From a legal perspective, that makes CME futures much simpler for institutional investors, making them no different from a similar future in wheat, maize or gold.

In contrast, Bakkt’s futures are all physically delivered, meaning that the underlying assets have to be transferred on a specified date. Institutional investors have to take custody of actual bitcoins, with a lot more hoops to jump.

In order to regularly trade in Bakkt bitcoin futures, institutional investors will have to consult specialized legal counsel, acquire new insurance policies, and possibly update their investors.

“[S]ome of [Bakkt’s] largest prospective clients still don’t have permission to trade physically-delivered futures contracts,” wrote analysts at BeQuant Exchange in a note. “As such, [the] build it and they will come mantra may not necessarily result in an influx of new, hot money, at least not right away.”

It’s hard to know what the big institutional investors were thinking when Bakkt opened up shop for the first time. But, given the fact that the platform is dealing with a volatile asset class, which has a nebulous regulatory status, it’s no surprise that many high rollers are playing wait-and-see.

If there’s one lesson to be learned from Bakkt’s trading today, it’s that the cryptocurrency space still has a tendency towards overblown expectations. Institutional investors were never going to dive headfirst into an unfamiliar asset. A cautious start to Bakkt’s futures today is a good sign, indicating that the majority of investors are still playing it safe.

Share this article