Bitcoin miners ramp up sales, hitting a nine-month high

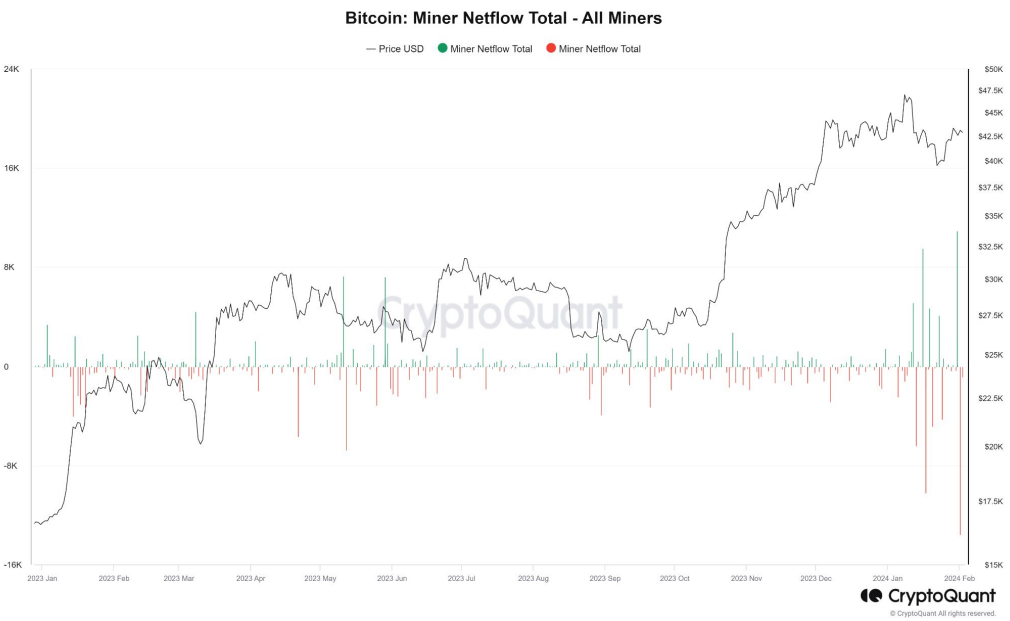

Miners' net outflow reaches 10,200 BTC post-ETF trading start, but long-term Bitcoin holders remain steadfast.

The Bitcoin (BTC) Miner Reserve has fallen to 1.826 million BTC, indicating a significant increase in sales or use of Bitcoin holdings by miners to generate capital according to a Feb. 5 report by cryptocurrency exchange Bitfinex. This is the lowest level since June 2021, and the movement might be related to miners upgrading their equipment and facilities.

With the anticipation of the Bitcoin halving event in April 2024, which will halve Bitcoin miners’ block rewards, the urgency to upgrade to more efficient mining technology has become apparent.

On-chain data from Jan. 12 showed a significant spike in Bitcoin miners’ sales, coinciding with the launch of spot Bitcoin ETFs and a nearly 9% drop in BTC’s price. Glassnode reported over $1 billion in BTC sent to exchanges that day, a six-year high in miner outflow. A noteworthy movement was also observed on February 1, with 13,500 BTC leaving miner wallets, the largest single-day outflow recorded.

The net outflow from miner wallets has been consistently negative since the start of spot Bitcoin ETF trading in the US, as per CryptoQuant, totaling around 10,200 BTC. This trend reflects miners’ responses to market conditions, including the need for liquidity and strategic adjustments following ETF approvals.

Despite the sell-off, the majority of long-term Bitcoin holders are retaining their assets, reluctant to sell at current prices. A slight uptick in the movement of ‘older Bitcoin’ has been noted, largely influenced by transactions involving the Grayscale Bitcoin Trust and conversions into other BTC ETFs.

The “liveliness” metric, which tracks the activity level of Bitcoin supply, has seen its largest increase since December 2022, indicating a higher volume of long-held Bitcoin being moved or sold. The Value Days Destroyed (VDD) Multiple, a key indicator of potential price peaks, has recently surged to 2.62, suggesting a possible peak in the current cycle. However, it remains below the historical threshold that typically signals a cycle top.

As the next Bitcoin halving approaches, the elevated VDD and recent price drops hint at potential further declines for Bitcoin. Nonetheless, the sustained low levels of the liveliness metric suggest that a large portion of Bitcoin supply remains tightly held, indicating a continued belief in Bitcoin’s long-term value among investors.