Bitcoin has 85% odds of hitting a new price peak within six months

IntoTheBlock points out five key factors propelling Bitcoin to a potential all-time high before 2024 ends, but there are three scenarios where this doesn’t concretize.

Different factors suggest that Bitcoin (BTC) has 85% odds of hitting a new all-time high within the next six months. Lucas Outumuro, head of research at on-chain data platform IntoTheBlock, pointed out halving, exchange-traded funds (ETFs), easing monetary policies, elections, and institutional treasuries as propellers for BTC to close the 32% gap that separates itself from its previous price peak at $69,000.

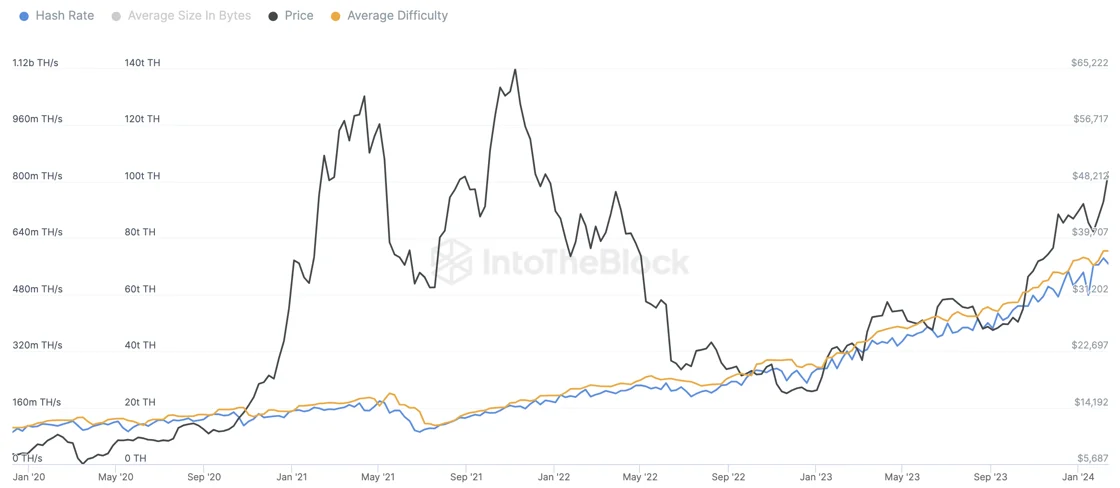

The upcoming Bitcoin halving in mid-April 2024 will halve miner rewards from 6.25 BTC to 3.125 BTC, potentially impacting the network’s hash rate temporarily. However, historical trends suggest a swift recovery in hash rate and security, bolstering Bitcoin’s value. Additionally, the halving is expected to reduce Bitcoin’s issuance inflation rate from 1.7% to 0.85%, potentially decreasing selling pressure from miners.

ETFs have also emerged as a significant growth driver, with over $4 billion in new inflows reported just a month after the launch of spot Bitcoin ETF products in the US. This trend is expected to continue, especially with the successful debut of Blackrock’s IBIT ETF, signaling strong market demand.

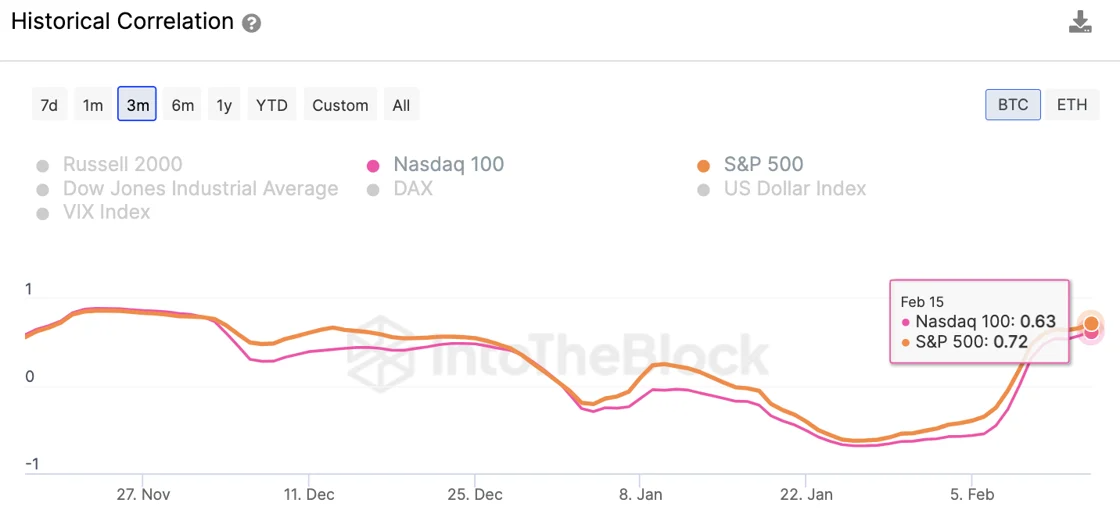

The easing of monetary policies by the Federal Reserve, in response to declining inflation rates, is likely to lower interest rates, injecting liquidity into markets and potentially benefiting Bitcoin and stocks. The anticipation of rate cuts has already been reflected in market activities, aligning Bitcoin’s performance more closely with major stock indexes.

Political factors, such as the upcoming presidential elections, could also influence market sentiments. The Federal Reserve’s historical leanings and the potential for a pro-crypto administration could further enhance market conditions favorable to Bitcoin.

Institutional interest in Bitcoin, particularly through corporate treasuries and increased accessibility via ETFs, may also contribute to the cryptocurrency’s growth. While this trend is more pronounced in Asia and South America, the legitimization of Bitcoin in the US through ETFs could extend this pattern.

Nonetheless, there are a few things that could go wrong within the next six months, Outumuro stated. Many of the catalysts mentioned are at least partially priced in, particularly the halving, the rise of spot Bitcoin ETFs in the US, and the easing by the Federal Reserve. “If one of these fails to materialize, then it is likely that Bitcoin could face a 10%+ correction,” he adds.

Moreover, there’s a possibility that the geopolitical conflicts in Gaza and Ukraine will spread globally. Thus, if Western economies or China become more directly involved, this might create an uncertain landscape that could potentially result in a sell-off, at least in the short term.

IntoTheBlock’s head of research also doesn’t discard the occurrence of unexpected selling pressure, triggered by different factors, such as major crypto institutions failing, Satoshi-era addresses becoming active again or there is a major vulnerability in Bitcoin.