Bitcoin Is Making A Comeback In Zimbabwe

Fiat has a well-earned distrust in Zimbabwe

Share this article

One of the textbook examples of hyperinflation is seeing a resurgence in demand for cryptocurrency. Bitcoin prices are soaring in Zimbabwe, as the government moves to limit trading in foreign currencies, Quartz reports.

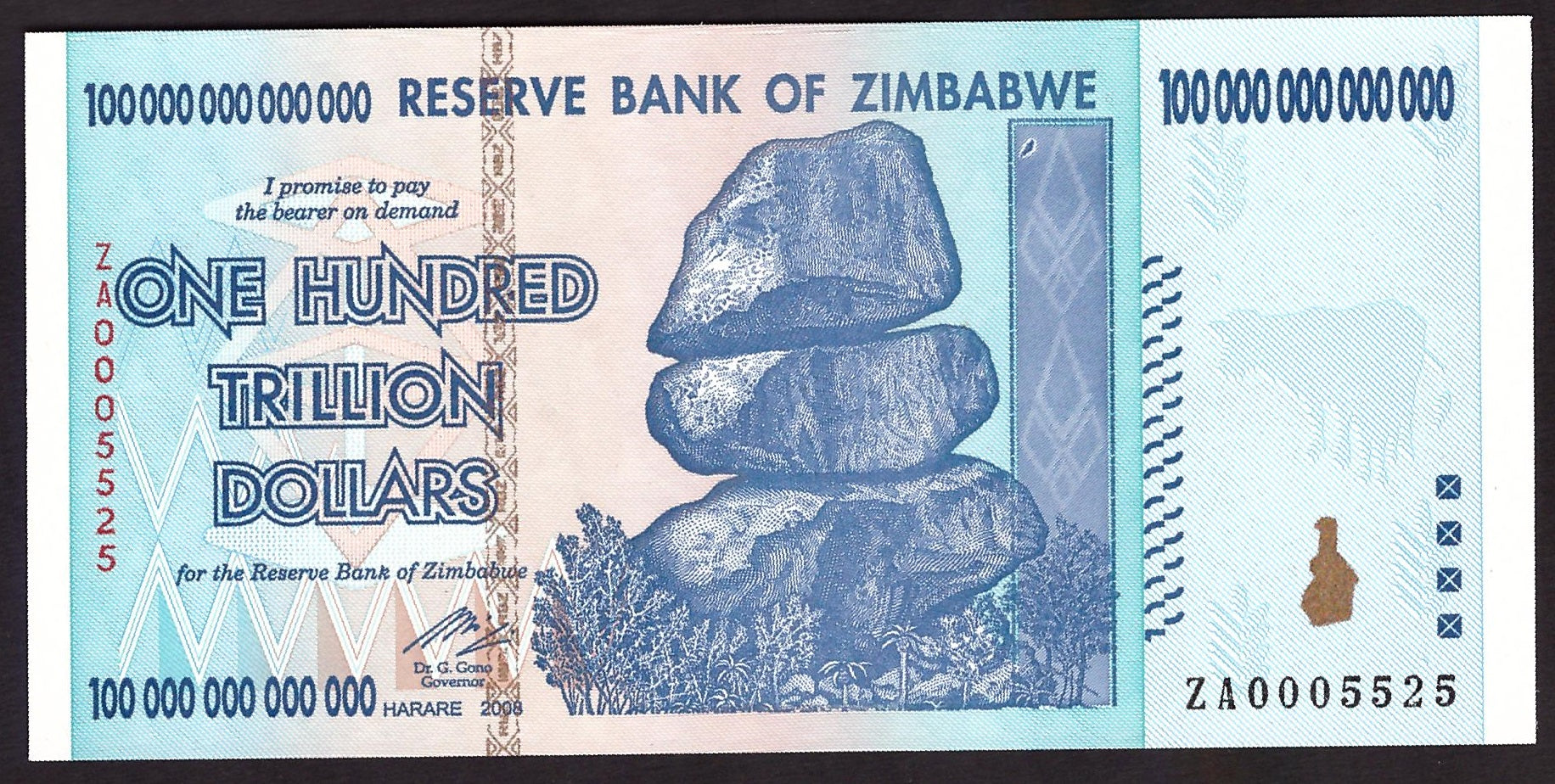

The Zimbabwe dollar became notorious for reaching Venezuela-levels of inflation after a series of currency crises starting in 2009. By 2016, the country was flooded with worthless hundred trillion dollar bills, prompting many to turn to foreign currencies.

The last time Bitcoin made a parabolic run in 2017, buyers in Zimbabwe paid upwards of $30,000 per coin, a 50% premium on world prices due to the pent-up buying pressure for hard currency.

Although the economic crisis has begun to subside, president Emmerson Mnangagwa’s government has introduced a new Zimbabwe dollar and banned the use of foreign currency. The U.S. dollar, British pound, South African Rand, and many other foreign currencies are no longer considered legal tender.

But Bitcoin can’t be stopped so easily. Even though the Reserve Bank of Zimbabwe has banned bitcoin-related transactions, there is no stopping peer-to-peer transactions, enabled via mobile services such as EcoCash or LocalBitcoins.

Although rumors of 600% premiums on trading for Bitcoin in the country appear to be exaggerated, the price of Bitcoin has surged in recent weeks and is currently trading at around 5% above the global average, according to trading data on localbitcoins.com.

Zimbabwe is one of the most active markets for trading cryptocurrencies in Africa, and is home to one of the continent’s first crypto exchanges. While Bitcoin may be considered volatile in stable economies, it is a safer and more reliable store of value for Zimbabwe’s citizens than the local fiat currency.

Tawanda Kembo, CEO of the Golix crypto exchange in Zimbabwe, has noticed the revival in demand for Bitcoin.“What we are seeing is that there is a lot of demand for bitcoin,” Kembo said. He went on to explain that the supply of the desired currency in the country is low, pushing much of the trading to “dark markets instead of exchanges.”

Share this article