Bitcoin Dipped Below $9,000, What's Next?

Volatility is back in the market and as many speculate whether Satoshi Nakamoto is dumping his holdings, Bitcoin is bound to surprise investors.

Key Takeaways

- Different on-chain metrics forecasted that Bitcoin was about to experience a correction.

- Now that it has corrected, it seems like BTC is sitting on top of a thin support barrier.

- However, the unpredictability of the market suggests that the bullish outlook cannot be taken out of the question just yet.

Share this article

Bitcoin dipped below $9,000, sending investors back into fear, but data suggests that the pioneer cryptocurrency is poised to regain some of the losses incurred.

Bitcoin Posts Considerable Losses

Fear, uncertainty, and doubt erased over $30 billion from the total market capitalization in the past few days.

During this time, the flagship cryptocurrency dipped below $9,000, liquidating more than over $70 million worth of long and short BTC positions on crypto derivatives exchange BitMEX.

Many investors and market participants alike claim that the sudden bearish impulse was fueled by speculation around a 50 BTC transaction potentially owned by Bitcoin’s creator Satoshi Nakamoto.

Despite this news, several on-chain metrics have been warning about the high probability of correction for a while now.

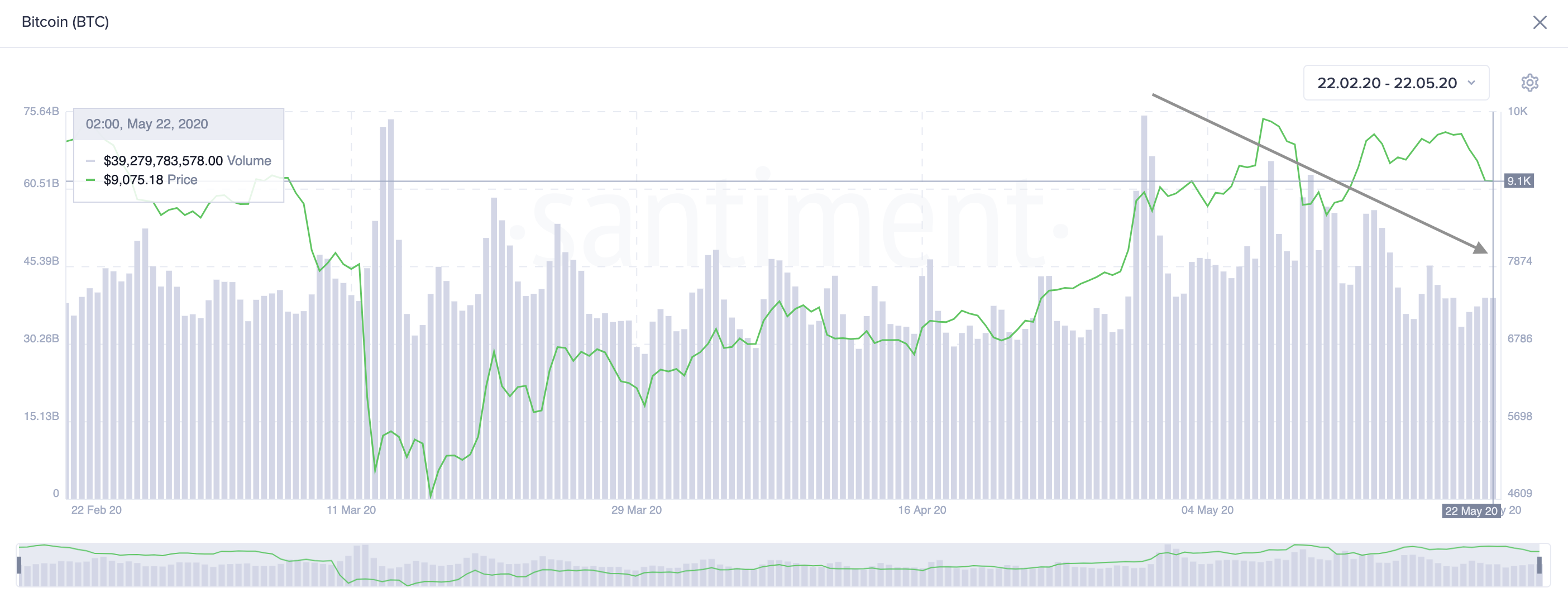

As Bitcoin’s price scraped above $9,400 at the end of April, the on-chain volume appears to have peaked. Since then, this metric has been on a steady decline making a series of lower lows and lower highs even though prices were increasing.

This sort of bearish divergence between the two suggested that the uptrend could soon come to an end.

