Bitcoin price pressured by whales, long-term holders, and miners: Bitfinex

Bitcoin's stability challenged by consistent selling from influential investors.

Bitcoin dropped by 4.4% last week pressured by long-term holders (LTH), whales, and miners selling their holdings, according to the latest edition of the “Bitfinex Alpha” report.

The movements happened mainly through exchange sales and over-the-counter transactions.

LTHs are known to divest during bull markets and consolidation phases, are demonstrating their market influence once again. The recent selling, though less intense than previous instances, underscores the significant impact LTHs and whales have on liquidity and price fluctuations.

Notably, on-chain metrics reveal that LTHs were the main contributors to the recent sell-off, overshadowing ETF outflows. This activity aligns with the unwinding of the basis arbitrage trade highlighted in the previous week’s Bitfinex Alpha report.

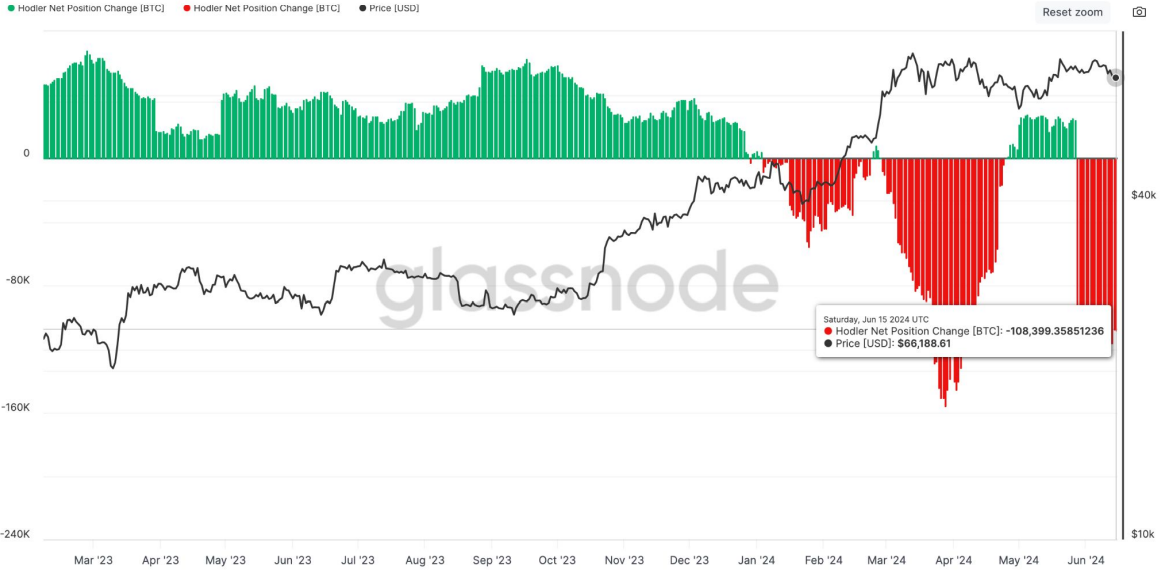

The “Hodler Net Position Change” metric, which tracks the monthly position changes of LTHs, has registered negative activity, indicating a selling trend among this cohort.

Additionally, the top 10 inflows into exchanges have risen as a proportion of total inflows, signaling heightened whale activity. This trend typically precedes a price drop, although the past three months have seen Bitcoin’s price remain relatively stable, possibly due to robust spot ETF demand. Nonetheless, the ongoing selling is seemingly capping Bitcoin’s potential price gains.

The Coinbase Premium Index, another indicator of whale behavior, suggests strong selling pressure from US investors on Coinbase Pro, as evidenced by a consistent negative percentage difference compared to other major exchanges.

Furthermore, an inverse relationship between Bitcoin’s price and miner reserves has been observed, with a notable decline in miner reserves coinciding with the peak in Bitcoin’s price around March 2024, indicating miners were selling to capitalize on high prices and prepare for the halving event.

As miner reserves approach four-year lows, it suggests that selling pressure from this group may be nearing a critical point, potentially impacting future market dynamics.

Earn with Nexo

Earn with Nexo