Bitcoin Heads for Bullish Monthly Close

Bitcoin is about to close the July in the green, with multiple technical indicators turning bullish.

Key Takeaways

- Bitcoin surged by nearly 18% in July.

- As the monthly close approaches, several indicators point to bullish price action for the top crypto.

- Bitcoin needs to hold above $20,650 to advance toward $31,340.

Share this article

Bitcoin is approaching the monthly candlestick close with strength as it holds above a significant area of support.

Bitcoin to Close July in the Green

Bitcoin is about to close July in the green while one technical indicator looks ready to flash a buy signal.

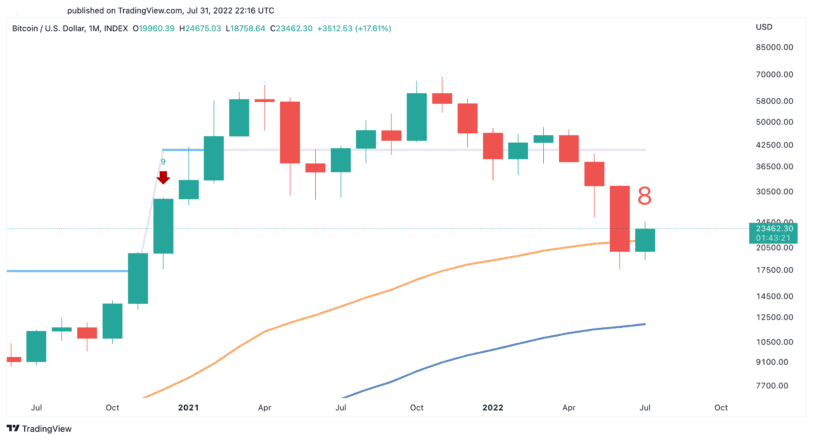

The leading cryptocurrency surged by nearly 18% in July after enduring a brutal 56% correction in the second quarter. The upward price action seen over the past month coincides with improving market sentiment. Although the U.S. economy has entered a so-called “technical recession” after two consecutive quarters of negative growth, investors are indicating that they believe that the weak macroeconomic conditions have been priced in.

From a technical perspective, Bitcoin is holding around the 50-month moving average. Meanwhile, the Tom DeMark (TD) Sequential indicator looks like it’s about to present a buy signal in the form of a red nine candlestick on the monthly chart. The bullish formation anticipates a one to four monthly candlesticks upswing or the beginning of a new uptrend.

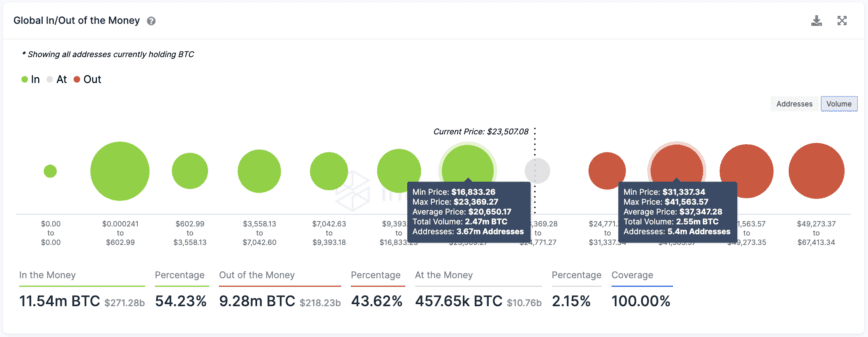

Transaction history shows the importance of the 50-month moving average. Roughly 3.67 million addresses have purchased 2.47 million BTC at an average price of $20,650. If this significant demand wall continues to hold, Bitcoin has a chance of validating the optimistic outlook.

Further buying pressure around the 50-month moving average could push Bitcoin toward $31,340 as IntoTheBlock’s Global In/Out of the Money model shows little to no resistance ahead.

It is worth noting that a loss of the $20,650 support level could lead to a major downturn. Dipping below this interest area could cause panic among investors, leading to potential sell-offs as market participants look to avoid further losses. The potential sell-off could push Bitcoin to the next crucial area of support, which sits at around $11,600.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article