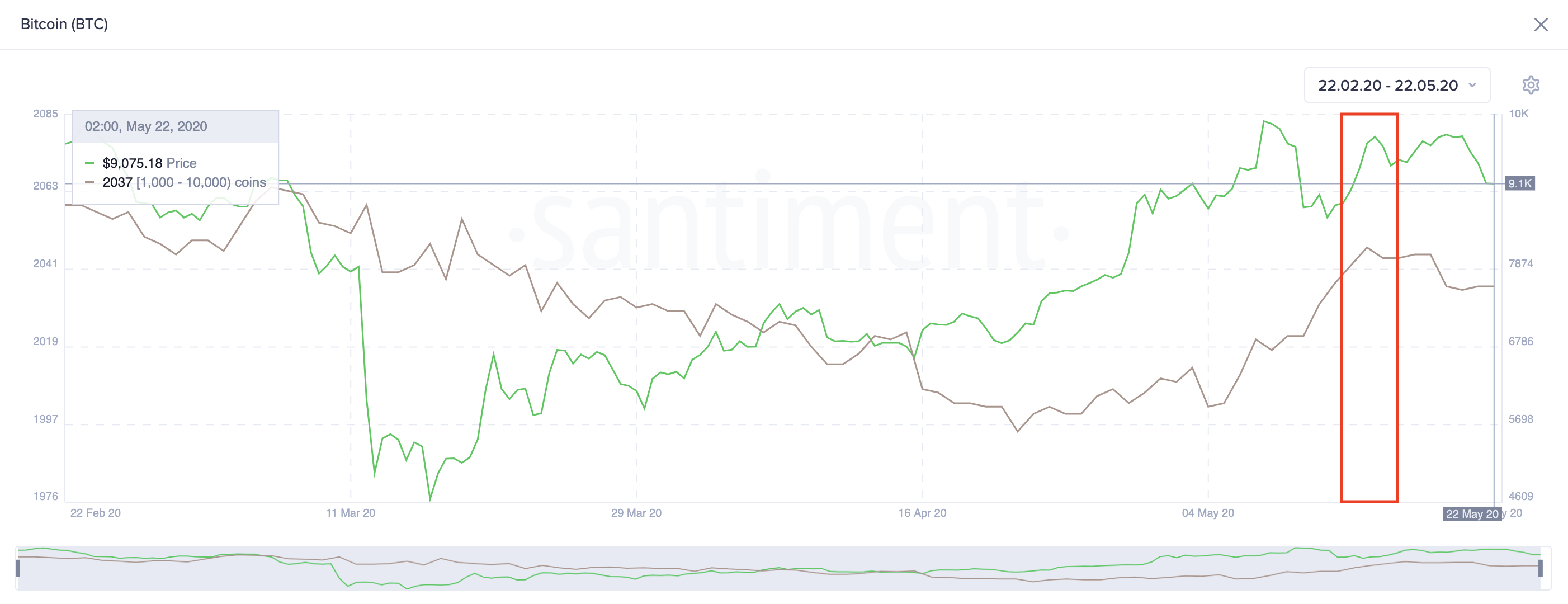

Another critical metric that signaled that a correction was coming has been the number of addresses with millions of dollars in Bitcoin, colloquially known as “whales.”

Santiment’s “holders distribution” index shows that the upswing to $9,900 on May 14 was significant enough for large investors. This demographic began accumulating in late April and may have begun taking profits from their long positions.

Although this is not necessarily a bearish signal, whales with 1,000 to 10,000 BTC have a disproportionate impact on prices because of their enormous holdings and their ability to coordinate buying and selling activity.

Everything’s Not Lost

The price action seen over the past few days has shaken out many investors. This dynamic is visible on the Crypto Fear and Greed Index, which has moved from a “neutral” position back into “fear.”

With so many prominent analysts in the industry calling for a steeper correction that could see Bitcoin plummet to $6,000, it is not surprising to see weak hands panic.

Still, technical indicators reveal that not all is lost.

The bellwether cryptocurrency has been contained in an ascending parallel channel that developed during the March market meltdown.

Since then, each time BTC rises to the upper boundary of the channel, it drops down to hit the lower limit, and from this point, it bounces back up again. This is consistent with the characteristics of a channel.

Now that Bitcoin has moved back to the lower boundary of the channel, two events could happen.

BTC could either rebound like it has for the past three months, or it could break out of this pattern in a downward direction.

Taking into consideration the pessimistic outlook, the 16.18% and 23.6% Fibonacci retracement levels are critical to BTC’s trend. These support barriers sit at $9,060 and $8,600, respectively.

A further increase in the selling pressure behind that pioneer cryptocurrency that allows it to close below these levels of support will confirm the bearish scenario.

Otherwise, it is reasonable to expect a bounce back to the middle or the upper boundary of the ascending parallel channel.

