Betting on Bitcoin? Don't Forget Risk Management

Disciplined risk management is the foundation of trading success.

Key Takeaways

- No risk, no reward. But taking on more risk than one can bear can lead to disaster.

- Defined risk per trade and stop losses just beyond invalidation levels is the core tenet of risk management.

- Taking trades that adequately compensate traders for the risk they take on is the best way to sensibly deploy capital.

- Once a trader builds experience, they can exercise less discipline and employ a dynamic risk management framework.

Share this article

The first step to becoming a profitable Bitcoin trader is following a disciplined approach to risk management. In this guide, Crypto Briefing outlines some risk management tactics that will go a long way in boosting profitability.

No Reward Without Risk

Risk and reward are two sides of the same coin.

Investors are rewarded for the amount of risk they take. This is precisely why investing in nascent technologies like Bitcoin and Ethereum yields far better returns than the traditional stock market.

But every trader – retail or institutional – has a risk appetite that is defined by various parameters, such as the size of one’s investment corpus, income levels, age, and other factors.

Knowing how to evaluate your risk profile is the cornerstone of managing risk.

Taking on risks that are beyond one’s threshold is a recipe for disaster. Losses can compound quickly, wiping out whole trading accounts.

This happens far too often – especially in crypto.

Copying the risk management parameters of traders on social media can also devastate trading accounts. This only makes sense if one has a similar background and risk threshold as the trader they’re imitating.

A trader whose standard position size is $100 cannot emulate the risk management of a trader who actively opens $100,000 positions.

Without risk management, it’s impossible to become profitable. This is because profitable traders let their winning positions roll and cut their losses early.

In this guide, Crypto Briefing will lay out a basic framework for managing risk.

Establishing Risk Management

Position Sizing and Stop Losses

Trading is all about minimizing losses and maximizing wins. That said, the process is more of an art than a science, varying from person to person.

But the first rule of risk management is to ask oneself: How much of a loss can I afford to sustain on a single trade?

Typically, it is recommended that one limits the risk per trade to 1-3% of their total trading account.

This concept, however, is subject to widespread misinterpretation.

Some sources incorrectly claim this means you should enter every trade with a position size that is 1-3% of your total portfolio. But it actually means that you should be willing to put 1-3% of your equity at risk.

For example, if Alice has a $1,000 trading account, it doesn’t mean her notional position size should be $10-30; it means she should be willing the lose a maximum of $10-30 on each trade.

But how do you ensure you limit risk in this way?

A trader can ensure their loss per trade has an upper limit when they employ a stop loss.

Stop losses shouldn’t be placed arbitrarily. Instead, one should place it at the point where their trade idea is invalidated.

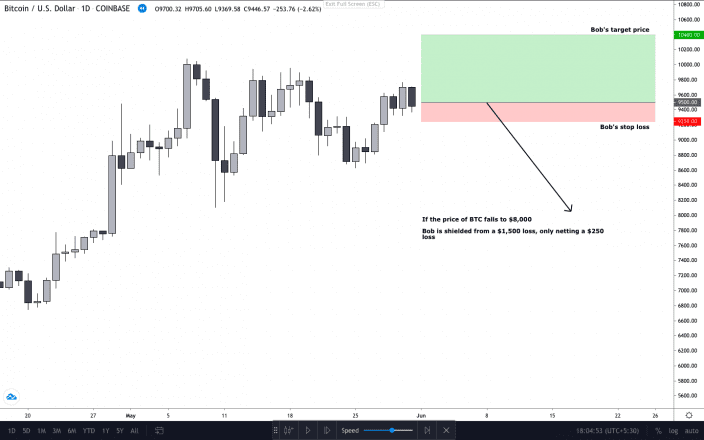

Say the price of BTC is $9,500, and Bob believes there is room for more upside, but if BTC goes to $9,280, the market structure turns bearish, and this idea is invalidated. Now Bob, whose trading account is worth $25,000, previously decided he will risk no more than $250 per trade.

So, Bob will buy one BTC at $9,500, placing a stop loss at $9,250, thereby limiting his maximum loss to $250 ($9,500 – $9,250).

But why does Bob place it $30 below his invalidation level?

Because when a certain level looks like the point of invalidation for many market participants, whales will run price just beyond that level to source liquidity and direct price in the opposite direction.

This is just an extra step for precaution in hyper-volatile crypto markets.

Trade Selectivity

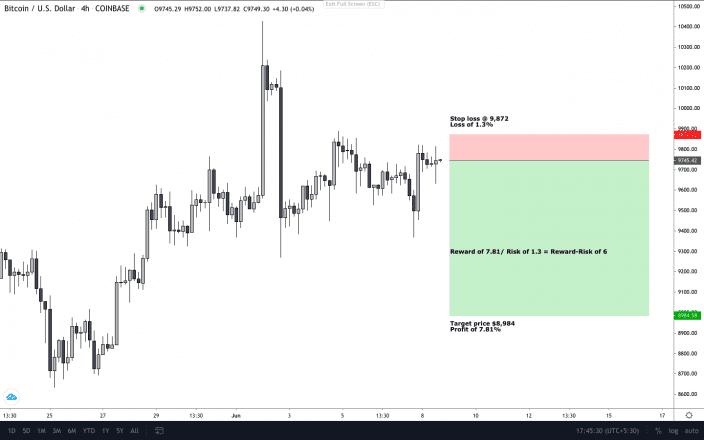

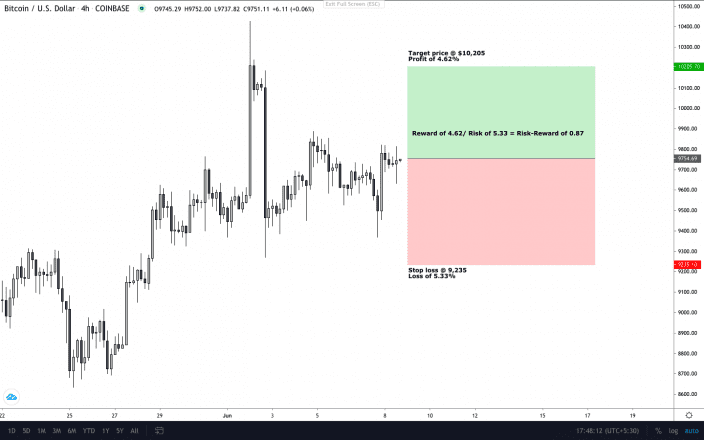

An underrated aspect of risk management is ensuring one only takes trades where the reward-risk ratio is favorable. In the absolute worst-case scenario, the reward-risk ratio should be one where the potential gain is equal to the potential loss.

This means if a trader is risking $10, the minimum profit from the asset reaching their target price should be $10.

Trades with a reward-risk below one make no sense because the trader stands to lose more than they can ever gain.

To supplement this, some traders have a minimum reward-risk that is much higher.

By only taking trades where the reward-risk ratio is, say, three or higher, traders can ensure they only risk their capital when the potential payout is two orders of magnitude higher.

Building a Dynamic Plan With Experience

Each trader will employ different styles of trading that have varied merits and drawbacks.

After an adequate amount of time staying disciplined with strict rules, traders can start to mold their risk parameters around their strengths and weaknesses.

Some may start to employ a trailing stop loss because their ability to locate profit-taking zones is inferior, and others might increase/decrease the risk they take based on the reward-risk ratio.

The bottom line is that there is no one size fits all risk management and trading framework. Each individual is tasked with setting their own risk parameters and adjusting until they find a working system.

Employing disciplined risk management is the first step to trading profitability.

Share this article