Binance stablecoin BUSD falls and loses top five spot

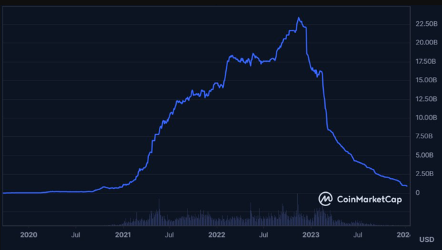

Binance stablecoin sees a dramatic drop in circulating supply, falling below the 1 billion mark.

Binance USD (BUSD) stablecoin has dropped from its position among the top five stablecoins. This past weekend, the circulating supply of BUSD plunged to below 1 billion tokens, a level not seen since December 2020. This marks a significant downturn for the stablecoin, which had previously reached a peak supply of 23.45 billion.

The decline in BUSD’s market presence is attributed to several factors. Last year, the US Securities and Exchange Commission (SEC) took legal action against the exchange, during which BUSD was classified as a security. This move, combined with the prohibition by the New York Department of Financial Services of minting new tokens, compelled BUSD issuer Paxos to halt further minting of the asset and sparked a notable shift within the crypto community.

Reacting to these developments, Binance quickly started promoting alternative stablecoins, including TrueUSD (TUSD) and First Digital USD (FDUSD). On January 5, Binance decisively announced the completion of an automatic conversion process, transitioning eligible users’ BUSD balances to FDUSD. The exchange also ceased support for BUSD withdrawals, advising users to manually exchange their BUSD for FDUSD at a one-to-one rate using Binance Convert.

Despite the phase-out, Binance and Paxos are dedicated to supporting BUSD until the transition is completed later this year.

The reordering of the stablecoin market sees TUSD and FDUSD, heavily endorsed by Binance, entering the top five, reshaping the market landscape. However, Tether’s USDT continues to dominate, holding approximately 70% of the market share with a capitalization surpassing $90 billion. Circle’s USDC comes in second, maintaining a significant presence with a market cap of $24.56 billion.

Tom Wan, a researcher at 21Shares, points out that for a stablecoin to effectively challenge the leaders, it must be integrated into centralized exchanges, incorporated into DeFi platforms, and utilized in payment and remittance services. This shift in the stablecoin hierarchy underscores the dynamic nature of the cryptocurrency market, where regulatory actions and strategic decisions by major players like Binance can significantly alter the competitive landscape.