Weak Support and Strong Resistance

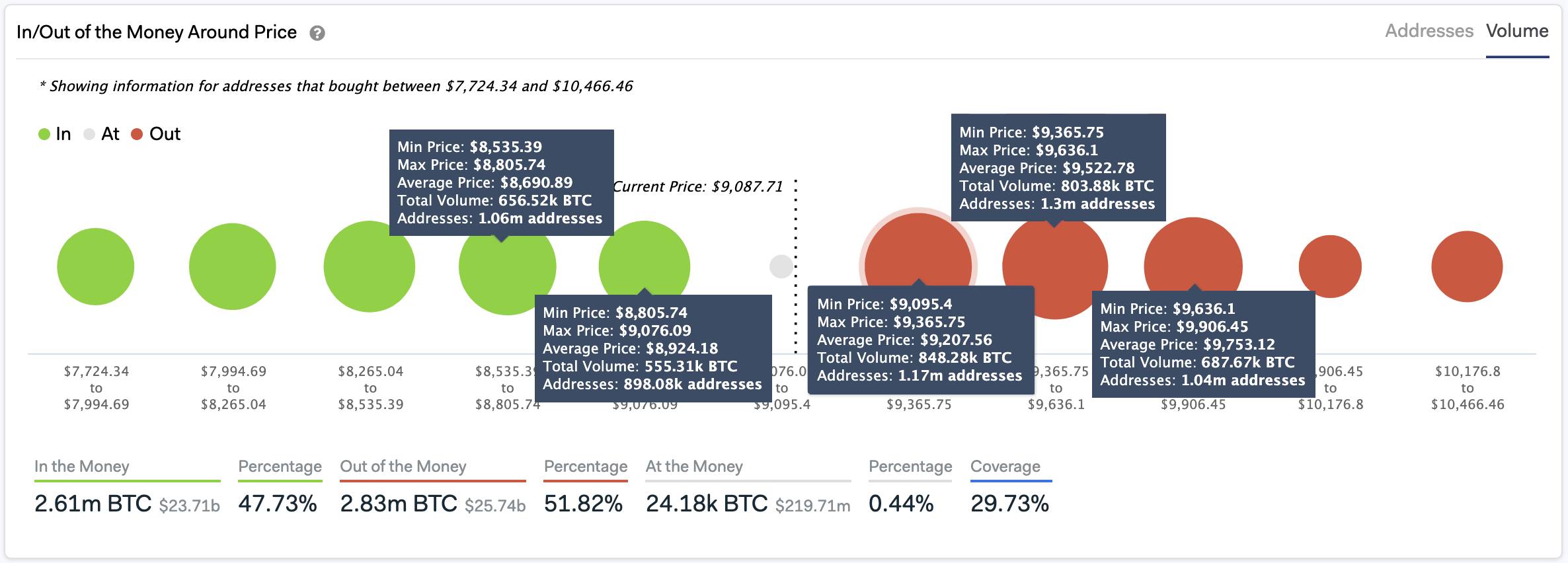

A look at IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that nearly 52% are of addresses “Out of the Money” and 47.7% are “In the Money.”

These figures indicate that the investor base behind BTC is losing confidence about what the near-term future holds.

The IOMAP cohorts show that the resistance levels above $9,200 are more robust than the underlying support. More than 3.5 million addresses bought over 2.34 million BTC between $9,095 and $9,900.

Such a massive supply wall may have the ability to prevent Bitcoin from bouncing off the lower boundary of the channel as it has done since February.

Conversely, the support given by the 16.18% and 23.6% Fibonacci retracement levels is backed by 1.9 million addresses holding 1.2 million BTC. If Bitcoin can break below these levels of support, investors who have been sitting in the red may unload their holdings, pushing prices further down.

Moving Forward

Emotions are running high following the recent downturn, and the ambiguous viewpoints about what the future holds seem more potent than ever.

Santiment, for instance, affirmed that the NVT ratio “looks healthy.”

This indicator takes into consideration Bitcoin’s market cap and the daily USD volume transmitted through the blockchain.

“Our model is showing a semi-bullish signal. The number of unique tokens being transacted on Bitcoin’s network is slightly above average for May, according to where price levels currently sit,” said Santiment.

Meanwhile, Weiss Crypto Ratings stated that the sentiment in the market is so high, and people are so bullish that a further drop in Bitcoin’s price will likely “scare the living daylights out of the children.”

Sentiment is so high and people are so bullish, that the next time #BTC drops, it will scare the living daylights out of the children. This is when you'd want to get in – not now.

— Weiss Crypto (@WeissCrypto) May 22, 2020

The financial rating firm maintains that the incoming correction will offer seizable opportunities to get back into the market.

With all of this in mind, it is important to remain cautious and wait for confirmation before entering a trade. Now that the market might be on the cusp of its next bull cycle, having cash ready to deploy is a must.

Share this article