Why is Bitcoin down today? ETF outflows, profit-taking pressure, and rising geopolitical tensions in Southeast Asia

ETF investors move money as long-term holders take profits and Southeast Asia’s tensions rattle global digital asset markets.

Bitcoin dropped to $117,100 during the Asian trading session on Thursday amid rising geopolitical tensions in Southeast Asia, continued outflows from US spot ETFs, and increased selling pressure from long-term investors.

US spot Bitcoin ETF outflows continue

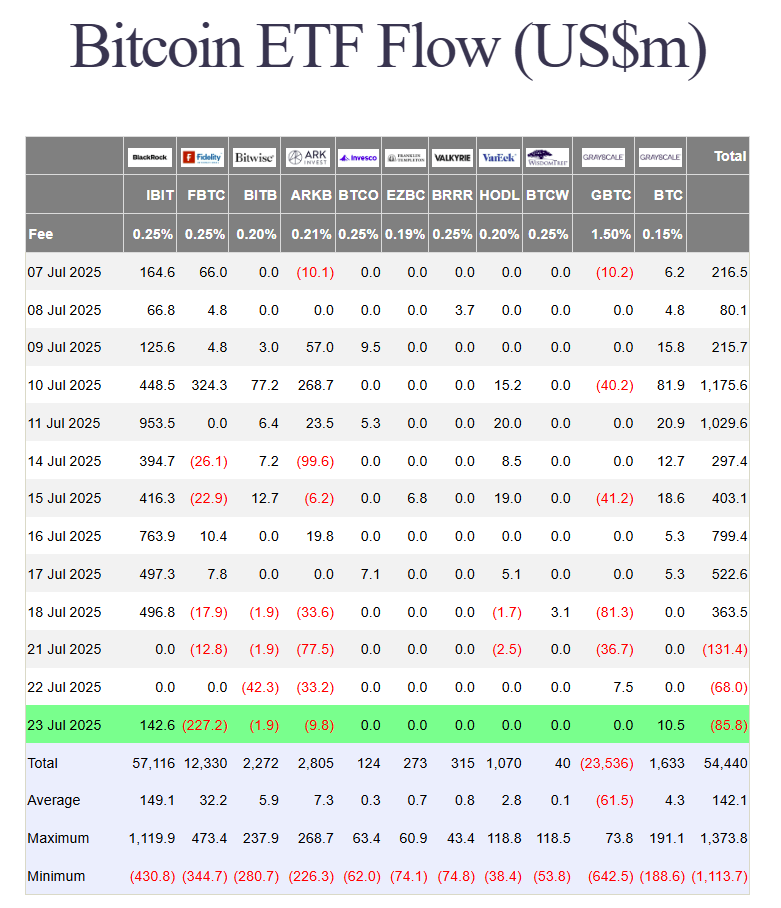

Spot Bitcoin ETFs in the US continue to see net outflows for a third consecutive day. According to data from Farside Investors, Wednesday alone saw approximately $86 million withdrawn from these funds.

That brings the week’s cumulative net outflows to more than $285 million, with Monday accounting for the largest single-day withdrawal of $131 million.

However, not all ETFs suffered losses. BlackRock’s iShares Bitcoin Trust (IBIT) attracted nearly $143 million in net inflows on Wednesday.

In contrast, Fidelity’s Bitcoin fund shed around $227 million, making it the primary driver of the day’s outflows. Bitwise’s BITB and ARK Invest’s ARKB also posted redemptions.

Long-term holders take profits

According to CryptoQuant analyst Gaah, the Spent Output Profit Ratio (SOPR) for long-term holders has climbed to its highest level this year, signaling increased profit-taking among investors who have held Bitcoin for more than 155 days.

The current SOPR reading, around 3.2, indicates that coins are being sold at a significant profit. However, this level remains below the historical SOPR peaks, typically above 4.0, which have marked the euphoric final stages of previous bull markets.

While the uptick in SOPR reflects growing confidence and moderate distribution, it does not yet suggest a market top. Instead, it points to a more mature phase of the cycle. Long-term holders are beginning to realize gains, but there are no signs yet of widespread capitulation or the exuberant exit behavior that usually precedes a macro peak.

Thailand and Cambodia exchange fire in worst border clash in decades

Bitcoin’s recent decline coincided with rising tensions on the Thailand–Cambodia border.

In the early hours of Thursday morning, Cambodian troops reportedly fired Russian-made rockets into Thailand’s Surin province, killing one civilian and seriously injuring three others, including a five-year-old child. In retaliation, the Thai military launched retaliatory airstrikes using F-16 fighter jets, escalating the conflict to a level not seen in decades.

Cambodian Prime Minister Hun Manet condemned the Thai airstrikes as an “armed invasion” and called for an emergency UN Security Council session. The exchange follows months of rising political instability in Thailand, where Prime Minister Paetongtarn Shinawatra was suspended from office earlier this month.

While the Thailand-Cambodia conflict is regional and unlikely to disrupt global trade, headline-driven markets often react to geopolitical flashpoints with short-lived volatility.

Similar market behavior was observed during the early stages of the Russia-Ukraine war, which also originated from a border dispute, though on a much larger scale.

Historically, Bitcoin has shown a pattern of reacting swiftly to geopolitical tensions, but it also tends to recover just as quickly once the immediate uncertainty subsides.

The price of Bitcoin was $118,000 at the time of publication, recovering slightly from an early drop.