Bitcoin is one week away from a 'pre-halving rally,' trader Rekt Capital states

Bitcoin could be gearing itself towards the second phase of the halving cycle, which is a period of accumulation and price leaps.

Share this article

Bitcoin (BTC) might be close to starting its ‘Pre-halving rally’ period next week, according to a series of posts by the trader identified as Rekt Capital on X. The trader points out that, if history repeats itself, then BTC price will experience an uptrend 63 days away from halving.

The pre-halving rally is the second of five phases related to Bitcoin halving. The first is a downside phase, which starts 70 days away from the event and has a seven-day duration, and this is where the market currently is. Given that an 18% pullback in Bitcoin price was already experienced in January, Rekt Capital is not sure if a correction will be seen this week.

After the correction occurs in the first phase, investors then begin “Buying the Hype”, Rekt Capital says. Consequently, BTC price shows growth in this period, led by a “Sell the News” movement in the third phase, when a “Pre-halving retrace” happens.

The retrace period can last multiple weeks, says the trader, and ended in a 20% retrace on Bitcoin’s price in the last halving. However, the downtrend in prices sparks another buying momentum, which might have a 150-day duration.

“Many investors get shaken out in this stage due to boredom, impatience, and disappointment with the lack of major results in their BTC investment in the immediate aftermath of the halving,” says Rekt Capital.

The fifth and last state is a “Parabolic Uptrend”, seen when Bitcoin breaks out of the accumulation area and commences a massive growth period.

Weekly movements

On top of its predictions for this halving cycle, Rekt Capital also shared his analysis of what is happening with Bitcoin prices now.

For the weekly period, the Relative Strength Index (RSI) broke its downtrend, suggesting that a bearish divergence pattern has been invalidated. A bearish divergence is characterized by the formation of progressively higher highs by the price candles in the presence of progressively lower peaks formed by the oscillator’s signal line.

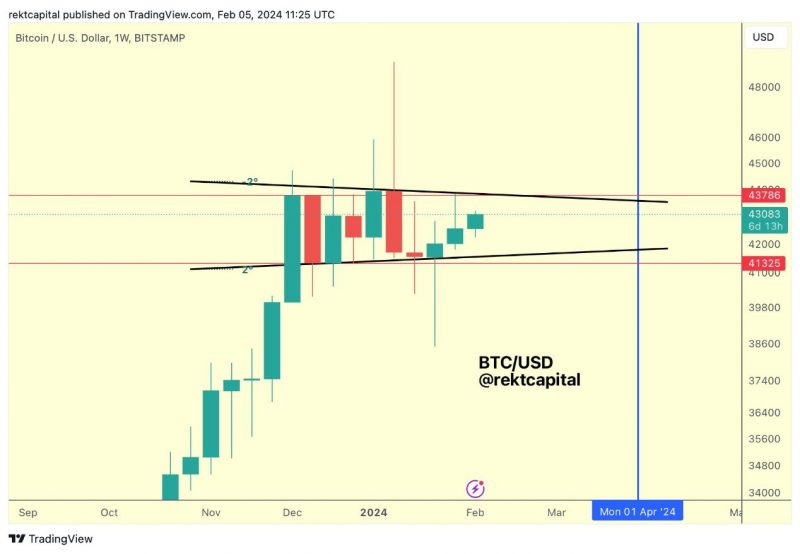

Moreover, Rekt Capital points out that Bitcoin looks like it is already within an accumulation range, stuck between $43,700 and $41,300. BTC price got rejected from this range high last week, forming an upside wick and a new lower high. However, the trader highlights that Bitcoin is attempting to revisit the range high again this week, which might suggest strength in the movement and a possible weakening of resistance.

Share this article